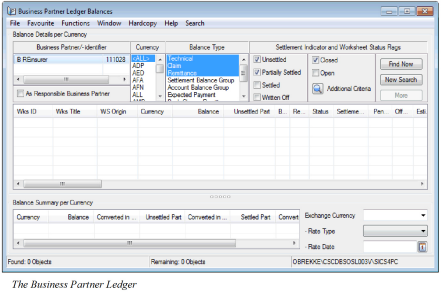

The Business Partner Ledger

The Business Partner Ledger lets you search for, inspect and analyse information pertaining to liquid balances, i.e. account balances and payments, to and from business partners.

You can group balances by creating Settlement Balance Groups and Account Balance Groups. Worksheets such as Remittance - and Technical Worksheets may be created from the Business Partner Ledger. These and other functions are described in the further documentation.

Open a Business Partner Ledger #

|

Business Partner Ledger button | To open a Business Partner Ledger, click the Business Partner Ledger button in the Navigation bar on the Business Properties window or on the Business Partner Properties window. Or, you can click the Business Partner Ledger icon in the Accounting folder on the SICS desktop. |

The Business Partner Ledger opens automatically upon selection. You have to Define Business Partner Ledger Extraction Criteria on page 11-495in order to retrieve balances.

Open the Business Partner Ledger from the Accounting Folder #

When you do not have to inspect other information, e.g. Business properties, Business Partner properties etc., you can navigate directly to a Business Partner Ledger.

- Click the Business Partner Ledger icon in the Accounting folder on the SICS desktop.

- Search for and find the Business Partner you want to inspect the liquid balances for.

- Select the Business Partner.

Open the Business Partner Ledger from the Business Partner Properties #

When you are inspecting information pertaining to a Business Partner you can navigate directly to this Business Partners Ledger.

- Open the Partners folders from the SICS desktop and select the Business Partner button.

- Find and open the properties of the Business Partner you want to have information about.

- On the Main Info tab of the View Business Partner window, click the Business Partner Ledger button.

Open the Business Partner Ledger from the Business Properties #

When you are inspecting the properties of a Business you can navigate directly to the Business Partner Ledger of the partner having the payment task defined.

- Open the Business folder from the SICS desktop and click the Business button.

- Find and open the Business you want to inspect the details for.

- Click the Business Partner Ledger button from the Navigation bar.

Open an Empty Business Partner Ledger from the Business Partner Properties #

When you want to open the Business Partner ledger with empty Business Partner container, without selecting any business partner, you can navigate directly from Business Partner Properties.

- Open the Partner folders from the SICS desktop and select the Business Partner button.

- Select checkbox field ‘Base’ and without highlighting any single or multiple BP’s, Right click and Select new option ‘Open Empty BPL’.

- An Empty Business Partner Ledger opens with empty Business Partner Container section, with As BC field selected by default (this is not selected by default if Base is not selected in step 2 above).

Open Business Partner Ledger from a Business Partner Group #

- Open an existing Business Partner Group, Main Info tab, from either the Business Partner Group option or from the Details tab, Groups, of a Business Partner

- Click on the Business Partner Ledger Icon

- The Business Partner Ledger for all the members of the Business Partner Group opens

Define Business Partner Ledger Extraction Criteria #

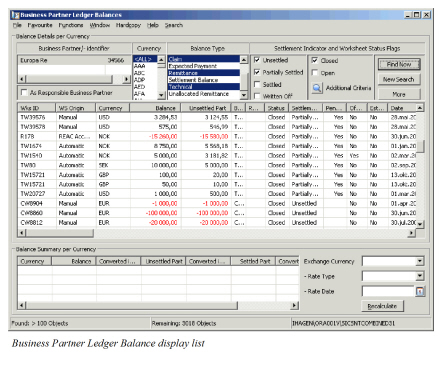

When you have opened a Business Partner Ledger, the Balance display list is empty. You may be interested in viewing, inspecting or handling only a limited number of the available balances. You define extraction criteria to list the limited number of balances in the Balance display list.

Business Partner Ledger Extraction Criteria for retrieving balances to be shown in the Balance display list can be defined:

- In the top part of the Business Partner Ledger. Some of the extraction criteria are predefined when the Business Partner Ledger is first opened.

- In the Additional Find Criteria window.

- Using the pop-up in the Balance table header on the Business Partner Ledger’s Balance Display list. NB!The result from this search is not automatically reflected in the Balance Summary per Currency display list, the user must select the popup menu option ‘Recalculate based on listed balances’ in the summary container to have this reflected.

Maintain Business Partners as Extraction Criterion #

When the Business Partner Ledger is opened, a Business Partner/Business Partner identifieris transferred to and selected by default in the Business Partner list. If the ledger is opened from the Business Partner properties or via the Accounting folder, the Business Partner you searched for is selected by default. If the ledger is opened from a business, all Business Partners/Business Partner identifiersdefined on the business, e.g. Cedent, Broker, Reinsurer, etc. are shown in the Business Partner list. Among these, the partner with the Payment task is selected by default. Also, any business partners belong to a Merged Business Partner Group, all other members within the merged business partner group will be added to the list of Business Partners automatically.

You can select one or more Business Partners from the display list when you define the extraction criteria.

Add a Business Partner: #

When you have opened the Business Partner Ledger and you want to inspect the Balances of a Business Partner that is not already defined in the Business Partners list, you can select to add one or more partners.

- Select Add from the pop-up menu in the Business Partner Ledger’s Business Partner list. You see the Find: Business Partner window.

- Find and select the Business Partner(s) you want to add.

- Transfer the selected Business Partner(s)

The Business Partner name(s)/Business Partner identifier(s) is transferred to the Business Partner Ledger and added to the list of Business Partners.

Remove Business Partners #

You can remove Business Partners from the list.

- Select one or more Business Partners from the list in the Business Partner Ledger.

- Select Remove from the pop-up menu. The Business Partner(s) are deleted from the list.

Note! You are not allowed to remove all partners from the Business Partner list.

Add Subsidiaries #

There may be links between Business Partners and/or Third Parties that decide the hierarchy-level for each partner (Owner or Subsidiary). When a Business Partner is defined as Owner having one or more subsidiaries linked, these subsidiaries may be added to the list of partners in the Business Partner Ledger.

- Select a Business Partner in the Business Partner list. The partner has to be defined as an Owner.

- Select Add Subsidiaries of type > from the pop-up menu.

- Select all types of subsidiaries or a specific type, e.g. Branch, Affiliate, etc., from the list. (Your System Administrator defines the types.)

- The Subsidiaries that match the selected type is added to the list of Business Partners.

By selecting the Owner and its Subsidiaries from the Business Partner list all balances pertaining this hierarchy will be displayed once Find Now is selected.

Add Business Partner Group #

When you have opened the Business Partner Ledger and you want to inspect the balances of all the partners in a Business Partner Group, you can add one or more Business Partner Groups that will list all the members in the group and their balances in the Business Partner Ledger

- Select Add Business Partner Group from the pop-up menu in the Business Partner Ledger’s Business Partner list. You see the Find: Business Partner Group window.

- Find and select the Business Partner Group(s) you want to add.

- Transfer the selected Business Partner Group(s)

Display the Business Partner Hierarchy #

You can display the hierarchy for a selected Business Partner. This may be relevant e.g. if you want to verify where in a hierarchy the Business Partner is located.

- Select a Business Partner from the Business Partner list in the Business Partner Ledger.

- Select Hierarchy from the pop-up menu. You see the Organisation Hierarchy window.

If the Business Partner is an owner, its subsidiary/ies is/are displayed. If the Subsidiary itself is an owner and has its own subsidiary, also this level is displayed. If the Business Partner is a subsidiary, the text Has Owner is displayed next to the Business Partner name in the Organisation Hierarchy window.

View Business Partner Properties #

When you want to get more information about a Business Partners in the Business Partner list, you can access the Business Partner properties directly from the Business Partner Ledger.

- Select the Business Partner you want to have more information about.

- Select Properties from the pop-up menu. You see the View Business Partner window.

Extract Balances for Responsible Business Partner #

The balances displayed for a Business Partner in the Business Partner Ledger are balances booked on businesses where the partner is defined with the Payment task. For a balance this Business Partner acts as the Expected Payment Partner.

As an alternative to this you can select to display the balances for businesses where the selected Business Partner is defined as the legal Responsible Business Partner. Which Business Partner role is defined as responsible for a business depends on the Level- and Type of Business, e.g. the Cedent on an Assumed Proportional Treaty

- Select one or more Business Partners from the Business Partner list in the Business Partner Ledger

- Select the As Responsible Business Partner check box

| Field | Description |

|---|---|

| Business Partner/Identifier | The name of the Business Partners/identifieryou have included in the list. You can search for and display balances for one or more of these Business Partners Values: Business Partner name/Business Partner identifier. Default: The Business Partner from where you opened the Business Partner Ledger. (I.e. the Business Partner properties, the Find Business Partner or the Business properties). Functional Impact: The Balance display list Mandatory: Yes |

| As Responsible Business Partner | Selected: Balances for businesses where the selected Business Partner is defined as Responsible Business Partner are included in the Balance Display list. Balances booked on e.g. an Assumed Business will get the Cedent as Responsible Partner. This is independent if a broker with a payment task exists or not. Cleared: Only balances booked on businesses where the selected Business Partner is the Payment partner on the balances displayed in the Balance Display list. The check box is cleared by default Relevant when: You want to see all balances for e.g. a Cedent independent if this Business Partner has the Payment Task on the Business or not. A Liquid Balance has both a payment partner and a responsible partner. These can be the same partner, e.g. if no broker is involved, or the responsible is different from the payment parties, normally when a broker is involved. Mandatory: No |

| As BC | Selected: Balances for businesses where the selected Business Partner acts as Base company are included in the Balance Display list. Balances booked on e.g. an Assumed Business will get the Reinsurer as Base Company. Cleared: Only balances booked on businesses where the selected Business Partner is the Payment partner on the balances displayed in the Balance Display list. The check box is cleared by default. Relevant when: You want to see all balances for Business Partner who acts as the Base Company (if this box is selected), the Payment Partner (if none of the boxes are selected) or the Responsible Business Partner (if the As Responsible BP is selected, see above). Mandatory: No |

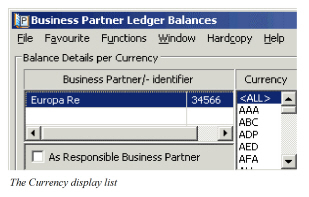

Define Currency #

When the Business Partner Ledger is opened, all currencies for which bookings have been made on the selected Business Partner are displayed in the Currency display list.

- Open a Business Partner Ledger. None of the listed currencies are selected.

- Select the currency or currencies for which you want to display balances.

- Make further extraction criteria definitions and click Find Now

Balances according to the selected currencies are displayed in the Balance display list.

When you want to select all currencies you can either select <ALL> or not select any value. In both situation balances for all currencies will be displayed.

Note! For Retrocessionaire Participation (RP) Proportional Treaty businesses the as Account balances applies for the Business Partner Ledger. For the RP Facultative business your System Administrator decides if the as Booking balances or the as Account balances applies for the Business Partner Ledger.

| Field | Description |

|---|---|

| Currency | All currencies booked on the selected Business Partner Values: <ALL> and the Currency names according to ISO, e.g. USD, GBP, CHF, etc Functional Impact: The Balance display list Mandatory: No |

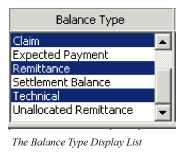

Define Balance Type #

Each balance in the Business Partner Ledger refers to a Balance Type. When the Business Partner Ledger is opened, the balance types Technical, Claim, Cession(only in Life) and Remittance are selected by default.

- Open the Business Partner Ledger.

- Select the Balance Types for which you want to extract balances in the Balance Display list.

- Make further definitions of extraction criteria and click Find Now

Balances according to your extracted balance types are displayed in the Balance Display list.

Some balances may refer to more than one Balance Type. If you extract Expected Payment and/or Settlement Balance together with other balance types, e.g. Technical, the Balance Display list shows each balance only once. For example, if a Technical Balance of NOK 7.000 has an expected payment of USD 1.000, only USD 1.000 is shown in the Balance Display list. To see the original technical balance amount you must clear Expected Payment in the Balance Type list.

| Field | Description |

|---|---|

| Balance Type | Indicates the different types a balance can apply to Values: Account, Bank Charge Remittance, Cession (Life specific), Claim (P&C specific), Expected Payment, Remittance, Settlement Balance, Technical and Unallocated Remittance. Functional Impact: The Balance display list Mandatory: Yes |

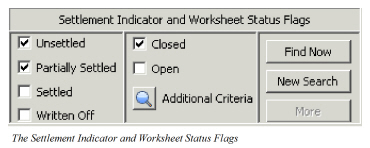

Define Settlement Indicator #

The Settlement Indicator makes it possible to extract on Unsettled, Partially Settled and/or Unsettled balances in addition to balances that are Written off.

- Open the Business Partner Ledger.

- Define which Settlement Indicator(s) you want to extract balances on.

- Define your other extraction criteria and click Find Now.

| Field | Description |

|---|---|

| Unsettled | Indicates that the balance is not yet Settled, i.e. included in a pairing process or written off. Values: Selected, Cleared Default: Selected Functional Impact: It decides if Unsettled balances s hould be included in t he Balance display list or not. Mandatory: No |

| Partially Settled | Indicates that the balance has been included in a pairing process but has not been fully settled. The partially settled balance has an Unsettled Part that differs from the Balance and Balance Paring Properties linked Values: Selected, Cleared Default: Selected Functional Impact: It decides if Partially Settled should be included in the Balance display list or not. Mandatory: No |

| Settled | Indicates that the balance has been fully settled. The Settled balance has an Unsettled Part that is zero and Balance Pairing Properties linked Values: Selected, Cleared Default: Cleared Functional Impact: It decides if Settled should be included in the Balance display list or not. Mandatory: No |

| Written Off | Indicates that a balance has been written off, i.e. being paired with a Remittance having Payment Type Write Off Values: Selected, Cleared Default: Cleared Functional Impact: It decides if Written off should be included in the Balance display list or not. Mandatory: No |

Define Worksheet Status Flag #

You can have Technical- and Claim Worksheets that are stored with the status Open in the Business Partner Ledger. An open worksheet is considered unfinished until it is completed and the Status changed to Closed.

- Open the Business Partner Ledger.

- Select worksheet statuses for which you want display balances.

- Define your other extraction criteria and click Find Now.

Balances are displayed in the Balance Display list according to your defined extraction criteria.

Note! The Remittance balances are not affected by this extraction. All Statuses for Remittance balances are displayed independent of this extraction.

| Field | Description |

|---|---|

| Closed | Balances from Technical- and Claim Worksheets with status closed are displayed in the Balance display list upon selection of this check box Values: Selected, Cleared Default: Selected Functional Impact: The Balance display list Mandatory: No |

| Open | Balances from Technical- and Claim Worksheets with status other than Closed and_Inactivated_ are displayed in the Balance display list upon selection of this check box _Values:_ Selected, Cleared _Default:_ Cleared _Functional Impact:_ The Balance display list _Mandatory:_ No |

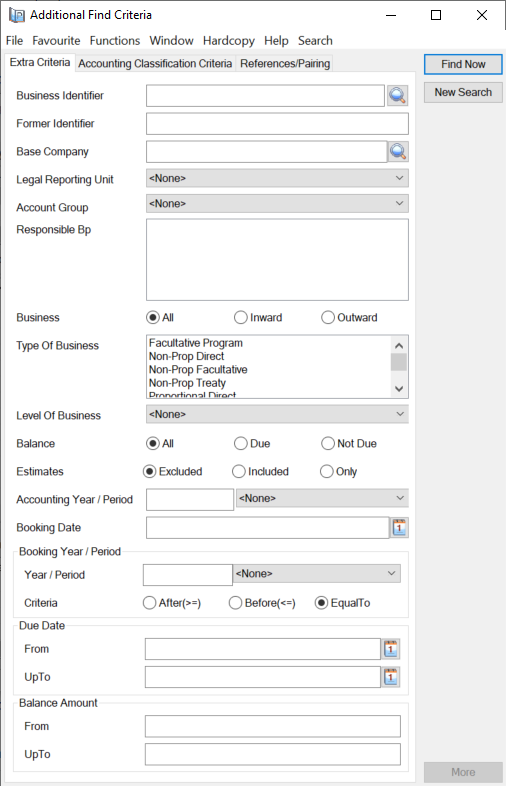

Define Additional Criteria #

You have more possibilities to define extraction criteria using the Additional Find Criteria window.

- Open the Business Partner Ledger.

- Define the extraction criteria, for example, currencies, balance types etc., in the top area of the ledger.

- Click the Additional Criteria button to define further extraction criteria. You see the Additional Find Criteria window.

- Define your extraction criteria on the three tabs; Extra Criteria, Accounting Classification Criteria and References/Pairing.

- Click Find Now.

The balances are displayed in the Balance Display list according to your defined search criteria both in the Business Partner Ledger window itself and in the Additional Find Criteria window. The Additional Criteria window remains opened with the defined search criteria even after Find Now is clicked. The defined criteria are kept until the New Search button is selected.

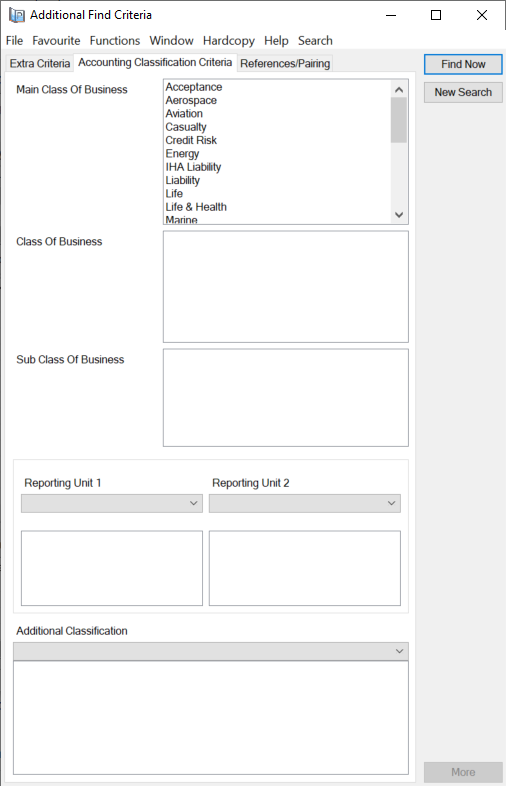

Note! The Accounting Classification Criteria tab is available only when activated in the System Parameters. (See your System Administrator for further information.)

| Field | Description |

|---|---|

| Business Identifier | Enter one or more Business Identifier(s) for which balances you want to display. You can either enter the Business Identifier manually or you can button beside the field to open the Find Business window from where to can transfer one or more Business Identifier(s). Values: One or more complete Business Identifier(s), e.g. PTTY2, OCC100, OCC100-1, etc, separated with a comma. Functional Impact: Balance display list Mandatory: No |

| Former Identifier | Enter the Former Identifier which balances you want to display. The value can be defined on the business properties in SICS Values: Any identifier value Functional Impact: Balance display list Mandatory: No |

| Base Company | Select Base Company by using the Find facility or you can type in the Base Company name or part of it directly into the field and receive possible matches for the text. If you know the Business Partner ID, you can also type this. Values: Business Partner name Functional Impact: Balance display list Mandatory: No |

| Legal Reporting Unit | Select a Legal Reporting Unit from the Drop-down list, for which balances you want to display Values: The reporting Unit Name and Code, e.g. Reporting Unit 1 (CL1), Reporting Unit 2 (CL2), etc. Default: <None>, i.e all values Functional Impact: Balance display list Mandatory: Yes |

| Account Group | Select an Account Group from the drop-down list. All balances booked on businesses having the selected Account Group defined among their Business Properties are displayed in the Balance Display list Values: Account Group Name. The values are defined and maintained by your System Administrator Default: <None>, i.e all values Functional Impact: Balance display list Mandatory: Yes |

| Responsible BP | Select one or more Responsible Business Partner from the list. The available Responsible Business Partner’s are the ones that apply for the selected Business Partner’s balances. You select Add Responsible BP from the pop-up menu to access the Find: Business Partner window, from where you can transfer additional Business Partners. All balances that apply for the selected Responsible Business Partner in combination with the selected payment partners are displayed in the Balance Display list Values: Business Partner name(s) Functional Impact: Balance display list Mandatory: No, meaning if none is selected, balances from all Responsible Business Partner are displayed. |

| Business | You can define if you want to search for and display balances for Inward businesses only, Outward business only or All businesses Values: All, Inward or Outward Default: All Functional Impact: Balance display list Mandatory: Yes, one of the values has to be selected |

| Type of Business | Select one or more Types of Business values. Balances booked on businesses with the selected type(s) of business are displayed in the Balance display list Values: Non-Prop Direct, Non- Prop Facultative, Non-Prop Treaty, Proportional Direct, Proportional Facultative and Proportional Treaty, Other values in Life. Functional Impact: Balance display list Mandatory: No, meaning if none is selected, balances from all types of business are displayed. |

| Level of Business | Select a Level of Business. Balances booked on the selected level of business are displayed in the Balance display list Values: <None>, Administrative Business, Assumed Business, etc. Default: <None>, i.e. all values Functional Impact: Balance display list Mandatory: Yes |

| Balance | You can define if you want to search for and display only due balances, only balances that are notdue or all balances (due + not due). Each balance’s Due Date is compared with today’s date in the search. Values: All, Due and Not Due Default: All Functional Impact: Balance display list Mandatory: Yes, one of the values has to be selected |

| Estimates | You can define if the extracted balances to be displayed in the Balance display list should include estimates, exclude estimates or be estimates only Values: Excluded, Included or Only Default: Excluded Functional Impact: Balance display list Mandatory: Yes, one of the values has to be selected |

| Accounting Year/-Period | Enter Accounting Year and/or select Accounting Period from the drop-down list. The balances having values that match this/these defined values are listed in the Balance Display list Values: Year: Free input (yyyy), Period: <None>, 1st of 12, 2ndof 4, 3rd of 3, Yearly, etc. Default: Year: blank. Period: <None>, i.e. all periods, Meaning all Accounting Year / Periods are extracted. Functional Impact: Balance display list Mandatory: No |

| Booking Date: | Enter or select from the calendar the booking date for which you want to extract and display balances in the Balance display list Values: Date Functional Impact: Balance display list Mandatory: No |

| Booking Year/-Period | Define the Booking Year and/or select the Booking Period for which you want to extract balances to be display in the Balance display list. It must be used together with the above Booking Search Criteria. Values: Year: Free input (yyyy), Period: <None>, 1st Half, 2ndQuarter, 5th Month, etc Default: Period: <None>, i.e. all periods Functional Impact: Balance display list Mandatory: No |

| Booking Search Criteria | Used in combination with the search criteria Booking Year/Period. Define if you want to search for bookings made After, Before or Equal to the specified Booking Year/Period values Values: ‘After (>=)’, ‘Before (<=)’ or ‘Equal To’ Default: Equal To_ _Functional Impact:_ Balance display list _Mandatory:_ Yes, one of the values has to be selected |

| Due Date | Enter or select from the calendar the Due Date for which you want to extract and display balances in the Balance display list. You can enter both the From and Up To date or you can just enter one of them Values: a From Date and/or an Up To Date Default: blank Functional Impact: Balance display list Mandatory: No |

| Balance Amount: | Enter Balance Amounts From the lowest Up To the highest for which you want to extract balances to be displayed in the Balance display list. You can either use From/To together or only limit one side. An amount in From will only display balances with an amount higher than this amount. An amount in Up To will only display balances with an amount smaller than this amount. This is independent of currency selected. Values: a From Amount and/or an Up To Amount Default: blank Functional Impact: Balance display list Mandatory: No |

Note! A System Parameter activates this tab. (Contact your System Administrator for further information.)

| Field | Description |

|---|---|

| Main Class of Business | A Classification defined as part of the Accounting Classification for each detail belonging to the balances. If at least one detail in a balance has the selected Main Class of Business then the balance will be listed. Enabling you to search for and identify balances. Select one or more of the values in the list. Values: E.g. Aviation, Casualty, Marine, Property, etc. (Maintained by your System Administrator.) Functional Impact: Balance display list (none selected means all) Mandatory: No |

| Class of Business | A Classification defined as part of the Accounting Classification for each detail belonging to the balances. If at least one detail in a balance has the selected Class of Business then the balance will be listed. Enabling you to search for and identify balances. Select one or more of the values in the list. Values: Dependent on the selection of Main Class of Business. When e.g. Property is selected the values can be; Fire, Business Interruption, Engineering, etc. (Maintained by your System Administrator). Derived from: Main Class of Business Functional Impact: Balance display list Mandatory: No |

| Sub Class of Business | A Classification defined as part of the Accounting Classification for each detail belonging to the balances. If at least one detail in a balance has the selected Sub Class of Business then the balance will be listed. Select one or more classification to narrow your search for balances. Values: Dependent on the selection of Class of Business. When i.e. Engineering is selected the values can be; Machinery, CAR and EAR, Boiler, etc. Derived from: Class of Business Functional Impact: Balance display list Mandatory: No |

| Reporting Unit 1 | A Reporting Unit Category defined for detail belonging to the balances. If at least one detail in a balance has the selected Reporting Unit 1 then the balance will be listed. (Your System Administrator decides if the Reporting Unit is to be included in the Accounting Classifications). Upon selection of category one or more values defined for the category appear. (These values are defined by your system administrator.) Values: Category: Profit Centre, Segment Code, Person, etc. (Values are system defined, but your System Administrator may create new values.) Functional Impact: Balance display list Mandatory: No |

| Reporting Unit 2 | A Reporting Unit Category defined for each detail belonging to the balances. If at least one detail in a balance has the selected Reporting Unit 2 then the balance will be listed. (Your System Administrator decides if the Reporting Unit is to be included in the Accounting Classifications). Upon selection of category one or more values defined for the category appear. (These values are defined by your system administrator.) Values: Category: Profit Centre, Segment Code, Person, etc. (Values are system defined, but your System Administrator may create new values.) Functional Impact: Balance display list Mandatory: No |

| Additional Classification | A Classification defined as part of the Accounting Classification for each detail belonging to the balances. If at least one detail in a balance has the selected Main Class of Business then the balance will be listed. Additional classification categories to further narrow the search for balances. Upon selection of the category one or more values defined for the category appear. (Your system administrator maintains Values.) Values: Category: E.g. Additional 1, Type of Risk, Add.2, etc. Functional Impact: Balance display list Mandatory: No |

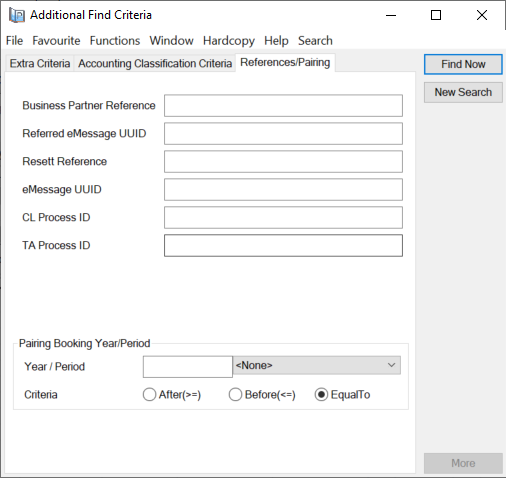

| Field | Description | Location |

|---|---|---|

| Business Partner Reference | A unique reference attached to each Balance. Enabling you to search for and identify balances. Values: Numbers, Letters of a combination. No limitation of characters. Function Impact: Balance display list Mandatory: No |

|

| Referred eMessage UUID | A unique reference attached to each Rebord message enabling you to search for and identify balances. Values: Numbers, Letters or a combination. No limitations of characters. Functional Impact: Balance display list Mandatory: |

|

| Resett Reference | A unique reference attached to each Resett message enabling you to search for and identify balances. Values: Numbers, Letters or a combination. No limitations of characters. Functional Impact: Balance display list Mandatory: No |

|

| eMessage UUID | A unique reference attached to each Retacc message enabling you to search and identify balances. Values: Numbers, Letters or a combination. No limitations of characters. Functional Impact: Balance display list Mandatory: No |

|

| TA Process ID |

A reference that helps you identify the balance. Please refer to the Process ID chapter of the Handle Reference Items chapter in the System Administration Guide for more details about the Process ID. Values: Free-text, maximum 30 characters Mandatory: No Functional Impact : if the System Parameter Enable Accounting Worksheet Process ID Validation is activated, the Process ID must exist in the Process ID table and the Status must be either Open or Re-Open when Worksheet has Status ‘Closed’. |

More Information view |

| CL Process ID |

A reference that helps you identify the balance. Please refer to the Process ID chapter of the Handle Reference Items chapter in the System Administration Guide for more details about the Process ID. Values: Free-text, maximum 30 characters Mandatory: No Functional Impact : if the System Parameter Enable Accounting Worksheet Process ID Validation is activated, the Process ID must exist in the Process ID table and the Status must be either Open or Re-Open when Worksheet has Status ‘Closed’. |

More Information view |

| Pairing Booking Year/-Period | Enter a Pairing Booking Year and/or select a Pairing Booking Period for which you want to extract balances to be display in the Balance display list. Balances with active pairings, annuled pairings are not relevant, will be extracted based on the Pairing Booking Year/Period they have. It must be used together with the below Pairing Booking Search Criteria. Values: Year: Free input (yyyy), Period: <None>, 1st Half, 2ndQuarter, 5th Month, etc Default: Period: <None>, i.e. all periods Functional Impact: Balance display list Mandatory: No |

|

| Pairing Booking Search Criteria | Used in combination with the above search criteria Pairing Booking Year/Period. Define if you want to search for balances with active pairings made After, Before or Equal to the specified Pairing Booking Year/Period values Values: ‘After (>=)’, ‘Before (<=)’ or ‘Equal To’ Default: Equal To_ _Functional Impact:_ Balance display list _Mandatory:_ Yes, one of the values has to be selected |

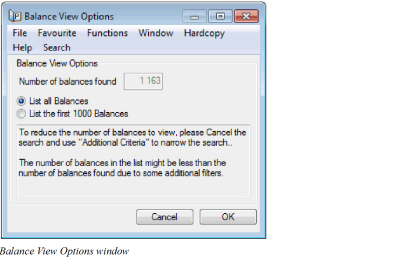

Retrieve Business Partner Ledger Balances #

When you click the Find Now button in the Business Partner Ledger the system finds and counts all balances to be retrieved according to your selection criteria. If less than 1000 balances are found, they are presented in the Business Partner Ledger display list directly. When more than 1000 balances are found a dialog window appears telling you how many balances that are found. You must then select to display all balances or only the first 1000 balances, or cancel in case you want to change the extraction criteria to retrieve fewer balances.

Note! The number of 1000 balances is hard coded and not user defined. The number of balance retrieved in the Balance display list is not necessarily the number of balances found. The Column Header Extraction may have excluded some of the found balances.

List all Balances #

- Open a Business Partner Ledger.

- Define extraction criteria.

- Click the Find Now button.

- The system finds and counts all balances. If less than 1000balances are found, they are presented in the Business Partner Ledger display list.

- If more than 1000 balances are found, the Balance View Options window appears. The system informs you about the total number of balances found.

- Select List all balances and click OK.

All balances are displayed in the Business Partner Ledger balance display list.

List the First 1000 Balances #

When your search in the Business Partner Ledger results in a large number of balances to be displayed this function should be used to increase the systems performance.

- Open a Business Partner Ledger.

- Define extraction criteria.

- Click the Find Now button. The system finds more than 1000 balances.

- Select List the 1000 first balances and click OK.

The 1000 first balances are display in the Business Partner Ledger balance display list. The More button is enabled in the display list enabling you to retrieve the remaining balances in the display list. You can click the More button as long as there is more balances to retrieve. When the button is disabled, no further balances exist.

On the status bar at the bottom of the Business Partner Ledger window you can see the number of retrieved balances and the number of balances remaining to be retrieved.

Note! The number of balances in the status bar indicates the number of balances found according to the extraction criteria but it might be that the number of balances in the display list is less than this number.

| Field | Description |

|---|---|

| Number of balances found | The number of balances found as result of your defined search criteria when more than 1000 balances are found. Values: A number (>1000 ) Mandatory: Yes Functional Impact: None |

| List all Balances | Indicate if all balances are to be displayed Values: Selected or Cleared Default: Selected Mandatory: No Functional Impact: Business Partner Ledger balance display list |

| List the first 1000 Balances | Indicate if only the first 1000 of the found balances are to be displayed Values: Selected or Cleared Default: Cleared Mandatory: No Functional Impact: Business Partner Ledger balance display list |

| Field | Description | Location |

|---|---|---|

| Wks ID | The worksheet identifier Values: A prefix + a number, e.g. TW1235, R'2004'316, CW5687, etc. (Depends on the type of worksheet) Mandatory: Yes |

|

| Wks Title |

The Worksheet Title from the associated worksheet for balance types Technical, Claim and Cession. For other Balances Types the field is empty. Values: Text Functional Impact: None Mandatory: No |

|

| WS Origin | Describes how/from where the worksheet is created Values: E.g. Automatic, Automatic Claim, Claim From Ground Up, Manual, REAC Account, REAC Preliminary, Reverse, etc. Mandatory: Yes (Except from Remittance worksheets) |

|

| Currency | The balance’s original currency. For bookings made through the Proportional Retrocession Accounting, only the balances in Accounting Currencies are displayed on the Business Partner Ledger. Values: The Currency names according to ISO, e.g. USD, CHF, GBP, etc. Mandatory: Yes |

|

| Balance | The original balance. If Expected Payment, Account Balance or Settlement Balance is extracted, then these balances are displayed instead of the original balance. Values: Amount Mandatory: Yes |

|

| Unsettled Part | The part of the original balance that is unsettled Values: Amount Mandatory: Yes |

|

| Payable Part | Reflects how much of the associated balance that is settled. E.g. if the associated Assumed Business balance for a Facultative Retrocessionaire Participation (RP) balance is settled, then the payable part of the RP balance is equal the balance amount of the RP balance. Only updated on negative balances, i.e. in your disfavour.) Values: Amount Mandatory: No. (Column exists only if activated by system parameter.) |

|

| Original RP | Displays the original responsible partner on outward business from original Assumed Business Values: The Business Partner Short Name Mandatory: No |

|

| Balance Type | Identifies the nature of the Balance Values: Technical, Remittance, Claim, (P&C) Settlement Balance, Account, Expected Payment, Bank Charge Remittance and Cession (Life) Mandatory: Yes |

|

| UwYR | The Underwriting Year of the balance if it contains only one Underwriting Year Values: A Year Mandatory: No |

|

| Remittance Type | Identifies the type of Remittance/Bank Charge Values: Bank Charge, Wire, Check, Group Wire, Group Reversal, etc. Mandatory: Yes, for the Balance Types Remittance and Bank Charge |

|

| Status | The status of the worksheet. (To find worksheets with status open, the status flag Open has to be selected.) Remittance balances are not dependent of the status flag. All statuses are displayed. Values: Depends on the balance type. E.g. Technical and Claim: Open, Closed, Remittance: Final, In Progress, etc. Mandatory: Yes |

|

| Settlement Indicator | Indicates the settlement status of the balance (The selected settlement indicators is reflected in the balance display list.) Values: Unsettled, Partially Settled, Settled or Written Off Mandatory: Yes |

|

| Last Pairing Date | Shows the last pairing date for balances with at least one active balance pairing Values: Date (dd/mm/yyyy) Functional Impact: None Mandatory: Yes, if the balance has at least one active balance pairing |

|

| Pending | Shows whether the balance is included in a Pending Balance Pairing or not. Is only visible if Pending Status in Balance Pairing is in use in your system. Values: Yes or No Mandatory: Yes |

|

| Offset Balance | Indicate if a balance, should not be settled as a separate balance but rather be offset with other balances. Impact: If value is Yes the Generate Payment Request function is not enabled. Values: Yes or No Mandatory: Yes |

|

| Estimated | Indicates if the balance is booked as estimate or actual Values: Yes (estimate) or No (actual) Mandatory: Yes |

|

| Date | The balance’s Due Date or Value Date (depends on the balance type). (Ref. Type of Date column). Values: A date (dd.mm.yyyy) Mandatory: Yes |

|

| Type of Date | Identifies the type of date displayed in the Date column. (Depends on the balance type). Values: Value Date for a Remittance/Bank Charge or Due Date for other balances. Mandatory: Yes |

|

| Account Group | Shows the Account Group copied from the business for which the balance is booked. Values: Maintained by your System Administrator Mandatory: No |

|

| Business ID | The identifier of the business for which the balance is booked. (Applies for the balance types Technical, Claim, Cession and Expected Payment) Values: E.g. Ptty103a, OCC53, OCC69-2, etc. Mandatory: No |

|

| Former ID | The former identifier of the business for which the balance is booked, if defined. Values: The value defined on the business Mandatory: No |

|

| Level of Business | The level of the business for which the balance is booked. Applies for Technical, Claim and Cession balances. Values: E.g. Assumed Business, Retrocessionaire Participation’s, etc. Mandatory: Yes, for Technical- and Claim balances |

|

| Business Title | The title of the business the balance applies for Values: The title defined on the business Mandatory: No |

|

| Claim Name |

The name of the claim the balance applies for Values: Free-text - maximum 60 characters Mandatory: For Claim Worksheets |

|

| Loss Start Date |

The start date of the loss occurrence Values: A date DD/MM/YYYY Mandatory: For Claims |

|

| Loss End Date |

The end date of the loss occurrence Values: A date DD/MM/YYYY Mandatory: For Claims |

|

| Claim ID | The identifier of the claim the balance applies for Values: Numeric value with 10 digits. (E.g. 0000001234) Mandatory: For Claim Worksheets. Only one Claim ID is displayed if balances created through a Treaty Outward Fac on a retrocessionaire participation, contain more than one claim. |

|

| Claim Name | The name of the claim the balance applies for Values: Free-text - maximum 60 characters Mandatory: For Claim Worksheets |

|

| Loss Start Date | The start date of the loss occurrence Values: A date DD/MM/YYYY Mandatory: For Claims |

|

| Loss End Date | The end date of the loss occurrence Values: A date DD/MM/YYYY Mandatory: For Claims |

|

| Headline Loss ID |

The identifier of the Headline Loss to which the claim balance is linked Values: Free text, maximum 20 characters Mandatory: For Headline Loss balances |

|

| Bank Charge CCY | The Currency of the Bank Charge in case of received remittances. Values: E.g. USD, GBP, CHF, etc. Mandatory: Yes, for Remittances |

|

| Bank Charge Amt | The amount of the Bank Charge in case of received remittances. An amount different from zero applies only when the Bank Charge is booked on the same worksheet as the Remittance and not as a separate worksheet. Values: 0,00 or booked amount Mandatory: Yes, for Remittances |

|

| Booking Year | The financial year when the balance was booked Values: Year value (yyyy) Mandatory: Yes |

|

| Booking Period | The financial period within the financial year when the balance was booked Values: E.g. Month 03, 2nd Quarter, 1sthalf-year, etc. (Defined in the base company specific settings by your system administrator.) Mandatory: Yes |

|

| Booking Date | The Booking Date on the Balance Values: Date (dd/mm/yyyy) Functional Impact: None Mandatory: Yes (except from Account Balance, Settlement Balance and Expected Payments) |

|

| Registration Date |

The date when the Worksheet was registered Values: Date (dd/mm/yyyy) Functional Impact: None Mandatory: Yes (except from Account Balance, Settlement Balance and Expected Payments) |

|

| Closed Date | The date when the Worksheet was closed Values: Date (dd/mm/yyyy) Functional Impact: None Mandatory: Yes (except from Account Balance, Settlement Balance and Expected Payments) |

|

| Responsible BP | The legal responsible business partner of the business the balance applies for. E.g. if assumed business, the cedent is the responsible business partner. Values: The responsible Business Partner name Mandatory: Yes, for Technical-, Claim-, Cession- and Expected Payment balances |

|

| Included in Settlement Balance Group | Indicates if the Balance is included in a Settlement Balance Group Values: Yes or blank Mandatory: No |

|

| Settlement Balance Group ID | Displays the identifier (worksheet id) of the Settlement Balance Group the balance belongs to. Values: A prefix + a number, e.g. SB1324 or blank Functional Impact: None Mandatory: No |

|

| Included in Account Balance Group | Indicates if the Balance is included in an Account Balance Group Values: Yes or Blank Mandatory: No |

|

| Account Balance Group ID | Displays the identifier (worksheet id) of the Account Balance Group the balance belongs to. Values: A prefix + a number, e.g. AB1324 or blank Functional Impact: None Mandatory: No |

|

| Has Expected Payment | Indicates if the Balance is defined with expected payment Values: Yes or blank Mandatory: No |

|

| BP Reference | Display the Business Partner Reference entered on the balance, either on the balance’s property or on the worksheet. Values: Text Functional Impact: None Mandatory: No |

|

| Base Company | The Base Company the balance applies for taken from the Insured Period on the Business. Values: The Business Partner’s short name Mandatory: No |

|

| TA Process ID |

A reference that helps you identify the balance. Please refer to the Process ID chapter of the Handle Reference Items chapter in the System Administration Guide for more details about the Process ID. Values: Free-text, maximum 30 characters Mandatory: No Functional Impact : if the System Parameter Enable Accounting Worksheet Process ID Validation is activated, the Process ID must exist in the Process ID table and the Status must be either Open or Re-Open when Worksheet has Status ‘Closed’. |

More Information view |

| CL Process ID |

A reference that helps you identify the balance. Please refer to the Process ID chapter of the Handle Reference Items chapter in the System Administration Guide for more details about the Process ID. Values: Free-text, maximum 30 characters Mandatory: No Functional Impact : if the System Parameter Enable Accounting Worksheet Process ID Validation is activated, the Process ID must exist in the Process ID table and the Status must be either Open or Re-Open when Worksheet has Status ‘Closed’. |

More Information view |

| Due Date | The balance’s due date Values: Date value Mandatory: Yes |

|

| Accounting Classification | The Accounting Classification the balance applies for. The value is activated by a system parameter. (Contact your System Administrator for further information.) Values: A system defined combination of an agreement’s classifications. Your system administrator decides which classification components to be included and how the value is displayed. (Example: PROPERTY_BI_EU). The values are only shown if exactions are made on the Accounting Classification Criteria. Derived from: The Accounting Classification is selected on the Technical-/Claim Worksheet Functional Impact: None Mandatory: Yes, for Technical- and Claim balances |

|

| Section Name | The Section of a Business Agreement where the balance has been recorded. The value is activated by a system parameter. (Contact your System Administrator for further information.) Values: Text Derived from: The section is selected on the Technical-/Claim Worksheet Functional Impact: None Mandatory: Yes, for Technical-, Cession- and Claim balances |

|

| Classification | A Classification of a Remittance Balance or Unallocated Remittance Balance Values: None plus user defned values Mandatory: No |

|

| Classification 2 | A Classification of a Remittance Balance or Unallocated Remittance Balance Values: None plus user defned values Mandatory: No |

|

| Mass Paired |

Shows whether or not the balance is included in a Balance Pairing created by the Mass Pairing Order. Values: Yes or No Mandatory: Yes |

|

| London Reference | A London Market EDI (LIMNET) Reference Values: Text Derived from: The LM reference field can be updated in the Technical- and Claim Worksheet Closing window or the EDI Reference field can be updated in the More Balance Information window from the Business Ledger or Business Partner Ledger Functional Impact: None Mandatory: No |

|

| Bulk Reference | Reference of Bulk Claims messages sent by LIRMA (supported by LIMNET) Values: Text Functional Impact: None Mandatory: No |

|

| Referred eMessage UUID | A unique reference attached to each Rebord message (supported by JV) Values: Numbers, Letters or a combination Derived from: The JV EDI Rebord message manually or automatically Functional Impact: None Mandatory. No |

|

| eMessage UUID | A unique reference attached to each Retacc message (supported by JV) Values: Numbers, Letters or a combination. Derived from: The JV EDI Retacc message manually or automatically Functional Impact: None Mandatory: No |

|

| Resett Reference | A unique reference attached to each Resett message (supported by JV) Values: Numbers, Letters or a combination. Derived from: The JV EDI Resett message manually or automatically Functional Impact: None Mandatory: No |

|

| Notes | A note that applies for the balance Values: Text Derived from: The Note may be entered in the Technical- and Claim Worksheet Closing window or in the More Balance Information window from the Business Ledger or Business Partner Ledger. In case of Reversed- or Copied worksheets, the field is automatically updated for reference between the worksheets. Functional Impact: None Mandatory: No |

|

| Registered By | System displays the User name who have created respective worksheet listed in search results.. Values: Text Functional Impact: None Mandatory: Yes, for Technical-, Claim |

|

| BP Name | The Business Partner Name. Values: Free-text, maximum of 80 characters. Functional Impact: None Mandatory: Yes |

|

| BP Number | SICS Identifier of Business Partner. Values: SICS Identifier. Functional Impact: None Mandatory: Yes |

|

| Source Wks ID on ORP | Show the identifier (worksheet id) of the source detail on ORP when the balance comes from IGC IAB, and the booking details of this balance has a detail pairing link to the source ORP. Values: A prefix + a number Functional Impact: None Mandatory: No |

|

| Invoice No |

Unique identification number allocated to set of transactions in order to pay GST to the authorities. Values: Free-text, maximum 100 characters Mandatory: No |

|

| Government Invoice Ref No |

Unique identification number, post implementation of e-invoices as per GST notification. Values: Free-text, maximum 100 characters Mandatory: No |

|

| Invoice Date | The date of the Invoice. Values: Date (mm/dd/yy) Mandatory: No Functional Impact: None |

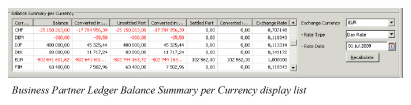

Display Balance Summary per Currency #

You can see a summary per currency of all balances selected and displayed in the Business Partner Ledger Balance display list. You can also specify a currency for which you want to see the converted balances converted.

- Open a Business Partner Ledger.

- Define extraction criteria.

- Click Find Now and select to list All Balances or the First 1000 Balances.

- Click the Recalculate button. All balances are included in the Summary even if you display only 1000. (If the total balance for a currency amounting to zero in all columns, the currency will be suppressed.)

- Define an Exchange Currency, Rate Type and Rate Date before you click Recalculate if you want to convert the balances and to see total for the converted balance.

6. NB! If additional filtering in the balance container heading have been done it is necessary to select the popup menu option ‘Recalculate based on listed balances’ in the Balance Summary per Currency list to have the summary recalculated based on the listed balances.

6. NB! If additional filtering in the balance container heading have been done it is necessary to select the popup menu option ‘Recalculate based on listed balances’ in the Balance Summary per Currency list to have the summary recalculated based on the listed balances.

| Field | Description |

|---|---|

| Currency | All selected Currencies in the Currency display list are listed in alphabetical order Values: Currency (E.g. GBP, CHF, NOK, USD, etc.) Functional Impact: None Mandatory: Yes |

| Balance | The total of original Balances for each currency. If further extraction in the column header of the Balance display list has been performed, the amount in this column may not be correct, you must select the popup menu option ‘Recalculate based on listed balances’ to have the summary recalculated based on the listed balances. Values: Amount Derived from: All original balances displayed Functional Impact: None Mandatory: Yes |

| Converted in: xxx | The total of original Balances for each currency converted into a specific currency (xxx). The bottom line shows the total of all converted currencies. Values: Amount Calculation: Balance multiplied with the selected Exchange Currency’s daily rate as per the defined Rate Date. If a daily rate is not defined at the specific day, the most recent daily rate prior to this date is used. Functional Impact: None Mandatory: No |

| Unsettled Part | The total of the Unsettled part of the Balances for each Currency Values: Amount Derived from: Unsettled-/Partially Settled balances in the balance display list Functional Impact: None Mandatory: Yes |

| Converted in: xxx | The total of the Unsettled part of the balances for each currency converted into a specific currency (xxx). The bottom line shows the total of all converted currencies. Values: Amount Calculation: Unsettled Part multiplied with the selected Exchange Currency’s daily rate as at the defined Rate Date. If a daily rate is not defined at the specific day, the most recent daily rate prior to this date is used. Functional Impact: None Mandatory: No |

| Settled Part | The total of the Settled part of the balances for each currency Values: Amount Derived from: Settled-/Partially Settled-/Written Off balances in the balance display list Functional Impact: None Mandatory: Yes |

| Converted in: xxx | The total of the Settled part of the balances for each currency converted into a specific currency (xxx).The bottom line shows the total of all converted currencies. Values: Amount Calculation: Settled Part multiplied with the selected Exchange Currency’s daily rate as at the defined Rate Date. If a daily rate is not defined at the specific day, the most recent daily rate prior to this date is used. Functional Impact: None Mandatory: No |

| Exchange Currency | The exchange rate used in the calculation when converting from the original currency to the selected currency in Exchange Currency according to the selected Rate Type and Rate Date. Values: Exchange Rate value. Calculation: The Balance amount for the currency divided by the corresponding Converted balance amount. (Balance Converted in currency yyy/Balance in currency xxx Functional Impact: None Mandatory: No |

| - Rate Type | The Type of Exchange Rate Values: Day Rate Functional Impact: The Converted in: xxx columns Mandatory: Only if Exchange Currency is selected |

| - Rate Date | The date the rate applies for or the rate at the mot recent date Values: Date value Functional Impact: The Converted in: xxx columns Mandatory: Only if Exchange Currency is selected |

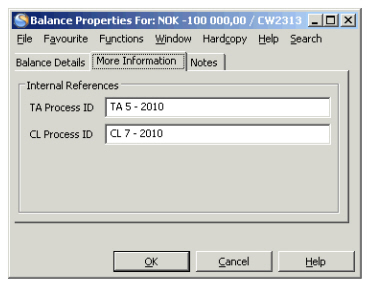

Open and Maintain the Balance Properties from Business Partner Ledger #

When balances are retrieved according to your selection criteria you may need more information about a Technical-, Claim-, Cession- or Expected Payment balance. You can view the balance property, change Business Partner when applicable, type a Cedent/Broker reference, type an EDI Reference, Account Documents Received Dates and/or create/edit/delete Expected Payment information.You can view the Functional Currencies for a balance from the Balance Property window by use of the option in the Menu button. You can also apply and/or change the Internal References in the More information tab.

- Select the Balance you want more information about from the Balance display list.

- Select ‘More Balance Information’from the pop-up menu. You see the Balance Properties window.

- Click the ‘Edit ‘button to change the business partner in the Payment Information section, and/or to type a reference in the Cedent Broker Reference field. You can change the business partner to another registered business partner on the business. If the ‘Allow Allocation of External Business Partner to Balance’ system parameter is in use, and the ‘External Business Partner’checkbox on the Business Properties window, Business tab has been selected, you can change the business partner to a business partner not registered on the business.

- If the ‘Recipient’checkbox on the Business Properties window, Business tab has been selected (available if the ‘Allow Allocation of External Business Partner to Balance ‘system parameter is in use), you see a new field on the Balance Details View window. You can register another business partner in this Recipient field. This business partner does not have to be a partner on the business.

- Clik the Edit button to change the Internal References TA Process ID and CL Procecc ID.

- Click the ‘OK’ button to save your changes.

Create/Edit Expected Payment Currency and Amount from Business Partner Ledger #

When a balance is to be settled in another currency than the original, you can create an Expected Payment Currency and Amount from the Balance Details View window. You can also modify already existing expected payment information.

The functionality only applies for Unsettled and Partially Settled Technical- Claim-, Cession- and Expected Payment balances.

- Select the balance you want to Create/Edit Expected Payment Currency and Amount for from the Balance display list.

- Select More Balance Information from the pop-up menu. You see the Balance Properties window.

- Click the Edit button to change to edit mode.

- Select the option Create/Edit Expected Payment from the Menu button. The selected balance in its original currency is displayed in an Expected payment for: xxx window.

- Select a Currency from the drop-down list. The rate of exchange between the selected currency and the original currency is defaulted and the converted balance is calculated.

- If required, change the rate of exchange or converted amount and click Save and OK.

- In case the exchange rate used exceeds the tolerance limits defined in your system parameters, a warning or even an error message will appear. If an error message appears you must correct the rate or amount before you can continue.

The Has Expected Payment field in the Balance display list is updated with the indictor Yes when the balance has an Expected

Payment Currency/Amount.

You can extract Expected Payment in the Balance Type list at the top of the Business Partner Ledger. All original Technical-, Cession- or Claim Balances with Expected Payments are now hidden and replaced by its Expected Payment Balance.

Delete Expected Payment from Business Partner Ledger #

You can delete the Expected Payment information from the balance.

- Select a balance that is updated with the indicator Yes in the Has Expected Payment field.

- Select More Balance Information from the pop-up menu. You see the Balance Properties window.

- Click the Edit button to change to edit mode.

- Select Delete Expected Payment from the Menu button and click OK.

The Currency, Exchange Rate and converted amount are removed. The Has Expected Payment indicator is also removed from the Balance display list.

| Field | Description |

|---|---|

| Business Partner | The expected payment partner of the balance. Values: Business Partner names Derived from: The agreements Business Partners with the Payment Task. Functional Impact: Business Partner Ledger Mandatory: Yes |

| Responsible Business Partner | The Legal Responsible Business Partner of the business, e.g. Cedent on Assumed Business and Reinsurer on Retrocessionaire Participation. Values: Business Partner name Derived from: The agreement’s Business Partners Functional Impact: None Mandatory: Yes |

| Original Currency/-Amount | The Currency and Amount of the selected balance Values: Currency and Amount Derived from: The Balance display list Functional Impact: None Mandatory: Yes |

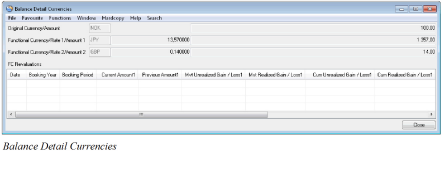

| Functional Currency | Opens a window containing: - Original Currency/Amount: The booking details Currency and Amount. Values: Currency and amount Derived from: The details currency and amount entered in the Worksheet Mandatory: Yes Functional Impact: None - Functional Currency/Rate1/Amount1: A defined currency to be used transferring details to the General Ledger Values: Currency, Rate and Amount Derived from: System Parameter settings (Refer to Accounting System Parameters in the System Administrator’s Guide). The rate displayed is calculated by dividing the Functional Amount by the Original Amount. Mandatory: No Functional Impact: None - Functional Currency/Rate2/Amount2: A defined currency to be used transferring details to the General Ledger Values: Currency, Rate and amount Derived from: System Parameter settings (Refer to Accounting System Parameters in the System Administrator’s Guide). The rate displayed is calculated by dividing the Functional Amount by the Original Amount. Mandatory: No Functional Impact: None |

| Functional Currency | -FC Revaluations/Date: The date and time when the Functional Currency revaluations were booked. Values: Date and Time Derived from: Functional Currency Revaluation Order (Refer to Period Functions/Accounting Mass Update) or when the balance pairing took place if this is a FC Revaluation created by a balance pairing Mandatory: Yes Functional Impact: None -FC Revaluations/Booking Year: The Year when the Functional Currency Revaluations were booked or the Year from the Booking Year/Period on the balance itself if this is a FC Revaluation for a balance and created from a balance pairing. Values: Year Derived from: Functional Currency Revaluation Order (Refer to Period Functions/Account Mass Update) or the Year from the Booking Year/Period on the balance itself if this is a FC Revaluation for a balance and created from a balance pairing. Mandatory: Yes Functional Impact: None |

| Functional Currency | -FC Revaluations/Booking Period: The Period when the Functional Currency Revaluations were booked or the Period from the Booking Year/Period on the balance itself if this is a FC Revaluation for a balance and created from a balance pairing. Values: Period Derived from: Functional Currency Revaluation Order (Refer to Period Functions/Account Mass Update) or the Period from the Booking Year/Period on the balance itself if this is a FC Revaluation for a balance and created from a balance pairing. NB! If the Booking Year/Period on this balance is not open within the Booking Term for the Base Company on the balance, the system will set the Default Booking Year/Period from this Base Company’s Booking Term Mandatory: Yes Functional Impact: None -FC Revaluations/Current Amount 1: The Original Balance amount converted to Functional Currency 1 according to specified exchange rate. Values: Amount Derived from: Functional Currency 1 defined in system parameters (refer to Accounting/Currency) and the FC1 Exchange Rate defined on Functional Currency Revaluation Order. If created by a balance pairing the amount is taken from the FC1 on the other balance in the pairing, e.g. the remittance balance Mandatory: Yes Functional Impact: This amount, if it is set by the revaluation order, will be set as Previous Amount when running the next Functional Currency Revaluation Order. Current Amount is used in calculation of the value in field MvtUnrealizedGain/Loss1 and the field MvtRealizedGain/Loss1. |

| Functional Currency | -FC Revaluations/Previous Amount 1: The Functional Currency 1 amount (when no previous Functional Currency Revaluation Order has been run) or the amount in field Current Amount from previous Functional Currency Revaluation Order Values: Amount Derived from: Functional Currency 1 Amount (when no Functional Currency Revaluation Order has been run) or Current Amount set by the Functional Currency Revaluation Order from the previous run In case the previous row is from a balance pairing so that the balance is partially settled the Previous Amount 1 is calculated as follows; Functional Currency 1 amount / Original amount on the balance * current Unsettled Amount on the balance Mandatory: Yes Functional Impact: Previous Amount is used in calculation of the value in field MvtUnrealizedGain/Loss1 and the field MvtRealizedGain/Loss1 |

| Functional Currency | -Mvt Unrealized Gain/Loss 1: The difference between the Current Amount1 and the Previous Amount1 when running the Functional Currency Revaluation Order Values: Amount Derived from: Values in fields Current Amount and Previous Amount When balance pairing takes place the unrealized gain/loss will be “reversed” with the part that is settled, e.g. if the cumulative gain/loss is 10 and the settlement part is 40% in this pairing then the unrealized gain/loss is reduced with 4. Mandatory: Yes Functional Impact: None -Mvt Realized Gain/Loss 1: When a technical balance becomes Settled, the system will use the Functional Currency amount found on the remittance balance and enter this in the Current Amount column and enter the original calculated Functional Currency amount from the technical balance in the Previous Amount column. The difference will be entered in the Realized Gain/Loss column. At the same time the existing Unrealized Gain/Loss will be reversed and set to zero Values: Amount Derived from: FC in the Remittance Balance and the FC in the Technical Balance Mandatory: Yes Functional Impact: None |

| Functional Currency | -Cum Unrealized Gain/Loss 1: The accumulated Gain/Loss upto the previous revaluation from the column MvtUnrealizedGain/Loss1 Values: Amount Derived from: Values in field-Mvt Unrealized Gain/Loss 1 Mandatory: Yes Functional Impact: None -Cum Rrealized Gain/Loss 1: The accumulated Gain/Loss upto the previous revaluation from the column MvtRealizedGain/Loss1 Values: Amount Derived from: Values in field-MvtRealized Gain/Loss 1 Mandatory: Yes Functional Impact: None |

| Functional Currency | -FC Revaluations/Current Amount2: The Original Balance amount converted to Functional Currency 2 according to specified exchange rate. Values: Amount Derived from: Functional Currency 2 defined in system parameters (refer to Accounting/Currency) and the FC2 Exchange Rate defined on Functional Currency Revaluation Order. If created by a balance pairing the amount is taken from the FC2 on the other balance in the pairing, e.g. the remittance balance Mandatory: Yes Functional Impact: This amount, if it is set by the revaluation order, will be set as Previous Amount2 when running the next Functional Currency Revaluation Order. Current Amount2 is used in calculation of the value in field MvtUnrealizedGain/Loss2 and the field MvtRealizedGain/Loss2 |

| Functional Currency | -FC Revaluations/Previous Amount2: The Functional Currency 2 amount (when no previous Functional Currency Revaluation Order has been run) or the amount in field Current Amount2 from previous Functional Currency Revaluation Order Values: Amount Derived from: Functional Currency 2 Amount (when no Functional Currency Revaluation Order has been run) or Current Amount2 set by the Functional Currency Revaluation Order from the previous run In case the previous row is from a balance pairing so that the balance is partially settled the Previous Amount 2 is calculated as follows; Functional Currency 2 amount / Original amount on the balance * current Unsettled Amount on the balance Mandatory: Yes Functional Impact: Previous Amount2 is used in calculation of the value in field MvtUnrealizedGain/Loss2 and the field MvtRealizedGain/Loss2 |

| Functional Currency | -Mvt Unrealized Gain/Loss 2: The difference between the Current Amount2 and the Previous Amount2 when running the Functional Currency Revaluation Order Values: Amount Derived from: Values in fields Current Amount and Previous Amount When balance pairing takes place the unrealized gain/loss will be “reversed” with the part that is settled, e.g. if the cumulative gain/loss is 10 and the settlement part is 40% in this pairing then the unrealized gain/loss is reduced with 4. Mandatory: Yes Functional Impact: None |

| Functional Currency | -Mvt Realized Gain/Loss 2:: When a technical balance becomes Settled, the system will use the Functional Currency amount found on the remittance balance and enter this in the Current Amount column and enter the original calculated Functional Currency amount from the technical balance in the Previous Amount column. The difference will be entered in the Realized Gain/Loss column. At the same time the existing Unrealized Gain/Loss will be reversed and set to zero Values: Amount Derived from: FC in the Remittance Balance and the FC in the Technical Balance Mandatory: Yes Functional Impact: None -Cum Unrealized Gain/Loss 2: The accumulated Gain/Loss upto the previous revaluation from the column MvtUnrealizedGain/Loss2 Values: Amount Derived from: Values in field-Mvt Unrealized Gain/Loss 2 Mandatory: Yes Functional Impact: None |

| Functional Currency | -Cum Realized Gain/Loss 2: The accumulated Gain/Loss upto the previous revaluation from the column MvtRealizedGain/Loss2 Values: Amount Derived from: Values in field-MvtRealized Gain/Loss 2 Mandatory: Yes Functional Impact: None -FC Revaluation/Transferred to GL: field is not in use |

| Expected Currency/-Amount | The Currency, Exchange Rate and Amount you expect the balance to be settled in. Values: Currency and Amount Default: The Original Currency/-Amount Functional Impact: Business Partner Ledger, Business Ledger Mandatory: No |

| Cedent/Broker | A reference helping you to identify/verify balances in the Business Partner Ledger/Business Ledger Values: Free text, max 30 characters Derived from: A reference may already be entered in the Technical-/Claim Worksheet Closing window. Functional Impact: None Mandatory: No |

| EDI Reference | A London Market EDI (LIMNET) Reference Values: Free Text Derived from: A reference may have been entered in the LM reference field in the Technical- and Claim Worksheet Closing window. Functional Impact: None Mandatory: No |

| Accounting Documents Received (External/Internal) | The date(s) when the account of the booked balances was received. The Received External represents the date when the account arrived the company, while the Received Internal represents the date when the account arrived the actual department. The Received Internal field is visible only if the parameter “Is Received Internal Date On Worksheet In Use” is selected on the Base Company Specific Settings. Values: Date(s) Derived from: The date entered in the Received Date field(s) of the worksheet. Functional Impact: None Mandatory: No |

| Balance Acknowledged | The field is not in use |

| Reallocate Booking Year | The field is not in use |

| Distributed to Reinsurers | The field is not in use |

| Origin of Worksheet | Indicates from which type of Worksheet the balance origin Values: E.g. Manual, Migrated, REAC Preliminary, REAC Temporary, REAC Account, Automatic, Automatic Claim, Claim From Ground Up, Reverse, Post Balance, etc. Functional Impact: None Mandatory: Yes |

| Include in Statement | Indicates if the selected balance should be included in Billing/Reminder statements. Values: Selected or Cleared. Default: Selected |

| Include in Billing/Reminder Statement | A log of when the balance has been included in the statements, and by whom the balance has been included. Values: Dates and Names Derived from: Billing/Reminder statement orders Functional Impact: None Mandatory: No |

| TA Process ID |

A reference that helps you identify the balance. Please refer to the Process ID chapter of the Handle Reference Items chapter in the System Administration Guide for more details about the Process ID. Values: Free-text, maximum 30 characters Mandatory: No Functional Impact : if the System Parameter Enable Accounting Worksheet Process ID Validation is activated, the Process ID must exist in the Process ID table and the Status must be either Open or Re-Open when Worksheet has Status ‘Closed’. |

| CL Process ID |

A reference that helps you identify the balance. Please refer to the Process ID chapter of the Handle Reference Items chapter in the System Administration Guide for more details about the Process ID. Values: Free-text, maximum 30 characters Mandatory: No Functional Impact : if the System Parameter Enable Accounting Worksheet Process ID Validation is activated, the Process ID must exist in the Process ID table and the Status must be either Open or Re-Open when Worksheet has Status ‘Closed’. |

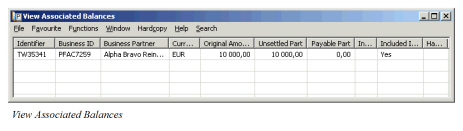

View Associated Balances #

From the Business Partner Ledger you can view the associated balances for a selected balance.

- Open the Business Partner Ledger

- Select one balance (technical or claim balance)

- Select View Associated Balances from the pop-up menu in the Balance display list.

Note! This option only exists if the Show Payable Amount in Business Partner Ledger is activated in the system parameters. (See your system administrator for further information.) Furthermore, the option is only enabled if the selected balance has associated balances.

The balances shown in the View Associated Balances window are either from the parent or the child business. If the selected balance belongs to an Assumed Business then the balances shown are from the associated Facultative Retrocessionaire Participations (Fac RP). And opposite, if the selected balance belongs to a Fac RP then the balance shown is from the associated Assumed Business.

| Field | Description |

|---|---|

| Identifier | The Worksheet Id of the worksheet belonging to the associated balance Values: : A prefix + a number, e.g. TW1235, R316, etc. (Depends on the type of worksheet) Mandatory: Yes |

| Business Id | The Business Id of the business belonging to the associated balance Values: E.g. Ptty103a, OCC69-2, etc. Mandatory: Yes |

| Business Partner | The Payment Partner of the associated balance Values: The Business Partner Name Mandatory: Yes |

| Currency | The associated balance’s Currency Values: USD, CHF, GBP, etc. Mandatory: Yes |

| Original Amount | The amount of the associated balance Values: Amount Mandatory: Yes |

| Unsettled Part | The unsettled amount of the associated balance Values: Amount Mandatory: Yes |

| Payable Part | Describes how much of the original amount of the associated balance is payable. This part is calculated only if the original amount is negative (in our disfavour) and the amount reflects how much of the selected balance is settled. If the selected balance is partially settled e.g. with 50% then the associated balance shows a Payable Part as 50% of its Original Balance Values: Amount (Negative) Mandatory: No |

| Included in Settlement Balance | Indicates if the associated balance is part of a Settlement Balance Group Values: Yes or blank Mandatory: No |

| Included in Account Balance | Indicates if the associated balance is part of an Account Balance Group Values: Yes or blank Mandatory: No |

| Has Expected Payment | Indicates if the associated balance has an Expected Payment Values: Yes or blank Mandatory: No |

To Generate Payment Request from Associated Balance:

You can select to generate a payment request from the View Associated Balances window. You can then select to pay the Payable Part or the Unsettled Part of the associated balance.

Refer to Auto Generate Payment Request in the Remittance Booking chapter for further information.

To navigate from the View Associated Balances window:

You can navigate from the View Associated Balances window to e.g. Worksheet properties or Business Ledger.

- Find and select a balance from the View Associated Balances window.

- Select one of the following options from the pop-up list.

-

More Balance Information: Opens the Balance Properties window for the selected balance.

-

Business Properties: Opens the latest Insured Period of the Business for the selected balance.

-

Business Ledger: Opens the Business Ledger for the selected balance.

Some of the options are only available for some types of balances, i.e. claim or technical:

-

Opens the claim worksheet properties.

-

Opens the technical worksheet properties.

Some of the options are only available if the balance is part of a group or has been included in a balance pairing

-

Opens the Account Balance Group Property for the selected balance.

-

Settlement Balance Properties: Opens the Settlement Balance Group Property for the selected balance.

-

This option is enabled if you select a balance that has been partially or fully settled (has pairing objects). Opens the Balance Pairing Property for the selected balance.

Offset Business Partner Ledger Balances #

You can indicate that a balance, should not be directly settled but rather be deducted from other balances settlement.

The functionality applies for Unsettled or Partially Settled Technical- and Claim balances.

- Select the balance you want to mark as Offset in the Balance display list.

- Select Offset Balance from the pop-up menu.

The selected balance is updated with the indicator Yes in the Offset Balance column in the balance display list.

You are not allowed to generate payment requests from balance being offset.

Navigate from the Business Partner Ledger #

You can navigate to other areas and functionalities from a Business Partner Ledger by using the pop-up menu within the Balance display list.

Open the Business Properties from the Business Partner Ledger #

You can open the business properties of a specific balance directly from the Business Partner Ledger.

- Select a Technical-, Claim-, Cession- or Expected Payment Balance from the Balance display list.

- Select Business Properties from the pop-up menu. The business is displayed with the properties of the Insured Period connected to the selected balance.

Open the Claim Properties from the Business Partner Ledger #

You can open the claim properties of a specific balance directly from the Business Partner Ledger.

- Select a Claim Balance from the Balance display list.

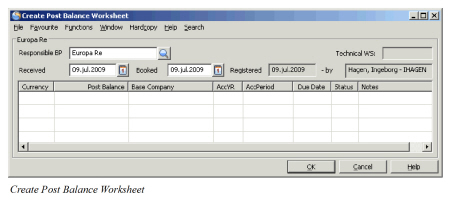

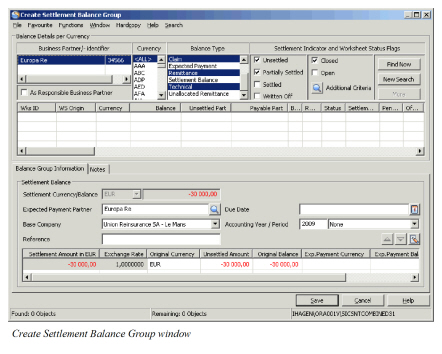

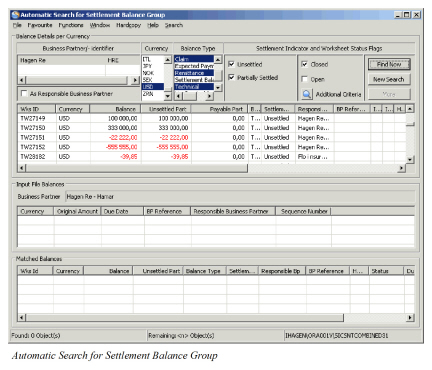

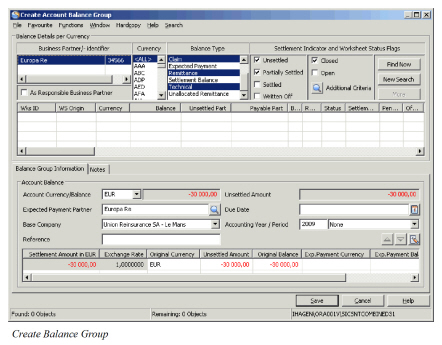

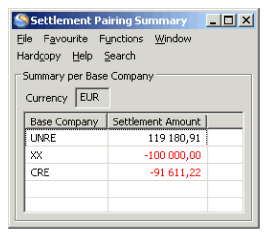

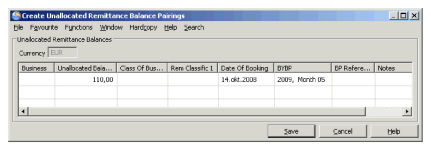

- Select Claim Properties from the pop-up menu. The claim properties is displayed for the claim connected to the selected balance.