Handle Claim Accounting (Inward)

If you have created claims on your business, SICS allows you to handle the Claim Accounting on Claim Worksheets instead of the general Technical Worksheet. The Claim Worksheet differs from the Technical Worksheet since it is specific to a single Claim, or Claims for a specific business. Worksheet validations will consider the bookings made for each claim. Also, the Claim worksheet may or may not be transferred to the ledger; whereas the Technical Worksheet is always transferred to the ledgers. This enables you to book for example your proportional treaty accounts through the technical worksheet function, but at the same time maintain details about major losses through claims, and claim worksheets using the No Transfer To Ledger option.

All bookings pertaining to a claim, including V.A.T. and Reinstatement bookings can be recorded on the Claim Worksheet, and will then be displayed on the Claim Ledger. The majority of Claim Worksheets are either created manually, or generated from the From Ground Up functionality. In addition Claim worksheets can be generated from the EDI module (refer to the Handling EDI chapter in this user guide).

In the following the specific Inward Claim Accounting processes are described. Most of these processes will also apply for manual Outward Claim Accounting. The general accounting processes (for example Finding Worksheet) are described previously in this chapter.

Create a Claim Worksheet #

Claim Worksheets can be created on all types of claims, regardless of the Transfer to Ledger indicator, or the Claim’s disposition. However, there are certain requirements.

Requirements #

In order to be able to create a claim booking; there are certain requirements that must be fulfilled. They are:

- The Business and Insured Period must be open for booking; the Cease Accounting check box on the Insured Period must be cleared. Refer to Handle Business Life Span chapter in the User Guide

- The Claim must be Active.

- The Claim’s status must be Open.

If the claim is linked to a placement of a Joint Contract, you must furthermore perform all manual accounting (not generated through EDI) from the Administrator’s Claim. From Ground Up claim accounting is not enabled for these claims.

The Business must of course meet the requirements for Claim Creation. Refer to the Handle Claims chapter in this guide for further details.

If the claim is linked to a Headline Loss and you are using the Event IBNR functionality, and the parameter “Mandatory Link When Event IBNR Group on Linked Headline” is not activated, the claim must also be linked to an Event IBNR Group on all sections. If you are using the Event IBNR functionality, and the parameter “Mandatory Link When Event IBNR Group on Linked Headline” is also activated, the claim must also be linked to an Event IBNR Group on all sections, only when the linked Headline has Event Groups defined. If Event IBNR Group is valid for single currency only, the link must be defined for all existing claim ledger currencies.

If claim Bdx functionality is in use, and the claim is linked to more than one business, all of these must have the same Claim Bdx indicator.

Create a (Manual) Claim Worksheet from Business #

- Select the Claim Worksheet button on the Navigation bar.

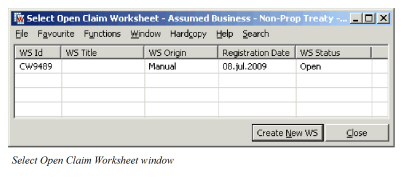

- If open claim worksheets exists for this business, the Select Open Claim Worksheet window is displayed.

- Select Create New WS or select New from the pop-up list.

Create a (Manual) Claim Worksheet from Claim Ledger #

- Select New Adjustment from the Claim Ledger.

- If the Claim is marked as an “Early Claim”, confirm that you want to create a booking. If the claim’s ‘FGU Indicator’ is activated, confirm that you want to create a manual worksheet.

- If open claim worksheets exist for this claim-to-section link, the Select Open Claim Worksheet window listing the open worksheets is displayed.

- Select New or Create New from the pop-up list.

Create a (Manual) Claim Worksheet from Find Worksheet #

- Select New Claim Worksheet from the pop-up list.

- The system opens the Find Claim window. Enter the Claim ID and/or other necessary search criteria in order to find the required claim.

- Double click or select Transfer from the pop-up list.

- If the claim is marked as an “Early Claim” or if the claim’s FGU indicator is activated, confirm that you want to create a booking.

Create From Ground Up Claim Worksheet #

- Open the From Ground Up Recording window of an Individual Claim.

- Select Create Claim Worksheet or Create Worksheet with Zero Adjustment from the menu in the lower right corner. The first option is only enabled if the From Ground Up Advisory has generated Adjustments.

(Refer to the From Ground Up Handling in the Claims chapter for further details about the From Ground Up functionality.) The second option is only enabled if the Incurred amount = > lowest priority of the linked sections, and only when current advisory does not result in any adjustments. 3. If the Claim is marked as an “Early Claim”, confirm that you want to continue with the booking. 4. If the From Ground Up adjustments should be partly transferred to the ledger, and partly not transferred, the system open the Select Open Claim Worksheet window with the two generated worksheets listed. 5. Select the worksheet you want to work with first, and double click to open.

| Field | Description | Location |

|---|---|---|

| WS Id | A unique identification of the Worksheet Values: Worksheet identifier Mandatory: Yes |

Select Open Claim Worksheet window |

| WS Title | A worksheet title given either by the System or by you dependent of the origin of the worksheet Values: Text Mandatory: When your System Administrator has activated this, title is mandatory on claim worksheets created manually, FGU, or through SICS API Server. |

Select Open Claim Worksheet window |

| WS Origin | From where the Worksheet originally was created Values: Manual, From Ground Up etc. Mandatory: Yes |

Select Open Claim Worksheet window |

| Registration Date | The date when the Account is registered in the system the first time. Values: Date (mm/dd/yy) Mandatory: Yes |

Select Open Claim Worksheet window |

| WS Status | The current status of the worksheet Values: Open, Closed, Inactivated, etc. Mandatory: Yes |

Select Open Worksheet window |

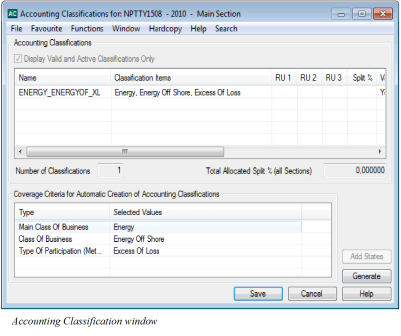

Split FGU Worksheet into multiple Accounting Classifications #

Please refer to Handle Claims chapter, From Ground Up for further details about splitting the FGU bookings into multiple Accounting Classifications.

The Basic Claim Booking Process - Steps Involved #

The Claim worksheet normally defaults part of the booking information using the business and the claim information at hand. What is automatically populated depends on from where you initiated the Claim booking process:

From the Business: The Business section of the worksheet is completed, and worksheet title can appear.

From the Claim Ledger or Find: Worksheet: In addition to the Business information, the section is completed

From the From Ground Up window: In addition to the Business and claim information, most of the Booking Properties, currencies, and booking information are also inserted.

The booking process involves the following steps:

- Add the Claim (or Claims) that you want to include in your worksheet, if not already defaulted.

- Select a Ledger Currency or Add a new currency by selecting Add Currency from pop-up list if not already defaulted. If the selected currency has not been defined on the Limit condition a warning appears.

- Register the other basic account information as required, and select your Booking Options

- Select whether bookings should impact FGU distribution. This indicator is not enabled if your System Administrator has activated the use of FGU indicator on claim.

- Add booking details by selecting Add Entry Code from the pop-up list on the Original Bookings section, selecting entry code and the adjustment/new position for that entry code.

- Repeat step 6 for each entry code that shall be included in the worksheet. Note that an entry code can only appear once for the same currency and booking row. If you need to add more than one adjustment to the same entry code in the same worksheet (for the same currency) you must add a new booking row for the same currency.

- Perform any automatic calculations if required.

- Apply or Change Status of the worksheet.

Book on many Businesses within the same Claim Worksheet

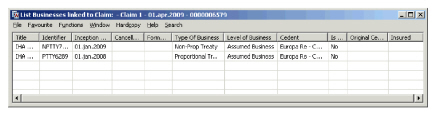

As a general rule, it is impossible to Add and Remove businesses to a claim worksheet. The Business from where you initiate the booking will be the one and only business included in the worksheet. The exception is when your claim is linked to more than one business; for example a number of layers within the same program. In this situation you are allowed to book on all the linked businesses within the same Claim Worksheet. (Refer to Assign to Existing Claim and Handle Claim Program in the Claims chapter of this guide.)

Add Business to a Claim Worksheet

When you book a manual claim worksheet on a claim that is linked to a number of businesses, you can add the linked businesses to the worksheet.

- Create Claim Worksheet from Business Properties or Claim Ledger.

- Select at least one Claim in the Claim section.

- Select Add Business from the pop-up list in the Business section of the Claim Worksheet.

- The List Businesses linked to Claim window appears, displaying all business linked to the claim currently being booked on.

- Select the Business that you want to include in the Claim Worksheet and double click, or select Transfer from pop-up list.

- Repeat the above until you have included all the businesses you want to include in the booking.

Automatically Add Business to a Claim Worksheet

Instead of adding businesses one by one, as described above, the system could be configured so that all linked businesses are always present in the claim worksheet. This means that regardless of other factors, such as claim status, cease accounting, and transfer flag setting, the business is displayed. If a business for some reason does not allow accounting, or cannot be booked in the same worksheet, the registration of booking details is disabled for that business.

Remove Business from a Claim Worksheet

If you added a business in error, there is no option to remove the business from the Claim worksheet. The system will however remove the business from the worksheet automatically, provided there are no balances booked for that business.

- Select the Business that you want to remove.

- The entered booking details for the business are displayed.

- In the Properties section of the worksheet; select the booking row and select Delete from the pop-up list.

- Repeat step 3 for all booking rows relevant for the business that shall be removed.

- When you complete and change the status of the worksheet the business will be removed from the worksheet.

| Field | Description | Location |

|---|---|---|

| Business ID | The unique identification of Business included in the booking. Values: Business Identifier Mandatory: Yes |

Claim Worksheet - Business section |

| Business Title | The title given to a business. Values: Text Mandatory: No |

Claim Worksheet - Business section |

| Direction | The direction of the business(es) included in the booking; equivalent to the Level of Business. Values: Assumed Business, Outwards Cedent’s Contract, Master Agreement, etc. Mandatory: Yes |

Claim Worksheet - Business section |

| Cedent Name | The name of the cedent as registered on the business. Values: Cedent name Mandatory: No |

Claim Worksheet - Business section |

| Inc. | The inception date of the business Values: A date - DD/MM/YYYY Mandatory: Yes |

Claim Worksheet - Business section |

| Canc. | The cancellation date of the business. Values: A date - DD/MM/YYYY Mandatory: No |

Claim Worksheet - Business section |

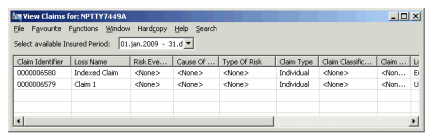

Book a Multi-Claim Claim Worksheet #

Sometimes the same claim advice is issued for a number of losses, for example for the entire Insured Period and adjustments should be made for all of them. In this situation, you need to add the claims to the claim worksheet.

Add Claims to Claim Worksheet #

- Open the Business Properties.

- Select Claim Worksheet button.

- Select Add Claim from the pop-up list in the Claim Section of the worksheet.

- The system opens the View Claim window; listing all Open and Active claims linked to the Business

- Reduce the number of claims displayed by selecting the Insured Period in the Select available Insured Period field.

- Select the claim you want to include in the worksheet and double click or select Transfer from pop-up list. If you are selecting a claim for which you are registered as being in conflict, you are not allowed to add the claim to the worksheet.

- If the selected Claim is marked as an Early Claim, or its' FGU Indicator is activated, confirm that you want to create a manual worksheet.

- Repeat the above process for all claims you want to include in the worksheet. Note that all the Claims must have the same settings for their Transfer to Ledger and FGU indicators.

- Transfer to Ledger indicator.

The Add Claim option is only enabled when the Claim Worksheet is created from Business Properties.

Remove Claims from Claim Worksheet #

If you have added a Claim ID in error, you can remove the claim from the worksheet.

- Select the Claim ID that you want to remove, and select Remove Claim from the pop-up list in the Claim Section of the worksheet.

The Remove Claim option is only enabled when the claim worksheet is created from the Business Properties.

Link Claim (Booking) to Amendment #

Opposed to Technical Accounting, amendments cannot be chosen manually, but are determined by the claim itself by applying the same rules that are used when validating the loss dates towards the Insured Period:

- If a Claims Trigger Date is defined, the Claims Trigger Date must be within the effective period.

- If only Date of Loss is defined, and the claim is not interlocking or Claim Basis is not Risks Attaching or Loss Portfolio Condition is not defined; the Date of Loss must be within the effective period.

- If Claim is Interlocking and the date of loss is within the Insured Period; the Date of Loss must be within the Insured Period.

- If Claim is Interlocking and the date of loss is prior to the Insured Period amendment 0 is used.

- If Claim is Interlocking and date of loss is after Insured Period, the last amendment of the Insured Period is used.

- If Claim Basis is Risks Attaching, the Original Policy Period Start date must be within the effective period.

- If Loss Portfolio condition exists, and the Date of Loss is within the Insured Period, the Date of Loss must be within the effective period.

- If Loss Portfolio condition exists, and the Date of Loss is prior to the Insured Period, amendment 0 is used. Note! Sometimes the amendment number is not visible on the worksheet itself. This is the case when ‘Creating From Ground Up’ bookings affecting more than one claim-to-section link, and also when creating bookings for interlocking claims. Selecting View Balance Changes from the worksheet properties section, enables you to inspect the amendment applied to each balance.

| Field | Description | Location |

|---|---|---|

| Claim ID | The unique identification of the Claim included in the booking. Values: Claim Identifier |

Claim Worksheet - Claim section |

| Claim Name | The loss name. Values: String |

Claim Worksheet - Claim section |

| Amendment | Indicator if which version of the contract the claim will be validated against. The indicator consist of a number and a date DD/MM/YYYY, where the number indicates the version of the contract Which effective period Values: Integer + Date, where the integer indicates the contract version. 0 equals the Original Contract, 1 indicate the first amendment, 2 indicate the second amendment, and so on. The Date ( DD/MM/YYYY ) denotes start date of the effective period. Derived from: Date of Loss, Claim Trigger Date as per above. Functional impact: Determines correct set of terms & conditions applied in validations. Mandatory: Yes |

Claim Worksheet - Claim section |

| Date of Loss | The date of loss or claim trigger date. Values: A date DD/MM/YYYY Functional impact: Determines amendment Mandatory: Yes |

Claim Worksheet - Claim section |

Register Basic Account and Worksheet Information #

The Basic Claim Worksheet account and worksheet information contains various information about the account; including booking dates, indicator whether worksheet is transferred to ledger or not, and booking currencies.

The Account Information dates consist of a date for when the Account was received, and when it was actually booked. The Account Received date can be replaced by a Received External, and a Received Internal date, provided your System Administrator has activated this functionality. This enables you to register both when the account was received by your company and also by your department. If booking dates are not allowed in the past, this date defaults to current date - even when you retrieve an unfinished worksheet.

Edit the Transfer to Ledger indicator #

The Transfer to Ledger check box indicates whether the bookings are transferred to the Business and Business Partner Ledgers, in addition to the Claim Ledger. It is not editable on the worksheet level, and must be changed on the claim or the claim program. Refer to Claim Booking Information in the Handle Claims chapter of this guide for further information.

Note! Informational entry codes, such as Paid in Aggregate, are never transferred to the Business or Business Partner Ledgers irrespective of the Transfer to Ledger setting.

Register Account Dates #

- Create a new Claim Worksheet or Open an existing worksheet with status Open.

- Select or add a currency. The Account Information fields are now enabled.

- Enter the Received (alternatively the Received External and Received Internal) and Booked dates.

Handle Currencies in Claim Worksheet #

By default the currencies for which previous bookings (technical and/or claim) exist are displayed when you create a new claim worksheet.

If previous bookings have been made in one currency, this currency is pre-selected when the Claim Worksheet is created. When more than one ledger currency exists, none of the currencies are pre-selected.

Add Currencies to a Claim Worksheet #

When no currencies exist for the business or you want to book in a new currency you select Add Currency from the pop-up menu.

To register a New Claim Worksheet Currency:

- Click in the currency section and select Add Currency from the pop-up menu. The system gives you a full currency listing of all active currencies.

- Select the currency or currencies you want to use in your booking by moving them over to the Selected column. The system returns a warning if the selected currency is not defined on the Limit condition.

A warning is also returned if the Claim is linked to a Headline Loss, and Event IBNR Groups are in use, and the claim is not linked to an event ibnr group valid for the new currency.

Remove a Claim WS Currency #

If you defined a currency in error, this can be removed as long as the currency is not a ledger currency. That is; the remove option is only available for currencies added after the worksheet has been applied to the database, andonly if no previous bookings (technical and/or claim) exist for the currency, and no current booking details have been defined for the currency.When booking details exist (previous and/or current), the currency becomes a ledger currency. A ledger currency can be inactivated to be hidden in the display list.)

To remove a Claim Worksheet Currency:

- Click in the currency section and select Remove Currency from the pop-up menu. The system displays the available/selected overview.

- Select the currency or currencies you want to remove from your worksheet by moving them over to the Available column. The system returns an error if the selected currency cannot be removed from the worksheet.

- Select a ledger currency or select Add Currency from the pop-up menu if the required currency is not included among the ledger currencies. You see the Select Booking Currency dialog box.

- Select one or more booking currencies from the list and move them to the Available list using the arrow buttons.

Inactivate a Ledger Currency #

The purpose of inactivating a Ledger Currency is to prevent further booking on this currency and therefore hide it from the display list.

The precondition is that no Worksheet(s) with status Open, Rejected, Corrected, Authorized and Suspended exists in this Ledger Currency. Furthermore, any defaulted entry codes must be removed prior to inactivating.

To inactivate a ledger currency:

- Click in the display list for the selected Business ID and Currency and select Inactivate Ledger Currency from the pop-up menu. The system now hides this Currency in the currency list on the worksheet, for the selected Business ID.

Re-activate a Ledger Currency #

If you want to add a new booking on a currency that has been inactivated for this ledger, you must first re-activate it.

- Select Display All Ledger Currencies.

- The system displays both active and inactiv.e ledger currencies.

- Select the currency and add booking details

- Apply or Close the worksheet. The currency is now re-activated.

Display Ledger Currency #

You can select to see all existing Ledger Currencies, only the Active Ledger Currencies or only the Inactivated Ledger Currencies.

- Select Display from the pop-up menu in the currency section

- Select between:

- Ledger Currencies, All existing Ledger Currencies are shown in the currency list.

- Active Leger Currencies (default value), Only the Active Ledger Currencies are displayed on the currency list.

- Inactive Ledger Currencies, Only the Inactive Ledger Currencies are displayed on the currency list.

Change the Currency on the Worksheet #

If you realise that you have recorded the booking details in an incorrect currency, you can easily change the currency.

- In the currency section elect Switch Currency from the pop-up list.

- System gives you a drop-down list called Select New Currency for Worksheet. All active currencies are available.

- Select the currency you want to switch to.

- The booking details are attached to the new currency.

| Field | Description | Location |

|---|---|---|

| Currency | The currency in which the Claim is to be booked. If a currency has booking details on the worksheet the currency is marked in another colour (pink). Values: The business' ledger currencies expressed according to ISO, e.g. USD, GBP, CAD, EUR, CHF, etc. Default: If no ledger currencies: Empty If one ledger currency: The one currency is pre-selected If many ledger currencies: None of the currencies are pre-selected. Validations: If a currency has not been defined as Main Currency or as a Booking Currency in the Administration Condition of the business, a warning appears when this currency is added. (Refer to the chapter Handle Administration Conditions.) Functional Impact: Business Ledger, Online Statistics, Business Partner Ledger, Claim Ledger, Worksheet validations Mandatory: Yes |

Claim Worksheet - Currency Section |

| Name | The full name of the Currency Values: Currency name, e.g. US Dollar, Pound Sterling, Canadian Dollar, Euro, Swiss Franc, etc Mandatory: Yes |

Claim Worksheet - Currency Section |

| Received Alt. Received External |

The date the Claim Account was received. Values: A date DD/MM/YYYY Default: Today’s date Validations: Must be less or equal to today’s date. Functional impact: None Mandatory: No |

Claim Worksheet - Account Information section |

| Received Internal | The date the Claim Account was received by your department. Enabled by your System Administrator. Values: A date DD/MM/YYYY Default: Received External Date, or (Order) Run Date on worksheets created through Accounting Orders. Functional impact: None Mandatory: No |

Claim Worksheet - Account Information section |

| Booked | The date the Claim account was booked. Values: A date DD/MM/YYYY Default: Today’s date Validations: Must be within a range defined by your System Administrator from today’s date. Mandatory: Yes |

Claim Worksheet - Account Information section |

| Transfer to Ledger | Indicator whether the Claim worksheet will be transferred to Business and Business Partner Ledgers. The field is an output field only. Values: Check box with true or false. Default: Setting on Claim Program - Treaty Links; or Claim Section Specific Functional impact: Business and Business Partner Ledgers, Online Statistics Mandatory: Yes |

Claim Worksheet - Account Information section |

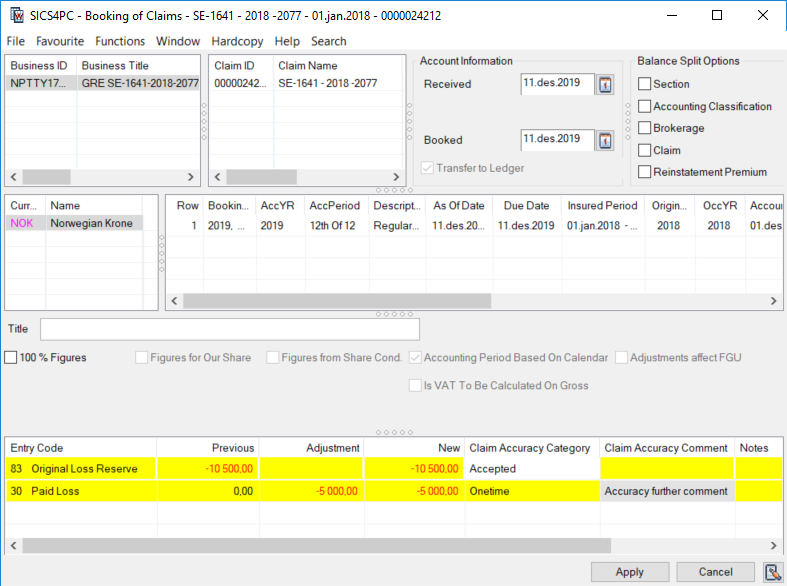

Add Claim Worksheet Booking Details #

The registration of the actual Claim booking is done in the Claim Worksheet Properties and Original Bookings part.

The Properties section enables you to record information related to the actual booking; that is booking dates, booking periods, and accounting classification. If your worksheet contains more than one business, the system can reflect the information registered for one business on all linked sections included in the same worksheet, provided your system administrator has activated this functionaltity.

The Original Bookings section allows you to register the actual entry codes and adjustments as well as a comment. The Claim Worksheet also offers flexibility how to enter the actual figures. Contrary to the Technical Worksheet, there are no separate Estimates tab; these must be recorded either using specific informational entry codes designated to this purpose, or through a technical worksheet.

Enter Claim Worksheet Title #

You can record a title for the claim worksheet that can later be used to identify the worksheet on the Business Partner Ledg er and in the Find Worksheet window. Your System Administrator may have made the Title mandatory when the worksheet is created manually, or from FGU. The Claim Worksheet title is relevant for all balances within the worksheet.

- Open a claim worksheet.

- Select or add a currency. Enter the worksheet title, or change the title that is generated automatically.

If the worksheet title is optional, but you forgot to enter in the actual worksheet, you can capture it in the closing window.

Book Actual Claim Figures #

Depending on the Transfer to Ledger indicator, the majority of the transactions (details and balances) entered on a Claim Worksheet can be reflected on Business Ledger, Business Partner Ledger, Online Statistics, etc. Informational entry codes, for example Annual Aggregate Deductible bookings, are not transferred to the Business Partner Ledger. All transactions are displayed on the Claim Ledger regardless of both the entry code type and the Transfer to Ledger indicator setting.

Book a Single New Adjustment #

- Create a new Claim Worksheet, and ensure that Business and Claim information is available.

- Select a ledger currency or add a new currency by selecting Add Currency from the pop-up menu in the Currency display list.

- Register basic accounting information and a worksheet title.

- Select the Booking options

- If required select to base the Accounting Period on Calendar Year. If your system is configured to set the accounting information based on the as of date, the Calendar Year is automatically selected, and cannot be modified.

- Record the booking information, or edit, if required, the booking information given automatically.

- The system populates the worksheet detail section if any previous bookings exist, or if this is the first initial booking on a claim and currency, entry codes which are defined as default. The figures represent the selected currency and claim-to-section or the selected currency, claim-to-section, and accounting classification combination, if your System Administrator has activated this display functionality.

- Add required entry codes to the worksheet, and make the necessary adjustments to either adjustment or new figures.

- Repeat step 8 for all required entry codes.

Book Multiple Adjustments in same Worksheet #

The registration of an additional booking rows, allows you to enter many Claim Accounts in the same worksheet. This could be relevant when you receive two updates for the same claim at the same time. The additional booking rows can of course have different Booking information, for example a different “As of Date”, or “Accounting Classification”.

- In your open claim worksheet select Add New Booking in the Properties section.

- A new booking row is added, defaulting the information from the first booking row. Change the defaulted information as required.

- Complete the new booking row by following the steps for single adjustment.

Note! You do not need to add a new booking row if you want to create a booking in another currency. In this case you just add the new currency to the worksheet, and use the same existing row. Refer to Handle Currencies in Claim worksheet, described earlier in this chapter.

Occurrence Year Allocation #

If you have defined Occurrence Year Split basis for both Premium and Loss on the Administration condition, you can perform an Occurrence Year Split of the Claim Adjustments. The system splits adjustments for entry codes subject to the split into Occurrence Years. The Occurrence Year is set to the Accounting Years applied for premium bookings. For each new Occurrence Year, the system adds an additional row to the worksheet. The row ID is the same as the original row ID, and does not result in a new balance being created. The original occurrence year, if any, is overwritten with the years derived from the calculation. The calculation is applied to the entire worksheet.

- Add at least one booking detail to the claim worksheet

- Select Occurrence Year allocation from the pop-up menu

- The system adds one or more booking rows to the worksheet, one per Occurrence Year.

Example

Insured Period 2013

| Accounting Year | Booked Premium |

|---|---|

| 2013 | 100,000 |

| 2014 | 100,000 |

Claim Worksheet booking Paid Loss 20,000

After Occurrence Year allocation:

| Occurrence Year | Paid Loss |

|---|---|

| 2013 | 10,000 |

| 2014 | 10,000 |

Delete a Booking or Booking Detail #

If you have added a booking row or an entry code in error you can easily remove this from the worksheet.

- On your open worksheet, select either the Row, or the Entry Code that you want to delete.

- Select Delete from the pop-up list.

- The row (with all the details), or the single entry code is removed from the worksheet.

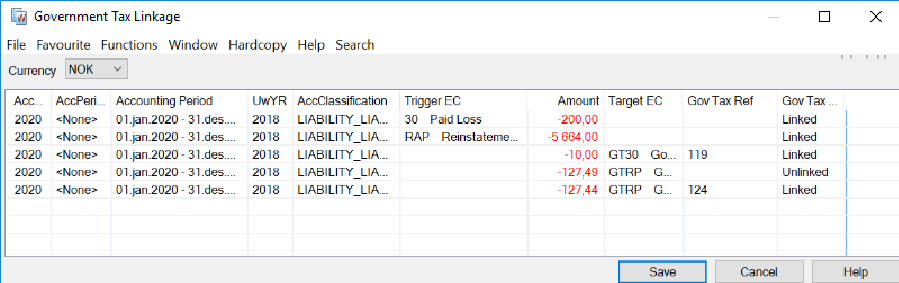

Note! When the Government Tax Framework is in use and the line to be deleted from the worksheet includes a booking detail linked to one or more other booking details, system automatically removes the Government Tax link for all details included in the linkage.

| Field | Description | Location |

|---|---|---|

| Row | Indicator of the booking line. Values: Integer Default: First booking added defaults row number 1. Subsequent booking rows default same row ID as the one immediately preceding if your System Administrator has activated the “Display Bookings and Entry Codes Per Accounting Classification” functionality. Otherwise subsequent bookings default to the preceding booking’s row ID + 1. If you have performed an Occurrence Year allocation, the row ID is the same for all Occurrence Years for the same claim Validations: None Mandatory: Yes Functional impact: Each booking row ID creates a separate balance |

Claim Worksheet - Properties section |

| Booking Yr /Period | The Base Company’s Year and Period in which the account is booked Values: All open booking years and periods are open for selection. Year, Period (e.g. Month, Half Year or Quarter) Default: The Booking year/period defined as default by your System Administrator. Validations: Against the Closing Booking Terms defined by your System Administrator. Mandatory: Yes |

Claim Worksheet - Properties section |

| Booking Yr /Period (Legal Entity) | The Period and Year in which the account is booked. Values: Year, Period (Month, Half Year or Quarter) Default: The Booking year/period defined in the Booking Terms defined by your System Administrator. Validations: Against the Closing Booking Terms defined by your System Administrator. Mandatory: No |

Claim Worksheet - Properties section |

| Booking Yr /Period (Global Entity) | The Period and Year in which the account is booked. . Values: Year, Period (Month, Half Year or Quarter) Default: The Booking year/period defined in the Booking Terms defined by your System Administrator. Validations: Against the Closing Booking Terms defined by your System Administrator. Mandatory: No |

Claim Worksheet - Properties section |

| AccYR | The Accounting Year of the Account to be booked into the Claim Worksheet Values: Year (YYYY) Default: The Acc Year default value depends on how your System Administrator has configured the system: Default value is the Year of the worksheet as of date, if System Parameter “Accounting Information default from As of Date” is activated. Default value is Year of first open account, if Business has accounts defined, System Parameter “Accounting Information default from As of Date” is not activated, and Base Company Specific parameter _Set Due Date/As of Date to Current Date for Claim Worksheets_ is cleared. Otherwise default value is current calendar year. If system parameter **"_Same Accounting Information for all linked Claim Sections_** has been activated by your system administrator, manual changes to the Accounting Year for one claim section, is reflected on all linked claim sections within the same worksheet provided the businesses have the same insured period start and end dates. _Validations:_ The Accounting Year cannot be higher than the Booking Year. The Accounting Year cannot be smaller than the year in the Insured Period from date. br/>_Mandatory:_ Yes<br/ Functional impact:_ Reinstatement Calculation Per Insured Period, if parameter _Reinstatement Calculation Per Insured Period based on Accounting Period to date_ is activated |

Claim Worksheet - Properties section |

| AccPeriod | The Accounting Period within the Accounting Year for which the Account applies. Values: 1st of 12, 2nd of 12, 1st of 2, 2ndof 4, Yearly, None, etc. Default: The Acc Period default value depends on how your System Administrator has configured the system: Default value is the Period or Month of the worksheet as of date, if System Parameter “Accounting Information default from As of Date” is activated. The Period is determined by the frequency in which accounts (if any) have been defined on the business; for example Quarterly. If no accounts have been defined the Period is set to the Month in which the as of date falls. In both situations, the system uses a Calendar Year calculation. Default value is Period of first open account, if Business has accounts defined, System Parameter “Accounting Information default from As of Date” is not activated, and Base Company Specific parameter “Set Due Date/As of Date to Current Date for Claim Worksheets” is cleared. Otherwise default value is the value defined as default value in reference table, or <None>. If function “Same Accounting Information for all linked Claim Sections” has been activated by your system administrator, manual changes to the Accounting Period for one claim section, is reflected on all linked claim sections within the same worksheet provided the businesses have the same insured period start and end dates. Mandatory: Yes Functional impact: Reinstatement Calculation Per Insured Period, if parameter Reinstatement Calculation Per Insured Period based on Accounting Period to date is activated, Retrocession Accounting |

Claim Worksheet - Properties section |

| Description of Account | Indicates the Type of Account Values: Customised by your System Administrator; for example Regular Account, Cash Call, None Default: Customised by your System Administrator If function “Same Accounting Information for all linked Claim Sections” has been activated by your system administrator, manual changes to the Description of Account for one claim section, is reflected on all linked claim sections within the same worksheet. Mandatory: Yes |

Claim Worksheet - Properties section |

| Due Date | The date when the account is due to be settled. Values: Date (DD/MM/YYYY) Derived from: The calculated accounts in the Administration conditions of the selected Insured Period Default: No default, or default to current date, or default as per calculated accounts in Administration condition, or defaulted as defined number of days after received date, depending upon how your System Administrator has defined the system. If function “Same Accounting Information for all linked Claim Sections” has been activated by your system administrator, manual changes to the Due Date for one claim section, is reflected on all linked claim sections within the same worksheet. Validations: Must be greater or equal to the as of date. Can be a future date. Functional impact: Determines when balance becomes due for settlement. Mandatory: Yes |

Claim Worksheet - Properties section |

| As Of Date | The date with which your bookings will be associated, which date the advised claim figures are composed at. Values: Date (DD/MM/YYYY) Default: For “From Ground Up” worksheets the as of date defaults to the one defined on the Advisory and cannot be changed on the worksheet. For “Manual” worksheets the “As of Date” defaults as per the calculated accounts on Administration condition or the current date according to your System Administrator’s definition, and can be changed on the worksheet. If function “Same Accounting Information for all linked Claim Sections” has been activated by your system administrator, manual changes to As of Date for one claim section, is reflected on all linked claim sections within the same worksheet. Validations: The As of Date must be less or equal to the Due Date. Must be greater or equal to the Date of Loss From. Future dates are not allowed. Functional impact: Sorting in Claim Ledger, Non-Proportional Recovery calculations, Reinstatement Calculations. If Claim Accounting parameter “Accounting information defaulted from as of date” is activated, the date also determines the setting of Acc Year, Acc Period, and Acc Period From and To within the Claim worksheet. Mandatory: Yes |

Claim Worksheet - Properties section |

| Insured Period | The period to which the claim is attached and for which you want to create a booking. Values: Date From -To (DD/MM/YYYY- DD/MM/YYYY) Derived from: The Insured Period or Insured Periods the Claim is linked to. Mandatory: Yes |

Claim Worksheet - Properties section |

| Original Underwriting Year | The original underwriting year of the policy which the claim affects. Values: Year (YYYY) Default: If your System Administrator has activated default of this field, or if the Cession Basis is Underwriting Year, the Original Underwriting Year defaults to the Claim’s Original Policy Period From year, if defined, otherwise Insured Period start year. Otherwise the default value is blank. Mandatory: When cession basis is Underwriting Year and the “Validate Orig. UW Year / Occ. Year” is selected on the administration condition. Validations: When cession basis is Underwriting Year and if “Validate Orig. UW Year / OCC Year” is either not available or selected on the Administration condition, the Original Underwriting Year must be equal or greater than the Portfolio From Year if defined on Administration condition, and equal or less than the Original Policy Period From Year, or the Insured Period year. For all other situations, the Original Underwriting Year may be any year. Functional impact: Retrocession Accounting |

Claim Worksheet - Properties section |

| OccYR | The year of the loss occurrence. Values: Year (YYYY) Default: When your System Administrator has enabled default of this field, or if cession basis is “Occurrence Year”, the Occurrence Year defaults to the Date of Loss Year, or the Claim Trigger Year. If you have performed an Occurrence Year allocation, the Occurrence Year is set to the Accounting Year for the relevant Premium Booking. Mandatory: When your System Administrator has defined the Occurrence Year as mandatory, or when cession basis is “Occurrence Year” and “Validate Orig. UW Year / OCC Year” is either not available, or activated on the administration condition. Validations: When Cession basis is “Occurrence Year”, and business option “Validate Occ. Year /Orig. UWY” is selected: The year entered must be greater or equal to the “Portfolio from Year” and less or equal to the Date of Loss/Claim Trigger Year. Otherwise there are no validations. Functional impact: Retrocession Accounting |

Claim Worksheet - Properties section |

| Accounting Period From - To | The period within the Accounting Year for which the account applies. Values: Dates (DD/MM/YYYY - DD/MM/YYYY) Derived from: The selected Accounting Year, Accounting Period, Insured Period, and selection of “Accounting Period based on Calendar” check box. If function “Same Accounting Information for all linked Claim Sections” has been activated by your system administrator, manual changes to Accounting Period From - To for one claim section, is reflected on all linked claim sections within the same worksheet provided the businesses have the same insured period start and end dates. Mandatory: Yes Validations: None Functional impact: Multi GAAP |

Claim Worksheet - Properties section |

| Section | The agreement may be split into different components according to the agreement’s classifications. Each “component” constitutes a section, with specific terms and conditions. Values: Section names given on the agreement Derived from: The Structure of the agreement Default: Main section if only one section. If more than one section, the field is empty and the user has to select from drop-down list. Mandatory: Yes |

Claim Worksheet - Properties section |

| Legal Area | The Country(ies)/Country Group(s) defined in the selected Accounting Classification. Values: System defined names Derived from: The selected Accounting Classification. Mandatory: Yes |

Claim Worksheet - Properties section |

| Accounting Classification | A unique combination of the different components in the agreement’s classifications. Values: A system defined or user defined name for each classification Derived from: The Accounting Classification conditions and the selected Section. Default: For the first initial booking only, depending on the Claim Classification, if your System Administrator has activated this function. Otherwise if only one Accounting Classification has been defined on the section, this will default. If more than one has been defined, but one has been defined as being default, this will be defaulted, if none has been defined as default, there is no default of the Accounting Classification. For subsequent bookings the Accounting Classification defaults to the Accounting Classification applied in the last booking Mandatory: Yes Functional impact: Display of previous booking entries if your System Administrator has activated the display of bookings and entry codes per Accounting Classification. Validation of positive reserves can be made on this level, if activated by your System Administrator. Display of Claim Bookings on Claim Ledger, Non-Proportional Recovery calculation. |

Claim Worksheet - Properties section |

| London Market Reference | For CLASS bookings (including Claim signing reversals) it is a concatenation of Stamp number, our sequence number and Unique claim reference. For Claim signing paid bookings it is a concatenation of Stamp number and signing reference. The field is only available if your System Administrator has activated the EDI Limnet functionality. Values: String Derived from: EDI Message Default: None Mandatory: No (automatically set on EDI bookings) Functional impact: Key indicator used in London Market pairing process, and used in the referencing process between the EDI message and business. |

Claim Worksheet - Properties section |

| London Bulk Reference | A concatenation of Stamp number, our sequence number and Bulk claim reference. The field is only available if your System Administrator has activated the EDI Limnet functionality. Values: A string. Derived from: EDI message Default: None Functional impact: Used when matching Claim Signing with the CLASS bookings. Mandatory: No. Automatically set on EDI bulk claim bookings |

Claim Worksheet - Properties section |

| Our Sequence Number | The number indicating sequence of the claim adjustments. It can vary from the Broker’s Sequence Number if the Unique Claim Reference has been changed. The column is available when your System Administrator has activated EDI Limnet functionality. Values: An integer - output field only. Derived from: EDI message and SICS Claim adjustments. Default: From the sequence number in the message Functional impact: Control sequence of claim adjustments. Mandatory: No. Automatically set on EDI claim bookings |

Claim Worksheet - Properties section |

| Broker Sequence Number | The number indicating sequence of the claim adjustments as recorded by the Broker. It can vary from Our Sequence Number if the Unique Claim Reference has been changed. The column is available when your System Administrator has activated EDI Limnet functionality. Values: An integer - output field only. Derived from: EDI message and SICS Claim adjustments. Default: From the sequence number in the message Functional impact: Control sequence of claim adjustments. (Adjustments must be processed in correct sequence.) Mandatory: No. Automatically set on EDI claim bookings |

Claim Worksheet - Properties section |

| Start Date | The date for which the “Disability” period started. The column is available when your System Administrator has activated Life functionality, and extended booking records. Values: A date (DD/MM/YYYY) Validations: None Functional impact: None Mandatory: No |

Claim Worksheet - Properties section |

| End Date | The date when the “Disability” period ends. The column is available when your System Administrator has activated Life functionality, and extended booking records. Values: A date (DD/MM/YYYY) Validations: None Functional impact: None Mandatory: No |

Claim Worksheet - Properties section |

| Disability % | The percent of the Disability. The column is available when your System Administrator has activated Life functionality, and extended booking records. Values: A percentage Validations: Between 0 and 999.99 Functional impact: None Mandatory: No |

Claim Worksheet - Properties section |

| Title | The title that is associated with all balances included in the worksheet. Values: A string Default: To the name of Insured and Main Class of Business on Direct and Facultative Business when your System Administrator has activated this. Functional impact: None Mandatory. No |

Claim Worksheet |

| Policy ID | The identifier of the primary Insurance Policy. The field is enabled when your System Administrator has activated the Life and Health Module, and extended booking records. Derived from: Policy ID on Claim Properties. If more than one claim is included in the worksheet, the Policy ID is taken from the first claim. Functional impact: None Mandatory: No |

Claim Worksheet |

| Accounting Period Based on Calendar | The calculation of the Accounting Period From and To dates will be based on Calendar Year rather than Insured Period. Values: Selected, Cleared. If Claim Accounting parameter “Accounting Information based on As of Date” is activated, the Accounting Period is always based on Calendar Year, and cannot be modified within the Claim Worksheet. Functional impact: Accounting Period From and To are based on the Calendar Year, and selected Accounting Year and Period, rather than Insured Period start date, and selected Accounting Year and Period. For example; an Insured Period 12 Months @ April 1st, 2006, the monthly account for June 2006 is “2006 - 3 of 12”. With this option selected the June Account should be registered as “2006 - 6 of 12”. |

Claim Worksheet |

| Adjustments affect FGU | Indicator whether the bookings on the worksheet will impact the From Ground Up distribution. Only available on manual claim worksheets Values: Selected/Cleared. If the FGU indicator functionality is in use, the worksheet flag is an output field only. Default: Selected. If FGU indicator functionality is in use, the default is as per the Claim’s indicator setting. Functional impact: The claim amounts booked will be included in the Previous figures on FGU. |

Claim Worksheet |

| Entry Code | A code determining the nature of the booking. Values: A combination of code and name, for example “30 Paid Loss”, “83 Reserve Loss”. Only entry codes available for Claim Accounting are available. The entry code must also be valid for the Base Company of the selected Insured Period. If Entry Code restrictions are defined in your User Preferences, the available entry codes are limited. Validation: Basis for system validations against the conditions of the Insured Period, and automatic calculations like Reinstatement Premium. Mandatory: Yes |

Claim Worksheet - Original Bookings section |

| Previous | The accumulated amount previously booked for the selected entry code for the selected business, claim, and currency combination. If your System Administrator has activated the display of bookings and entry codes per accounting classification the figures represent the selected accounting classification only. Values: Amount, maximum 20 digits |

Claim Worksheet - Original Bookings section |

| Adjustment | The accumulated amount to be booked for the selected entry code for the selected business, claim, and currency combination. If your System Administrator has activated the display of bookings and entry codes per accounting classification the figures represent the selected accounting classification only. Values: Amount, maximum 20 digits Mandatory: No |

Claim Worksheet - Original Bookings section |

| New | The sum of columns Previous and Adjustment. This figure represents the current amount for the selected entry code and is used when booking replacement figures /accumulated position. Values: Amount, maximum 20 digits. |

Claim Worksheet - Original Bookings section |

| Claim Accuracy Category | When Claim booking is is not according to business/claim limits, an Acceptance Category for this breach may be required. The column is only enabled when discerpancy between booking and limit is more than defined tolerance. Values: Customised by your System administrator. Mandatory: Yes (when column is enabled). |

Claim Worksheet - Original Bookings section |

| Claim Accuracy Comment | A further description why you accept claim booking not according to contract terms. Column is only enabled when discrepancy is more than defined tolerance. Values: Free text input. Mandatory: When selected Acceptance Category requires additional comment. |

Claim worksheet - Original Bookings section |

| Government Tax Category | When an error message is issued on a Claim Worksheet due to booking is not according to the respective Rule defined in the Government Tax Table or the field ‘Always Stop if Trigger/Target EC is booked’ is selected in the Government Tax Table or the corresponding Validation Indicator is defined on the business insured period, a Government Tax Category for this breach may be required. The column is only enabled when an error message is issued due to the Government Tax validation Values: Customised by your System administrator. Mandatory: Yes (when column is enabled). |

Claim Worksheet - Original Bookings section |

| Government Tax Comment | A further description why you accept claim booking not according to Rule defined in the Government Tax Table/Validation Indicator on the Assumed Business. Column is only enabled when an error message is issued due to the Government Tax validation. Values: Free text input. Mandatory: When selected Acceptance Category requires additional comment. |

Claim worksheet - Original Bookings section |

| Tax Country | The country for which the Government Tax applies. Values: Any country defined in the system. Derived from: Government Tax Table when detail is automatically booked, but can be edited. Mandatory: No. |

Claim worksheet - Original Bookings section |

| Tax % | A Government Tax percentage used to calculate the Government Tax amount Values: Percentage. Derived from: Government Tax Table when detail is automatically booked, but can be edited. Mandatory: No. |

Claim Worksheet - Original Bookings section |

| Tax Type | Description of the Government Tax. Values: Available options are according to the list of reference data Tax Type. Derived from: Government Tax Table when automatically booked, but can be edited. Mandatory: No. |

Claim worksheet - Original Bookings section |

| Government Tax Rule Ref | A reference number referring to a specific rule in the Government Tax Table. Can not be manually updated Values: A reference number automatically updated for the booking detail. Derived from: Government Tax Table when detail is automatically booked or validated based on the Government Tax Table. Mandatory: No. |

Claim worksheet - Original Bookings section |

| Notes | A note applying to the booking detail can be entered Values: Free-text Mandatory: If your System Administrator has activated mandatory comment for the selected entry code. |

Claim Worksheet - Original Bookings section |

Booking Options #

The Claim Account is normally registered by booking the adjustments for your share. SICS allows you however to register the account in different ways.

Book ReplacementValues on the Claim Worksheet #

In some Claim Advices the figures displayed reflect the current status and not the adjustments. In SICS you can choose whether to book adjustment or accumulated position, by making your changes in either the Adjustment column or the New column.

If the Allow Entry of Replacement Values is allowed in the Entry Code Maintenance, your system administrator can also select the parameter ‘Calculate Based On As of Date’. Normally, claim bookings in the claim ledger are conducted in a time order according to the As of Date of the claim accountings. However, for certain reason, you may miss a few claim accountings and receive them at a later time. Then, you will have to insert a claim account between two accounts or revise/update an account between two accounts.

To ensure the claim bookings are correct, the system will calculate the previous amount based on claim as of date. And previous amount will be calculated based on already closed worksheets with as of date prior to this worksheet plus adjustment on balance with as of date prior to this balance on this worksheet. The system will trigger adjustment to later closed worksheet when a previous worksheet is booked out of sequence.

Example: Reserve accounts

| As of date | Claim Account | Previous Amount | Amount | New Amount |

| 1 Jan 2019 | 100.000 | 0 | 100.000 | 100.000 |

| 1 May 2019 | 40.000 | 100.000 | -60.000 | 40.000 |

| 1 Apr 2019 | 80.000 | 100.000 | -20.000 | 80.000 |

| 1 May 2019 | 40.000 | 20.000 | 20.000 | 40.000 |

The claim accounting on 1 Apr 2019 comes late, the previous amount of it will be calculated according to the booking on 1 Jan 2019. And at the same time, the system will generate an adjustment booking for 1 May 2019 to ensure reserve amounts are correct.

Register a Claim Account Using Different Share #

Accounts are sometimes presented using a share condition not reflecting your signed share. This could for example be the 100% Figure, or the Broker’s Share Figure, etc. The Claim Worksheet allows you to register the account in the same manner as it is presented.

To register Claim Figures for 100%:

- Create a Claim Worksheet.

- Select or Add New Currency.

- Select 100 % Share Figures check box.

- Complete and/or change the defaulted booking row information.

- The system displays the previous bookings made for that claim in your share.

- Select “100% Figures” check box.

- The system converts the previous bookings, if any to 100% Figures.

- Book the adjustments to existing or new entry codes as required, using the Adjustment column.

Note! The share option is not editable after details are present on the worksheet - at that point you can only toggle between “100% Figures”

To register Claim Account for a given Percentage:

This option allows you to enter any percentage, thus indicating that the entered bookings reflect that percentage.

- Create a Claim Worksheet.

- Select or Add New Currency.

- Complete and/or change the defaulted booking row information.

- The system displays the previous bookings made for that claim in your share.

- Select “Figures for Our Share” check box.

- The system display the previous booking for your share (or 100% of your share)

- Enter the share that you want to use as basis in your booking, for example 10%. (This means the account is expressed for a 10% share, and all figures are displayed for this amount.)

- The system converts the previous booking using the entered share.

Note! The share option is not editable after details are present on the worksheet. Once you have applied the worksheet bookings are converted to “our share”. At this point you can only toggle between “100% Figures” and “Our share” figures.

To register Claim Account for a Defined Share Condition:

When this option is enabled by your System Administrator, it allows you to select another of the shares defined on share condition than your share, e.g. “Broker’s Order”. All bookings (previous and adjustments) represent the selected share.

- Create a Claim Worksheet.

- Select or Add New Currency.

- Complete and/or change the defaulted booking row information.

- The system displays the previous bookings made for that claim in your share.

- Select “Figures from Share Condition” check box and select the Share condition you want to use, e.g. “Broker’s Order”. System displays your share of the selected order.

The system displays the previous booking and the new amounts grossed up to represent the chosen order for example Broker’s Order. 6. Book the adjustments to existing or new entry codes as required, using the Adjustment column. The figures should represent the chosen Share Condition, e.g. “Broker’s Order” rather than your share.

Note! The share option is not editable after details are present on the worksheet. Once you have applied the worksheet bookings are converted to “our share”. At this point you can only toggle between “100% Figures” and “Our share” figures.

| Field | Description | Location |

|---|---|---|

| 100% Figures | A check-box indicating that the figures about to be booked represent 100% of the reinsurance agreement, rather than your signed share. Values: Selected (100%) / Cleared (your share) Default: On manual claim worksheet: Your share (cleared), on FGU worksheet: Depending on Display option in FGU Derived from: Display selection on From Ground Up when worksheet “From Ground Up”. Mandatory: No Functional impact: When “100%” is selected, all other share options are disabled. |

Claim Worksheet |

| Figures for Our Share | A check-box indicating that the figures about to be booked represent a given percentage of the reinsurance agreement, rather than your signed share. Values: Selected, Cleared Mandatory: No Functional impact: When “Figures for Our Share” is selected, the “Share %” is enabled. All other share options are disabled |

Claim Worksheet |

| Share % | The percentage that the booked figure represent. Values: A percentage; between 0 and 100% Default: 100 % - meaning 100% of your share. Mandatory: Yes, when “Figures for Our Share” check box is selected. Functional impact: No |

Claim Worksheet |

| Figures from Share Condition | A check-box indicating that the figures about to be booked are not based on the share “your share of 100%” but one of the other “Shares” defined on “Share Condition”. Values: Selected /cleared Mandatory: No Functional impact: When selected, the “Share Condition” field is enabled and Our Share Of Placement field is displayed. All other share options are disabled. |

Claim Worksheet |

| Share Condition | The selected share condition that the figures about to booked represent.. Values: None, Net Of Gross, Order of 100%, Broker’s Order, Ceded Default: None Derived from: Share condition Mandatory: Yes when “Figures from Share Condition” has been selected. Functional impact: No |

Claim Worksheet |

| Our Share of Placement | An output field displaying your share of the selected Order/“ShareCondition”. Values: Percentage field, not editable Derived from: Share Condition Mandatory: No. Functional impact: No |

Claim Worksheet |

Automatic Bookings within Claim Worksheet #

Within the Claim worksheet there are various automatic or half-automatic calculations. They are:

- Reinstatement Premium Booking

- V.A.T. Booking

- Annuity Bookings

- Automatic Booking of Government Taxes

- Automatic Generation of an Additional Entry Code; for example Automatic Reduction of Reserves when booking payments

These are described in detail below.

Reinstatement Calculation for Assumed Business #

For non-proportional assumed business, a reinstatement provision can be agreed between the Reinsurer and the Cedent. The Automatic Reinstatement Calculation is based upon the Reinstatement Condition, Premiums, Deductions and Claims. In order to calculate the assumed reinstatement premium automatically, SICS requires the following:

- Reinstatement Condition defined.

- Reinstatement currency is defined.

- Reinstatement Calculation Rule is either Per Loss or Per Insured Period.

- Reinstatement Calculation Method has been defined as Pro Rata Amount, Pro Rata Time, or Pro Rata Time and Amount.

- Premium has been booked, or your System Administrator has activated calculation based on Deposit Premium.

- Cover is not unlimited.

- Entry Codes defined for Reinstatement Premium for Assumed Business in System Parameters. If you want to calculate the reinstatement premium reserve, Client IBNR, ACR you must define entry codes for these also.

- Entry Code for Reinstatement Premium is included in the Entry Code Group that is the basis for the Deductions. For example if Deductions are based on Gross Net Premium, the Reinstatement Premium must be part of the equivalent Entry Code Group.

- If you want to book deductions for the calculated Reinstatement Premium Reserves, Client IBNR, and ACR, corresponding Entry Codes and Entry Code Groups have been defined in the System Parameters for the Reinstatement Premium Calculation.

- The Entry Codes for Reinstatement Premium Reserve which form the basis for the Reinstatement Premium Reserve Deductions have been included in the Entry Code Group that is the basis for the Deductions, in Entry Code Group Category “Subject Premium Income, Non-Proportional”.

Below is described the various calculations, and the effect of the different conditions will have on the Reinstatement. For more details about Claims Handling, Premiums, Claim Condition, Deduction Condition and Reinstatement Conditions, refer to these chapters.

The assumed business reinstatement calculation is available from the Assumed Business Claim List, the Claim worksheet, and the Business Ledger, depending on the Reinstatement Calculation Rule, described below.

Reinstatement Condition #

Reinstatement Currency #

The system performs two different calculations depending on the chosen Reinstatement Currency in the Reinstatement Condition.

Currency of Loss: Reinstatement Premium is calculated in the same currency and with the same currency split as the loss. This means that the Claim amounts booked are the basis for the currency of the reinstatement premium. If the loss is booked in only one currency, and the premium is booked in several currencies, the reinstatement premium is calculated by converting the premium to the loss currency using the exchange rate defined under the Reinstatement Premium Conditions (see Handle Reinstatement Conditions).

Note! If the currency of loss is not defined on the business, SICS will convert the loss currency to the Main Currency of the business, using the latest daily rate of exchange. The reinstatement premium will therefore be calculated in the Main currency only.

Currency of Premium: Reinstatement Premium is calculated in the same currency as the premium. The premium up-front decides the currency of the Reinstatement Premium. The Reinstatement Premium (either in one currency or in several) is the same as the premium up-front (before taking into the calculation the Reinstatement Premium percent and the loss' percent of the cover).

Note! If Premium is booked in a currency that is not defined on the business, SICS will convert the currency into the Main Currency, using the latest daily rate of exchange.

Reinstatement Payment Rule #

The Reinstatement Payment Rule defines whether Reinstatements are to be calculated Pro Rata Amount, Pro Rata Time and Pro Rata Time and Amount. SICS performs calculations for all.

Pro Rata Amount Calculation:

Claim Amount / Cover * Amount % * Premium

Pro Rata Time

Claim Amount Cover * Time % * (Remaining Days of Insured Period / Number of Days in Insured Period) * Premium

The time element is calculated according to the following rules:

- If Claim Trigger Date is recorded, the remaining day calculation will use this date

- If Date of Loss From, the remaining days will use this date

- If Date of Loss Period, the remaining days will use the To date

- If Date of Loss is outside the Insured Period, for example on a Risks Attaching, the time element will be zero, and no calculation will take place. Pro Rata Time and Amount

(Claim Amount/Cover) * Amount % * (Remaining Days of Insured Period/Number of Days in Insured Period) * Time % * Premium

The Calculation Rule determines whether the Reinstatement should be calculated automatically, and at which level the booking is done. Possible options are <None>, No Calculation, Per Insured Period and Per Loss.

- <None> means that no Calculation Ruleis defined - and that no automatic Reinstatement Premium calculation is done.

- No Calculation means that no automatic Reinstatement Premium calculation is done.

- Per Insured Period calculates the Reinstatement Premium per Insured Period, with no reference to the claim that triggered this Reinstatement Premium. The booking is made only on the Business Ledger.

- Per Loss calculates the Reinstatement Premium per loss, with a booking made directly on the Claim Ledger, connected to the claim that triggered the Reinstatement Premium

Deductions #

Brokerage: If there is a broker involved, the reinstatement calculation will apply the brokerage defined on the Reinstatement Condition, and not the brokerage defined on the Deduction Condition.

Note that “Brokerage” must be defined as a percentage in order to be calculated.

Other Deductions: Apart from the brokerage all other deduction provisions will be taken from the Deduction Condition.

Note that all “other Deductions” must be defined as a percentage in order to be calculated.

Claim Condition #

Claim Amounts - Expense Clause #

The calculation of Reinstatement Premium is based upon the claim amounts booked on the Assumed Business. Note that the Assumed Reinstatement Calculation only considers paid losses, and in some cases paid expenses - when these are part of liability, or defined as none. Loss Reserves and/or Expense Reserves will not generate any reinstatement calculation, nor will they be considered in such a calculation.

Settlement Sequence #

The Settlement sequence determines the sequence in which the reinstatements shall be allocated.

Date of Loss Order: The losses are sorted chronologically, and the reinstatements are allocated in the same fashion. Date of Settlement Order: The losses are sorted by the date they are booked and reinstatements are allocated in this fashion. The date of loss will have no impact. Not Defined or None: When the settlement sequence is defined as None, or not defined at all, SICS will interpret this as being Date of Settlement Order.

Premium Condition #

The Premium Conditions must be registered and premiums must be booked on the Assumed Business. It is not a requirement that the Premium has been received. The basis for calculating reinstatements is Adjusted Premium. If Adjusted Premium is not booked, the Deposit Premium is the basis and if Deposit Premium is not booked, the Minimum Premium is basis for the calculation. _Refer to the Handle Business Conditions chapter; Handle Limit and Premium Conditions section for more information about premium on non-proportional business.

Create Reinstatement Calculation Per Loss #

When the Calculation Rule is “Per Loss”, the Reinstatement booking is generally made on a Claim worksheet, and will as such be displayed on the Claim Ledger. Depending on the Settlement Sequence, the calculation option is available from the Business Claim List, from within a Claim Worksheet, and from the Business Ledger.

Create Reinstatement Calculation Per Loss when Claim is Indexed #

When the assumed claim is marked as Indexed, reinstatement premium due will consider the indexed cover when calculating reinstatement premium. The calculation is applied when the reinstatement is calculated Per Loss, Standard indexation is selected and the claim is handled via Claim FGU booking.

Automatic Reinstatement Calculation from FGU will perform the following calculation:

Paid reinstatement: Paid Adjustment/Paid Index Ratio)/Nominal Cover*Premium *xx %

Reserve reinstatement: Reserve/Paid Index Ratio)/Nominal Cover*Premium *xx%

ACR reinstatement: ACR/Paid Index Ratio)/Nominal Cover*Premium *xx%

Create Reinstatement as Part of Claim Booking #

Manually select to calculate reinstatement premium

The Reinstatement calculation is available from within the claim worksheet when the Calculation is Per Loss. SICS only calculates and includes the reinstatement premium for the claims included in the worksheet.

- Create a claim worksheet, book claim payments and/or reserves.

Select Automatic Booking from the pop-up menu. If more than one business and/or claim are included in the worksheet, select the business-claim you want to perform the reinstatement calculation for.

- The system generates the Reinstatement booking. Additional entry codes are added to the worksheet.

- Close the booking, or make the necessary changes to the Reinstatement calculation. If you change the Paid Reinstatement Premium only, note that SICS will not automatically change the booked deductions. If the Balance Split option flag for “Reinstatement Premium” is selected, a separate reinstatement balance is created. (The Reinstatement Premium Balance Split option may be selected by default on claim worksheets if your System Administrator has activated this functionality.) Otherwise, clear this flag to combine the reinstatement premium and claim balance.

If you apply or select to Change the worksheet status without calculating the reinstatement premium, and the reinstatement premium option is enabled, and the worksheet is not validated by Claim Accuracy rules, SICS will present you with a confirmation message.

**Reinstatement Premium is automatically calculated

** Your system is set up to automatically create reinstatement premium bookings (and associated deductions) when due.

- Create a claim worksheet, book claim payments and/or reserves. Your worksheet may include one or more businesses.

- Select to Apply worksheet. The system generates reinstatement booking for all businesses where reinstatement premiums are due. Additional entry codes are added to the worksheet. Alternatively, select to change status without applying the worksheet first. System returns an message informing user that reinstatement calculation has been executed.

- Close the booking, or make the necessary changes to the Reinstatement calculation. If you change the Paid Reinstatement Premium only, note that SICS will not automatically change the booked deductions. If the Balance Split option flag for “Reinstatement Premium” is selected, a separate reinstatement balance is created. (The Reinstatement Premium Balance Split option may be selected by default on claim worksheets if your System Administrator has activated this functionality.) Otherwise, clear this flag to combine the reinstatement premium and claim balance.

Note! DXC recommends that you always initiate a reinstatement calculation from the business claim list, so that any reallocations of premium between claims not included in your worksheet can be calculated and booked.

Calculation of Reinstatement when Combined Aggregate Limit on Main section #

If your System Administrator has activated this functionality, and the Annual Aggregate Limit is defined as being a Combined Aggregate Limit, the calculation considers the reinstatement condition on the Main section. In the calculation the cover from the section to which the claim is linked is used. Maximum reinstateable per child section is that section’s cover amount * (Main Section’s number of reinstatements-1) , and maximum reinstateable for all sections of the business is the Main Section’s Cover amount (Main Section’s number of reinstatements-1).

Create Reinstatement after Claim Booking #

If you select not to book the reinstatement premium simultaneously as the claim amount, the calculation can be performed later, from the Business Claim List, or from the Business Ledger.

To calculate Reinstatement from the Business Claim List:

- Open the Business Claim List, select any claim and select Automatic Reinstatement Calculation from the pop-up menu.

- SICS opens a Claim worksheet containing all claims for which a reinstatement is due, with the associated reinstatement bookings. Be aware that the claim not necessarily is the same as the one you selected on the Business Claim List. Also note that only reinstatement bookings are displayed on the worksheet.

- Close the booking. One balance is created per claim.

To create Reinstatement Calculation Order from the Business Claim List:

- Open the Business Claim List, select a claim and select Create Reinstatement Order from the pop-up menu. SICS opens the New Reinstatement Premium Assumed Business Order window.

- Enter Order information as required, and click OK.

- Select Run Now from the menu.

- If Reinstatement is due, SICS produces bookings on a Claim worksheet with reference to the claims triggering the reinstatement calculation. Set the worksheet status as required, and click Save.

- If no reinstatement is due, a warning message to this effect is presented, and no worksheets are created.

Calculate Reinstatement Premium Adjustment #

When you have received premium adjustment, the booked reinstatement should also be adjusted based on the new revised premium. Although the Calculation Method is Per Loss, the reinstatement premium adjustment is made for the entire Insured Period.

- Open the Business Claim List.

- Select Create Reinstatement Calculation Order.

- Enter the order information.

- Select Run Now from the menu.

- Set the Order worksheet status as required.

- Click Save.

Note! The Reinstatement Adjustment booking is made on a Technical worksheet without reference to any specific claim.

Create Reinstatement Calculation Per Insured Period #

When the Calculation Rule is “Per Insured Period”, the Reinstatement bookings are always made on a Technical worksheet without any direct reference to specific claims. The calculation is available from the Business Claim List, and from the Business Ledger. Also note that when booking a claim you will not be informed that Reinstatement is due.

Create Reinstatement Calculation Per Insured Period based on Accounting Period To Date #

If your System Administrator has activated this functionality, the Reinstatement Calculation can be initiated from a Technical Worksheet. The calculation is based on section, and accounting year and period, so this must be selected before option is enabled.

- Create a technical worksheet

- Select business (if not already defined), and currency

- In the details section, add booking, and define Insured Period, Accounting Year, and Accounting Period.

- Select section (if not already defined)

- Make sure that entry code is either not defined, or not reinstatement premium related (this includes any deduction codes.)

- From pop-up menu, select Automatic Reinstatement Premium Calculation. (Note that option is only enabled for the latest Accounting Period present in the worksheet for the Insured Period/Section.

The system calculates reinstatements and deductions:

- Premiums for section is considered; including any bookings on current worksheet

- Loss amounts with an Accounting Period To date prior or equal to the Technical Worksheet’s Accounting Period To date

- Deductions are calculated based on bookings in the worksheet