Manual Bookings on a Worksheet

When Reinsurance Company participates in a treaty or facultative protection, the company receives accounts from the ceding company including their share of premium, claims and other figures that their agreement includes. The figures of these accounts are manually entered onto Technical Worksheets in order to update the Ledger and Online Statistics of the Business to which the accounts apply. The Business Partner Ledger is also updated accordingly.

Open a Technical Worksheet for a Business #

|

Technical Worksheet button on the Navigation bar. | Whenever you receive an account from one of your business partners, the details and figures of the account have to be booked in a Technical Worksheet. |

You can open and book figures into a Technical Worksheet from different Levels of Business (Assumed Business, Outward Cedent’s Contract and Retrocessionaire’s Participation).

Sometimes it is necessary to leave the Technical Worksheet unfinished. The status of the worksheet is then open and it is possible to re-open and finish the worksheet later on.

Note! You can set SICS to automatically search list and open worksheets in the Select Open Worksheet window every time you click the Technical Worksheet button on the Navigation bar. To set this feature you need to select the ‘Automatically check for Open Worksheets when selecting “Technical Worksheet” in your User Preferences (on the Accounting tab).

If you do not set this feature, SICS will not make a search for open worksheets when you click the Technical Worksheet button on the Navigation bar. To search for open worksheet, you need to click the List Open WS button in the Select Open Worksheet window. (The List Open Worksheet button only appears on the Select Open Worksheet window when you have not selected the Automatically check for Open Worksheets when selecting “Technical Worksheet”.

You need to set theAutomatically check for Open Worksheets when selecting. “Technical Worksheet” check box in your User Preferences to follow the below procedure.

- Open the business to which the account originates.

- Click the Technical Worksheet button on the Navigation bar.

- If Unfinished worksheets exist for this business, SICS opens the Select Open Worksheet window with all worksheets listed. Select the worksheet that you want to open, or click the Create New WS button to create a new worksheet.

- If business is a Proportional Facultative Outward Cedent’s Contract, and the worksheet has be generated from another source, a summary of the source business booking information will be displayed.

- If no Unfinished Worksheets exist, SICS automatically opens a new technical worksheet.

Field description 1. Select Open Worksheet

| Field | Description | Location |

|---|---|---|

| WS Id | A unique identification of the Worksheet Values: WS Id Mandatory: Yes |

Select Open Worksheet window |

| WS Title | A worksheet title given either by the System or by you dependent of the origin of the worksheet Values: Text Mandatory: No |

Select Open Worksheet window |

| WS Origin | From where the Worksheet originally was created Values: Manual, Automatic, Migrated, REAC Preliminary, REAC Temporary, REAC Account, etc. Mandatory: Yes |

Select Open Worksheet window |

| Registration Date | The date when the Account is registered in the system the first time. Values: Date (mm/dd/yy) Mandatory: Yes |

Select Open Worksheet window |

| WS Status | The current status of the worksheet Values: Open, Closed, Inactivated, etc. Mandatory: Yes |

Select Open Worksheet window |

| Source Booking Information | Source Business Summary Information Values: Source Business Id, Section/Declaration Name, Section/Declaration Currency, Date of Booking Mandatory: No |

Select Open Worksheet window |

You can also open the Technical Worksheet from other parts of SICS:

- Select the Worksheet icon in the Accounting folder on the SICS desktop. You can search for and open a worksheet by selecting it from the display list. Or, you can open a new Technical Worksheet.

- Select Make New Bookings from the pop-up menu of a Business Ledger. (Refer to the chapter Make New Bookings from Business Ledger.)

- Open a Business Partner Ledger, select a technical balance and select Make Technical Booking from the pop-up menu.

Enter Details on a Technical Worksheet #

The Technical Worksheet consists of two windows. In the first window, the Open window, you enter all the details of the account. In the second, the Closed window, you verify the balances and close the worksheet when all details have been entered correctly.

Add Businesses to the Technical Worksheet #

Each account you receive belongs to a business. The business should already have been recorded in SICS when the account is due to be booked in a technical worksheet. You can book details from several businesses on the same worksheet.

- Open a Technical Worksheet. You can open it from, for example a business or from the desktop. Refer to Open a Technical Worksheet for a Businesson page 11-12for more information about how to open a worksheet.

- The Business ID and Business Title are already listed in the display when the worksheet is created.

- In the Business display list, select Add Business from the pop-up menu if you want to book an account for another business. You see the Find Business window.

- Search for the Business and transfer the business to the technical worksheet by double-clicking it.

- The Business is added to the Business display list if required, continue to add businesses for accounts to be booked.

Add/Remove Currencies on the Technical Worksheet #

Before you can book any account details, you need to add an account currency to the worksheet.

- Open a Technical Worksheet. You can open it from, for example, a business, or from the desktop. Refer to Open a Technical Worksheet for a Businesson page 11-12 for more information. .

- Add a business or select a business from the Business display list. The existing ledger currencies (if any) of the business are displayed in the currency display list.

- Select a ledger currency or select Add Currency from the pop-up menu if the required currency is not included among the ledger currencies. You see the Select Booking Currency dialog box.

- Select one or more booking currencies from the list and move them to the Available list using the arrow buttons.

- Click Save.

If you have added a currency by mistake, or the currency is not needed in the display list, select the currency and select Remove Currency from pop-up menu in the Currency display list. You can only do this for currencies added after the worksheet has been applied to the database. The currency will then become a ledger currency. A ledger currency can be inactivated to be hidden in the display list. Refer to section ‘Inactivate a Currency on the Worksheet’.

- Select a currency from the display list in order to book the accounting details.

Inactivate a Currency on the Worksheet #

The purpose of inactivating a Ledger Currency is to prevent further booking on this currency and therefore hide it from the display list.

The precondition is that no Worksheet(s) with status Open, Rejected, Corrected, Authorized and Suspended exists in this Ledger Currency. Also, the current worksheet cannot have an entry code present for the currency

To inactivate a ledger currency:

- Click in the display list for the selected Business ID and Currency and select Inactivate Ledger Currency from the pop-up menu.The system now hides this Currency in the currency list on the worksheet, for the selected Business ID.

- If you want to book on an Inactivated Currency, select Display All Ledger Currencies and select the Currency and add booking details. Click Apply or_Close Worksheet_. The Inactivated Currency will now become an active currency again.

Refer to Add/Remove Currencies on the Technical Worksheet on page 11-16.

To display the ledger currency:

You can select to see all existing Ledger Currencies, only the Active Ledger Currencies or only the Inactivated Ledger Currencies.

- Click in the display list and select Display from the pop-up menu.

- On the Display option you have three sub options that you can select:

- Ledger Currencies, All existing Ledger Currencies are shown in the currency list.

- Active Leger Currencies (default value), Only the Active Ledger Currencies are displayed on the currency list.

- Inactive Ledger Currencies, Only the Inactive Ledger Currencies are displayed on the currency list.

Refer to Add/Remove Currencies on the Technical Worksheet on page 11-16

Change the Currency on the Worksheet #

If you realise that you have recorded the booking details on a worksheet in the incorrect currency, SICS allows you to easily change the currency.

To change the currency:

You are editing a manually created worksheet. For all booking details on the worksheet for the selected Business ID and Currency you want to change the currency.

- Refer to Add/Remove Currencies on the Technical Worksheet.

- For selected Business ID and Currency you have one or more booking details.

- On the currency display list you right click and select Switch Currency on all Details

- System gives you a drop-down list called Select New Currency for Worksheet.

- Here you can select on a list with all existing active Currencies. You can select either an existing Ledger Currency or any other active Currency.

- The Currency you have selected will be the new Currency for all the booking detail(s).

Register Basic Accounting Information on the Technical Worksheet #

The basic accounting information that you enter on the technical worksheet updates different parts of SICS and is important to have when you want to, for example, search for and identifies accounts.

- Open a Technical Worksheet. You can open it from, for example, a business or from the desktop. Refer to Open a Technical Worksheet for a Businesson page 11-12 for more information about how to open a worksheet.

- Select or add a currency. The fields on the Accounting tab get enabled.

- Enter the required basic accounting information in the fields.

Enter Accounting Year and Period #

You can enter an Accounting Year and Period in the AccYr/Period fields in the Balance Control Information box. When this is done before you add any bookings to the selected currency, this Accounting Year and Period will be the default Accounting Year and Period on added bookings. When you have several ledger currencies, any values entered in AccYr/Period on the first currency you select will be copied to all other currencies. If you add a new currency, any values in AccYr/Period on the existing currency will be copied to the new currency. If you later change the AccYr/Period on one of the currencies, this will not update any of the other currencies.

Indicate Balance Split Options on the Technical Worksheet #

In order to create and book balances on the same level as in the accounting document received from the Cedent or Broker, you can select different split options. If for instance, a broker is assigned to the business and you want to see the brokerage as separate balances in the Business Ledger, you select the split option Brokerage.

You may select one or more of the following options:

- Insured Period

- Section

- Accounting Classification

- Brokerage

- Claim

- Fire Brigade Charges

- Government Taxes

- Open a Technical Worksheet. You can open it from, for example, a business or from the desktop. Refer to Open a Technical Worksheet for a Businesson page 11-12 for more information about how to open a worksheet.

- Select or add a currency. The Balance Split options get enabled.

- Enter the Balance Split Options tab and select the appropriate check box(es) to indicate the level of balances.

- Make your bookings in the Technical Worksheet.

- Select Change Status from the Menu button, or select View Balance Changes from the pop-up menu in order to open the Worksheet Closing window. (Refer to the chapters ‘Change the Status of the Technical Worksheet’ or View Balance Changes of the Technical Worksheet’).

- Inspect the balances that are split according to your selection in the Balance Split Option tab.

- If you want another split, select the Worksheet button to return to the Technical Worksheet. Make your changes to Balance Split Options and inspect your balances in the Worksheet Closing window again.

You may enter your bookings into the Technical Worksheet before or after you define your Balance Split Options.

For Insured Period, Section and Accounting Classification a default Balance Split Option may already be defined in the Base Company Specific settings of the System Parameters. Different options may be defined for different Types of Business. The predefined selections may be overruled in the Technical Worksheet as described above. (Refer to Base Company Specific settings in the System Administrator’s Guide).

The main principle in SICS is that the legal Responsible Business Partner of a Business is assigned as Responsible Business Partner of all balances booked on the Business (both Account balances and Brokerage balances). However, you may set up your system to always assign the Broker as Responsible Business Partner of the Brokerage Balance on inward business. This is done by selecting the System Parameter Assign Broker as Responsible Business Partner on Brokerage Balance. The system will then split out the Brokerage as a separate balance, independent on what is selected in the split options.

Balance Split Options in Technical Worksheet when Brokerage Payment Task or Claims Payment Task is assigned to different partners on the business. Whenever the Brokerage Payment Task or Claims Payment Task is assigned to a different partner in a given Business the Balance Split Option fields Brokerage and Claim respectively, will be selected by default on the worksheet when a currency is selected, otherwise cleared.

Functional impact of the Balance Split Option Brokerage: Separate balance is created for entry codes that are included in the Entry Code Group Category Business Partner Ledger Balance Split - Brokerage Payment; provided the Brokerage Payment task is assigned to a different partner than the one with the ‘normal’ payment task.

Functional impact of the Balance Split Option Claim: Separate balance is created for entry codes that are included in the Entry Code Group Category Business Partner Ledger Balance Split - Claim Payment; provided the Claim Payment task has been assigned to a different partner than the one with the ‘normal’ payment task.

Balance Split Options in Technical Worksheet when Government Tax Accounting Task is assigned to a partner on the business. Whenever the Government Tax Accounting Task is assigned to a partner in an Assumed Business, the Balance Split Option field Government Taxes will be selected by default on the worksheet when a currency is selected, otherwise cleared. Functional impact of the Balance Split Option Government Taxes: Separate balance is created for Entry Codes included in the Entry Code Group Government Tax within the Entry Code Group Category Business Partner Ledger Balance Split. Note that the Government Tax Entry Code Group must be defined with code GOVTAX to be identified as Government Tax Entry Code Group. The Notes field of the balances including Government Tax Entry Codes are updated with the text Government Tax.

Note! The Brokerage, Claim and Government Taxes split are based on Entry Code Groups defined for the Entry Code Group Category Business Partner Ledger Balance Split. If the above groups are not defined or inactivated, then the Entry Code Sub Category Brokerage and Entry Code Sub Category Loss used as basis for the split. The Fire Brigade Charges is based on Entry Code Sub Category Fire Brigade Charges. The Government Taxes balance split is based on an Entry Code Group which must have the code GOVTAX. If this group is not defined or inactivated, then no split of Government Taxes is performed. (For further information about Entry Code Groups, refer to the chapter View Entry Code Groups in the System Administrator’s Guide).

Enter a Technical Worksheet Title #

You can enter a title for the whole worksheet. This title can later be used to identify the worksheet on the Business Partner Ledger and in the Find Worksheet window.

- Open a Technical Worksheet. You can open it from, for example, a business or from the desktop. Refer to Open a Technical Worksheet for a Businesson page 11-12 for more information about how to open a worksheet.

- Select or add a currency.

- Enter a worksheet title. The title can be set automatically for Facultative and Direct business, refer to the System Parameter Automatic Produced Worksheet Title in the System Administrator’s Guide for more information.

Calculate the Accounting Period From - To based on the Calendar Period #

If you register an account for a business with divergent insured period, for example, a facultative business you can choose if you want to have the accounting period ‘From - To’ calculated based on the calendar period or the insured period.

- Open a technical worksheet. You can open it from, for example, a business or from the desktop. Refer to Open a Technical Worksheet for a Businesson page 11-12for more information about how to open a worksheet.

- Select or add a currency.

- Add your bookings and enter an accounting year and period if necessary, and enter the mandatory account information

- Select the Accounting Period Based On Calendar check box in the Worksheet section.

SICS calculates the accounting period ‘From - To’ based on the calendar period instead of the insured period.

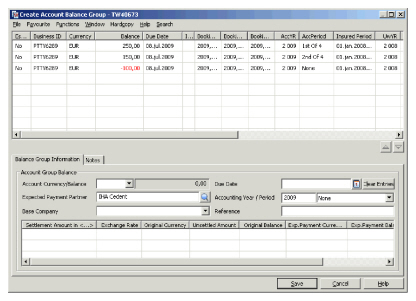

Book a Technical Worksheet in Post Mode #

If you receive an account and you want to register the account in SICS without having to enter all the figures of the account, you can book a Technical Worksheet in Post Mode.

- Open a Technical Worksheet. You can open it from, for example, a business or from the desktop. Refer to Open a Technical Worksheet for a Businesson page 11-12 for more information about how to open a worksheet.

- Select or add a currency.

- Select the Post Balance check box in the Balance Control Information box

- Enter the Balance of the account in the Control Amount and the Accounting Year/Period of the account in the AccYR/Period.

- Select UNFI(unfinished) from the Menu button.

SICS now stores the worksheet as an open worksheet and the worksheet Origin is shown as Post Balance on the Business Partner Ledger.

An alternative way to book a technical worksheet in post mode is to create a post balance. The result will be the same. For more information about how to create a post balance, refer to the chapter Create a Post Balance from Business Partner Ledger on page 11-566.

Book Post Mode Details on a Technical Worksheet #

You can create and store a worksheet in Post Mode and later re-open it and finish the bookings of the account.

- Open the Business to which the Account originates.

- Select the Technical Worksheet button on the Navigation bar.

- When there is worksheet in Post Mode registered, SICS opens the Select Open Worksheet window. The WS Origin column in the display list shows Post Balance for all worksheets in Post Mode.

- Select the appropriate worksheet in the list.

- Clear the Post Balance check box. You are now allowed to add booking lines to the worksheet. Note that if the AccYR/Period field is filled in when new detail rows are added in the worksheet, the AccYR and the AccPeriod columns automatically are populated with these values.

- Enter your booking details into the Worksheet. (Refer to the chapter ‘Book the Actual Account and Estimates in the Technical Worksheet’).

- Select Apply or Change Status.

SICS validates the Worksheet Balance against the Control Amount entered in the worksheet. For more information about Post Mode Bookings, refer to Book a Technical Worksheet in Post Mode on page 11-22.

If there is a discrepancy between the total balance of the booking and the control amount, a SICS message appears proposing a Minor Adjustment booking of the difference. If you click Yes to make the adjustment, a new line is automatically created on the worksheet and is booked with the minor adjustment entry code. If you click No, you go back to the worksheet with no changes.

You can also make a manual Minor Adjustment from the Worksheet Closing window. (Refer to the chapter ‘Make Minor Adjustment from the Worksheet Closing window’).

Enter Replacement Values on the Technical Worksheet #

- Replacement Values

In some accounts the current status and not the adjustments of, for instance Premium-/Loss Reserves and Premium-/Loss Deposits, are presented. In SICS, you can book the current status and let the SICS calculate the adjustments. By doing this, you avoid incorrect adjustment to be calculated and booked manually.

- Open a Technical Worksheet. You can open it from, for example, a business or from the desktop. Refer to Open a Technical Worksheet for a Businesson page 11-12 for more information about how to open a worksheet.

- Select or add a currency.

- Select the ‘Replacement Values’check box in the Balance Control Information box. Two new amount columns appear in the W_orksheets Actual Account tab_. (Previous amount, New amount)

- Add a booking line to the worksheet. (Refer to the chapter Book the Actual Account and Estimates on the Technical Worksheet ).

- Enter the booking details including the entry code for which the replacement value is to be calculated. The Previous amount booked to the recorded entry code is displayed.

- Enter the New Amount (the Current Status from the Account).

The Previous Amount is calculated based on previous bookings on the ledger. The system calculates the difference between the New- and Previous amount and displays the difference (the adjustment) in the Amount column.

If more than one accounting classification exists and you for a booking line select an entry code without selecting an accounting classification, the previous amount for all accounting classifications is displayed. Whenever an accounting classification is selected in conjunction with the entry code, thePrevious amount displayed will only be for that accounting classification and entry code combination.

For each entry code, you must define whether a replacement value is allowed or not in the Entry Code Maintenance. Only entry codes allowed as replacement values will get the Previous Amount calculated and will affect the New Amount when you enter a value.

Additionally, a replacement rule must be defined on the entry code to decide how the Previous value shall be calculated. The cession basis on your business decides what rule to be used. If the replacement rule for your cession basis is, for example, “Per IP, Occ Year, Section, AC” then the previous amount calculation is based on all closed details having same insured period, occurrence year, section and accounting classification (and of course the same currency, entry code and estimateindicator) as the detail entered on the worksheet.

The following Replacement Rules exist:

- Per IP, AC

- Per IP, AC HLL

- Per IP, Occ Year, AC

- Per IP, Occ Year, AC, HLL

- Per IP, Occ Year, Section, AC

- Per IP, Occ Year, Section, AC, HLL

- Per IP, Orig UW Year, AC

- Per IP, Orig UW Year, AC, HLL

- Per IP, Orig UW Year, Section, AC

- Per IP, Orig UW Year, Section, AC, HLL

- Per IP, Section, AC

- Per IP, Section, AC, HLL

- Per Occ Year, AC (only mandatory elements within the AC)

- Per Orig UW Year, AC (only mandatory elements within the AC)

(IP = Insured Period, AC = Accounting Classification, HLL = Headline Loss Link, Occ Year = Occurrence Year,

Orig UW Year = Original Underwriting Year)

The Cession Basis on the Business decides what replacement rule to be used. These rules also take the Currency, Entry Code and Estimate Indicator into consideration. If no rules can be found then the default system defined rule (Per IP, Section, AC) is used.

Refer to the 11.5 “Entry Code Maintenance” on page 11-21 in the System Administrator’s Guide for more information.

- Calculate Based on As of Date

Normally the booking accounts on technical worksheets come in a sequential order according to the as of date (Accounting Period To Date). However, for certain reason you may miss a few accounts and receive them at a later time. You will have to insert an account between two accounts or revise/update an account between two accounts.

To ensure the replacement values are correct, your system administrator need to also define ‘Calculate based on As of Date’ in the Entry Code Maintenance. Only entry code allowed to calculate based on as of date, then the system will capture the “As of Date” (default to be the Accounting Period To date) of each technical worksheet and will use this “As of date” sequence to perform the calculation on the ‘Previous Amount’ and ‘New Amount’ of the accumulated figures. The system will trigger adjustment to later account when an account is booked out of sequence.

Example: Reserve Accounts

| As Of Date | Account Quarter | Previous Amount | Amount | New Amount |

| 31/03/2019 | 1st Account | 0 | -1.000 | -1.000 |

| 30/06/2019 | 2nd Account | -1.000 | 200 | -800 |

| 31/12/2019 | 4th Account | -800 | 300 | -500 |

| 30/09/2019 | 3rd Account | -800 | 100 | -700 |

| 31/12/2019 | 4th Account | -400 | -100 | -500 |

The loss reserves for 1st account, 2nd account and 4th account come first, and the loss reserve for 3rd account receives late. The system will insert 3rd account between 2nd account and 4th account. The previous amount of the 3rd account has been calculated based on 2nd account. And at the same time, the system will generate an adjustment booking for 4th account to ensure the loss reserve amounts are correct.

Show All Bookings

To avoid leaving out some Reserve adjustment bookings, you can let the system automatically show all Reserve Entry Codes allowed for Replacement Values (refer to chapter Enter Replacement Values on Technical Worksheet for more information).

- Open a Technical Worksheet. You can open it from, for example, a business or from the desktop. Refer to Open a Technical Worksheet for a Business on page 12-3 for more information about how to open a worksheet.

- Select or add a currency.

- Select the Show All Bookings check box in the Balance Control Information box. System displays all Entry Codes allowed for Replacement Values within the Entry Code Category Reserves. Only Entry Codes with a total amount different from zero are shown. System shows the status per Entry Code allowed for Replacement Values in the columns Previous Amount and New Amount. (Aggregation level is according to the rule defined for the Entry Code/Cession Basis)

- Enter the booking details in the column Amount and the system will automatically update the New Amount or enter the New Amount (the Current Status) and the system will calculate the difference between the New- and Previous amount and displays the difference (the adjustment) in the Amount column.

- System shows all reserve entry codes allowed for Replacement Values for the selected currency. When accessing another currency on the Technical Worksheet, system shows all reserve bookings also for this currency.

If you enter a manual booking with an Entry Code allowed for Replacement Value beforeyou select Show All Bookings, this will be taken into consideration when system displays all bookings.

- When selecting one of the options ‘Change Status’, ‘UNFI’ or ‘Apply and UNFI’ from the menu on Technical Worksheet, you have to confirm if you want/not want the system to generate bookings for the Entry Codes with no Adjustments. If you select ‘Yes’, the system makes zero bookings for all booking lines displayed by the system. If you select ‘No’, the s ystem deletes all lines without any adjustments.

The following Replacement Rules are supported when selecting Show All Bookings:

- Per IP, AC

- Per IP, Occ Year, AC

- Per IP, Occ Year, Section, AC

- Per IP, Occ Year, Section, AC, HLL

- Per IP, Orig UW Year, AC

- Per IP, Orig UW Year, Section, AC

- Per IP, Orig UW Year, Section, AC, HLL

- Per IP, Section, AC

- Per IP, Section, AC, HLL

- Per IP, AC, HLL

- Per IP, OCC Year, AC, HLL

- Per IP, Orig UW Year, AC, HLL

(IP = Insured Period, AC = Accounting Classification, Occ Year = Occurrence Year, Orig UW Year = Original Underwriting Year, HLL = Headline Loss)

The Cession Basis on the Business decides what replacement rule to be used. These rules also take the Currency, Entry Code and Estimate Indicator into consideration.

If no rules can be found then the default system defined rule (Per IP, Section, AC) is used.

Refer to the Handle Reference Items chapter, Entry Code Maintenance in the System Administrator’s Guide for more information.

Note! For Entry Codes having a rule notincluding Section, the system displays the Target Scope of Cover (SOC) of the Accounting Classification (AC). (Target SOC is the SOC where an AC is created).

Inspect the Rolling Total Balances of the Technical Worksheet #

SICS lets you define up to five running balances on the Technical Worksheet. These fields are defined in the Base Company Specific settings of the System Parameters and Entry Code Maintenance. For each detail row you enter on the worksheet, the amount can be included in one or more of the running balances. This depends upon whether or not the Entry

Codes are included in the running balance. In case you would like to have the rolling totals calculated when all details have been registered on the worksheet you can deselect the box Automatic Calculation Of Rolling Total. This could be a smart move in case many details are to be registered on the worksheet to avoid that the system need to recalculate the rolling totals for each detail added to the worksheet.

Your System Administrator can, for instance, label one of the running totals ‘Account Bal’ and include all liquid Entry Codes in this running total. In this case the ‘Account Bal’ can be used to check against the account received from the Cedent or Broker after the details have been entered in the worksheet. For more information, refer to Base Company Specific Settings and Entry Code Maintenance in the System Administrator’s Guide.

Enter Life and Health Details on Technical Worksheet #

If you use the Life and Health functionality, you can on Technical Worksheet enter life and heath related information originating from the prime insurance policy level. The identifier of the prime insurance policy is entered in the Policy ID field placed in the Worksheet section of the worksheet. The attributes Start Date, End Date and Disability % are entered on accounting detail level.

View Details on a Technical Worksheet #

When you have finished your bookings for every business, you click each business in the Business display list to see their individual booking details. If there are no bookings details for one of the businesses in the list, SICS removed the business from the list when the worksheet is closed.

| Field | Description | Location |

|---|---|---|

| Currency | The currency in which the technical account is to be booked. If a currency has booking details on the worksheet the currency is marked in another colour (pink). Values: The business’ ledger currencies expressed according to ISO, e.g. USD, GBP, CAD, EUR, CHF, etc. Default: If no ledger currencies: Empty If one ledger currency: The one currency is pre-selected If many ledger currencies: None of the currencies are pre-selected. Validations: If a currency has not been defined as Main Currency or as a Booking Currency in the Administration Condition of the business, A warning will appear when this currency is added. (Refer to the chapter Handle Administration Conditions.) Functional Impact: Business Ledger, Online Statistics, Business Partner Ledger Mandatory: Yes |

Technical Worksheet |

| Name | The full name of the Currency Values: Currency name, e.g. US Dollar, Pound Sterling, Canadian Dollar, Euro, Swiss Franc, etc Mandatory: Yes |

|

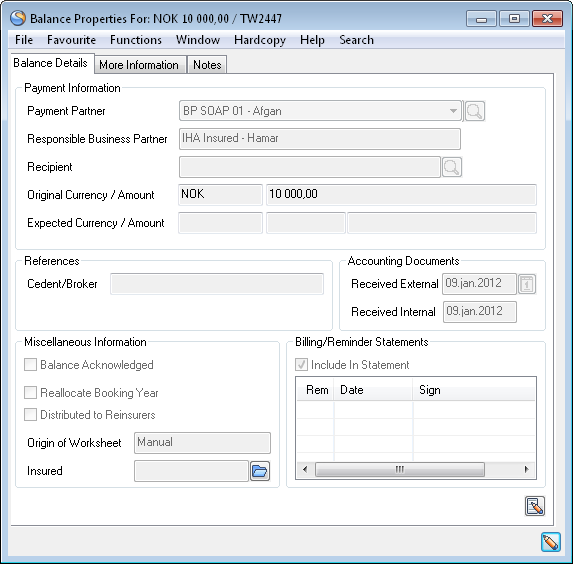

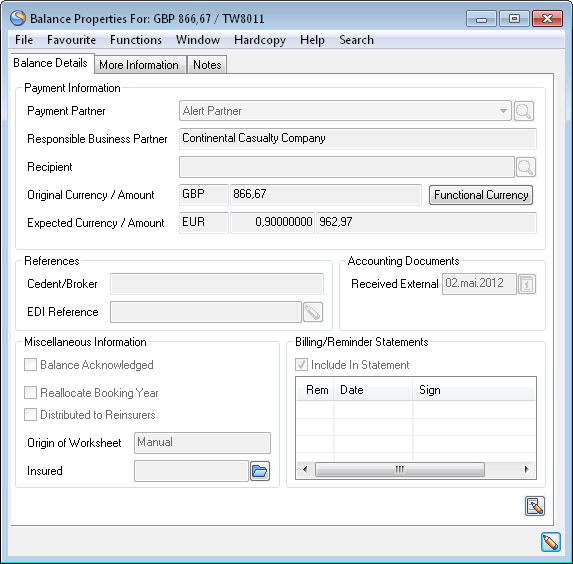

| Received External | The date when your company receives the account.This field gets changed to ‘Received External’ if the system parameter ‘Is Received Internal Date On Worksheet In Use’ has been activated for the base company you book on. If you book on more than one business on the worksheet it is possible to have different Received External dates per business. But all balances on the same business will get the same Received External date. Values: Date (mm/dd/yyyy) Default: Today’s date Validation: The date cannot be in the future. The field is validated when you select Apply or Change Status from the menu. Functional Impact: The Received field in the Accounts tab of the Administration Conditions for the related Business. When the Received External date is changed the same date will also be set in the Received Internal field. Mandatory: Yes |

Technical Worksheet/ Accounting Information tab |

| Received Internal | The date when the account was received at your company’s technical account department. This field is available if the system parameter ‘Is Received Internal Date On Worksheet In Use’ has been activated for the base company you book on. This Received Internal date is common for the whole worksheet, i.e. if you have bookings on different businesses on the worksheet and change the date on one of the businesses this change will affect all balances on all businesses on the worksheet. Values: Date (mm/dd/yyyy) Default: Today’s date. In case the Received External date is changed this new date will also be set as default in the Received Internal field. Validation: The date cannot be in the future and must be equal to or larger than the ‘External Received’ date. Functional Impact: None Mandatory: Yes |

Technical Worksheet/Accounting Information tab |

| Booked | The date when the account is booked. Values: Date (mm/dd/yyyy) Default: Today’s date Validation: If the Booking Date is not within the timeframe determined by an Accounting System Parameter, a validation message is given upon selection of Apply or Change Status. Mandatory: Yes |

Technical Worksheet/Accounting Information tab |

| Registered/-by | The date when and by whom the worksheet was initially created. Values: Date (mm/dd/yyyy) and Name Default: Today’s date and the name of the person creating the worksheet Mandatory: Yes Functional Impact: The Registration Date field of the Open Worksheet window |

Technical Worksheet/Accounting Information tab |

| Last Complete Accounting Year | The last year that all accounts are received from the client and booked (the Accounting Year is completed). Values: Year Functional Impact: Business Ledger, Online Statistics and Administration Conditions Mandatory: No |

Technical Worksheet/Accounting Information tab |

| Last Complete Booking Year | This year indicates that bookings are completed for this Booking Year. Values: Year Functional Impact: Business Ledger and Online Statistics Mandatory: No |

Technical Worksheet/Accounting Information tab |

| Title | You can enter a title for the worksheet. This title can later be used to identify the worksheet on the Business Partner Ledger and in the Find Worksheet window. Value: Free text field. The title can be set automatically for Facultative and Direct business, refer to the System Parameter Automatic Produced Worksheet Title in the System Administrator’s Guide for more information. Functional Impact: The text is shown on Business Partner Ledger and can be used as search criteria in the Find Worksheet function. Mandatory: No |

|

| Is VAT To Be Calculated On Gross | In case the VAT calulation is in use, refer to the System Parameter Is Automatic VAT Calculation in Use, this option is available on the worksheet. Either the VAT is calculated based on the entered amount (on net) or is included in the entered amount, and therefore is to be calculated based on gross. Value: Inactive, Active Default: Active Functional Impact: If the business is subject for VAT calculation, refer to the Insurance Period tab on the business, the system will calculate VAT amounts based on the entered detail amounts when the worksheet is saved to the database. When this field is inactive the system will calculate VAT as if the entered amount is net. When this field is active (the box is selected) the system will calculate VAT as if the entered amount is gross, meaning the VAT is part of the entered amount. Mandatory: Yes, if the System Parameter is Automatic VAT Calculation in Use is active. NOTE: When the VAT calculation is in use; and in addition the VAT Calculation based on EC Groups is activated; the ‘Is VAT to Be Calculated On Gross’ field will always be inactive. This means that the VAT will always be calculated based on net; i.e. on the entered amount. |

When this field is inactive the system will calculate VAT as if the entered |

| Accounting Period Based on Calendar | Defines if the Accounting Period From - To should be based on the Calendar Period instead of the Insured Period. This field is available when the system parameter ‘Prevent User Update of Accounting Period From - To on TW For’ is not activated for the Type of Business you book on. Values: Inactive, Active Default: Inactive Functional Impact: Calculation of the Accounting Period From - To on Technical Worksheet Mandatory: No |

|

| Post Balance | You select this check box if you want to book an account balance instead of all the details of the account. Values: Inactive, Active Default: Inactive Mandatory: No |

Technical Worksheet/ Balance Control Information |

| Control Amount | The balance of the account. Values: Amount, maximum 20 characters Validation: The amount entered is validated against the Balance of the Technical Worksheet when the details of the account have been booked Mandatory: No |

Technical Worksheet/ Balance Control Information |

| Accounting Year/Period | The Accounting Year and Period of the Account to be booked in Post Mode. Values: Year (yyyy) and Period, i.e. 1stof 12, 2nd of 2, 3rd of 4,etc) Default: If accounts are calculated in Administration Conditions: The first account not having a closed date registered. If no accounts are calculated: Current Accounting Year and Accounting Period = None Mandatory: No |

Technical Worksheet/ Balance Control Information |

| Replacement Value | You select this check box if you want the system to calculate an adjustment amount for specific entry codes. Values: Inactive, Active Default: Inactive Functional Impact: Two new amount columns appear in the W_orksheets_. _Mandatory:_ No |

Technical Worksheet/Balance Control Information |

| Show All Bookings | You select this check box if you want the system to show all Reserve bookings allowed for Replacement Value. (Reserve booking is a booking with an entry code within one of the Entry Code Sub Categories in Category Reserves). Values: Inactive, Active Default: Inactive Functional Impact: Two additional amount columns appear in the Technical Worksheet. All Reserve bookings in the selected currency, with total amount different from zero are displayed by the system. Automatically selects and disables the check box Replacement Values. Mandatory: No |

Technical Worksheet/Balance Control Information |

| Previous Amount | The column presenting the amount of previous bookings for a specific entry code. Values: Amount Calculation: The amount is calculated based on previous bookings of an entry code. The amount is only displayed to help calculating the adjustment value of the entry code. Mandatory: Yes |

Actual Account tab/Estimates tab |

| New Amount | The current status of the booking details. Values: Amount, maximum 20 characters Calculation: The amount is entered in order to calculate the difference between previous bookings and the current status of for instance the Loss Reserve. Validation: The system checks if the Replacement value is allowed for the Entry Code. If not allowed, the manual input is ignored. Functional Impact: Amount Column Mandatory: Yes |

Actual Account tab/Estimates tab |

| Policy ID | The identifier of the prime insurance policy Values: Free-text field Location: Technical Worksheet / Worksheet Information |

|

| Start Date | The Insured’s disability start date Values: Complete date (dd/mm/yyyy) Mandatory: No Location: Actual Account tab/Estimates tab |

|

| End Date | The Insured’s disability end date Values: Complete date (dd/mm/yyyy) Validations: Must be equal to or later than the Start Date Mandatory: No Location: Actual Account tab/Estimates tab |

|

| Disability % | The Insured’s disability percentage Values: Numeric Validations: Must be a value between and including 0,00 and 999,99 Mandatory: No Location: Actual Account tab/Estimates tab |

Book the Actual Account and Estimates on the Technical Worksheet #

SICS allows you to book both actual figures and estimated figures on the same Technical Worksheet. The actual figures are booked on the Actual Account tab and the Estimated figures on the Estimates tab. You are able to distinguish between the actual bookings and the estimates when you look at the balance changes in the Worksheet Closing window.

Estimates may be received from the Cedent or calculated internally. The estimates may be used for instance in the Accrual accounting. All transactions (details and balances) entered on a Technical Worksheet are reflected on Business Ledger, Business Partner Ledger, Online Statistics, etc. All estimates are shown separately in the Business Ledger and Online Statistics. Estimates do not influence the Liquid Balance and do not appear as balances on the Business Partner Ledger.

When the estimates are booked they become Unsettled as the Actuals. It is not possible to do Balance Pairing with Estimate balances so it is necessary to Reverse the Estimate balances to mark them as Settled, refer to the chapter Reverse Estimates from a Technical Worksheet on page 11-81and Reverse Estimates with Corrections from a Technical Worksheet on page 11-81.

It is possible to define entry codes to be used only as estimates. This is defined in Entry Code Maintenance. If an entry code is defined as ‘Estimate Only’, this code appears only on the Estimates tab. (For further reference, see the Entry Code Maintenance chapter in the System Administrator’s Guide).

- Open your Technical Worksheet. Refer to Open a Technical Worksheet for a Business on page 11-12 for more information about how to open a worksheet.

- Select a business in the business display list or add a new business by selecting Add Business from the pop-up menu Business display list.

- Select a ledger currency or add by selecting Add Currency from the pop-up menu in the Currency display list.

- Register basic accounting information on the Accounting tab and then a worksheet title.

- Click the Add Bookings button below the Actual Account tab or select Add New Booking from the pop-up menu on the Actual Account or Estimates tab.

The system adds a new row to the Actual Account/Estimates tab. 6. Edit, if required, the booking information given automatically. Book the figures from the Technical Account and/or book the estimates. This includes the Entry Code, detail Booking Amount and E_ntry Comment_ (if any). 7. Click _Add Bookings_ button or select _Add New Booking_ from the menu in order to get another booking line. The details from the first booking line are copied to the next except from the Entry Code, Amount and comments. 8. Continue to make the bookings until you have entered all the details from the received account/estimated figures on the worksheet.

The Actual Account-/Estimates tab contains several columns. In some columns information is added automatically. In some columns the information has to be entered manually.

Note! Some of the columns only appear if they are set to appear in System Parameter Maintenance (by your SICS System Administrator).

Booking Year and Period (Legal Entity and Global Entity) must be set on the System Parameter Accounting/Booking Periods tab, and Override must be “on” for both.

Financial Year is only shown if the System Parameter Deferred Business is set.

| Field | Description | Location |

|---|---|---|

| Insured Period | The Insured Period refers to the period within which the agreement is in force and the Cedent is covered. Values: The From- and To date of the Insured Period(s). Default: Empty if more than one Insured Period is selectable. Validations: System may be set up to validate that the Insured Period Start Date is not later than current booking period. Mandatory: Yes |

Actual Account tab/Estimates tab |

| Booking Yr/Period | The Base Company’s Year and Period in which the account is booked. (Refer to Base Company Specific Settings of the System Administrator’s Guide). Values: Year, Period (e.g. Month, Half Year or Quarter) Default: The Booking year/period defined in the Booking Terms of the System Parameters Validations: Against the Closing Booking Terms of the System Parameters. The system may also be set up to validate that the Booking Year and Period is not prior to the start date of the Insured Period. Mandatory: Yes Functional Impact: The proportional treaty outward Business Ledgers (OCC ‘as Original’ and ‘as Booking’and ORP ‘as Booking’and ‘as Account’) are updated with values from this field when system parameter ‘Keep Booking Year/Period from Source Business’ is active. The booking year and booking period are shown in the fields Orig Book Year and Orig Book Per on the outward ledgers. |

Actual Account tab/Estimates tab |

| Booking Yr/Period (Legal Entity) | The Period and Year in which the account is booked. (Refer to Base Company Specific Settings of the System Administrator’s Guide). Values: Year, Period (Month, Half Year or Quarter) Default: The Booking year/period defined in the Booking Terms of the System Parameters Validations: Against the Closing Booking Terms of the System Parameters. Mandatory: No |

Actual Account tab/Estimates tab |

| Booking Yr/Period (Global Entity) | The Period and Year in which the account is booked. (Refer to Base Company Specific Settings of the System Administrator’s Guide). Values: Year, Period (Month, Half Year or Quarter) Default: The Booking year/period defined in the Booking Terms of the System Parameters Validations: Against the Closing Booking Terms of the System Parameters. Mandatory: No |

Actual Account tab/Estimates tab |

| AccYr | The Accounting Year of the Account to be booked into the Technical Worksheet Values: Year Default: If accounts are calculated in the Administration conditions, the default value is the year in the first account not having a closed date.If no accounts are calculated, the default value is the Current Calendar Year. Note that if the AccYR/Period field is entered in the Balance Control Information area, then the AccYR column is defaulted with this value. Can only be overwritten manually. This is independent of the calculated accounts in the Administration conditions. Validations: The Accounting Year cannot be higher than the Booking Year. The Accounting Year cannot be smaller than the year in the Insured Period from date. Mandatory: Yes |

Actual Account tab/Estimates tab |

| AccPeriod | The Accounting Period within the Accounting Year for which the Account applies. Values: If single accounts are defined on the Administration Conditions then the values will reflect these accounts, e.g. if quarterly accounts are defined then only the values for quarters plus Yearly and None are available. But if no single accounts are defined then ALL values from table 177 Accounting Period are available, 1st of 4, 2nd of 4, 1st of 2, 1st of 12, etc. plus Yearly, None. For manual bookings on a Prop Treaty ORP the accounts matching the account frequency on the actual Insured Period are available in the Acc Period drop down down list. If the accounts are calculated Half-yearly, than only 1st of 2, 2nd of 2 should be available. For Quarterly, 1st of 4, 2nd of 4, 3rd of 4 & 4th of 4. Default: If accounts are calculated in the administration conditions, the default value is the first account not having a closed date. If no accounts are calculated, the default value is None. Note that if the AccYR/Period field is entered in the Balance Control Information area, then the AccPeriod column is defaulted with this value. Can only be overwritten manually. This is independent of the calculated accounts in the administration conditions. If all accounts are booked in the administration conditions for the actual insured period, the default value is the the last account in the last accounting year, even if it is booked. Mandatory: Yes |

Actual Account tab/Estimates tab |

| Orig AccYR | The Original Accounting Year of the inward booking. The Original Accounting Year is only available for input on worksheets created on Level of Business Retrocessionaire Participation, and if the global system parameter Convert Figures to Account Currency According to Orig Acc Year and Period is selected. Values: Year Default: If accounts are calculated in the Administration Condition, the default value is the same as the year in the first account not having a closed date. If no accounts are calculated, the default value is set to the Current Calendar Year. Validations: The Original Accounting Year must be inside the minimum and maximum year defined in System Parameter. Mandatory: No |

Actual Account tab/Estimates tab |

| Orig AccPeriod | The Original Accounting Period of the inward booking. The Original Accounting Period is only available for input on worksheets created on Level of Business Retrocessionaire Participation, and if the global system parameter Convert Figures to Account Currency According to Orig Acc Year and Period is selected. Values: 1st of 12, 2nd of 12, 1st of 2, 2nd of 4, Yearly, None, etc. Default: If accounts are calculated in the Administration Condition, the default value is the same as the first account not having a closed date. If no accounts are calculated, the default value is set to None. Validations: Valid values are determined by the values defined in Reference Data. Mandatory: No |

Actual Account tab/Estimates tab |

| Description of Account | Indicates the Type of Account Values: Additional, Cash Claim Account, First Additional Account, Initial Account, Regular Account, Regular Claim Account, Regular Claim Reserve Account, Regular Premium Account, Second Additional Account, Supplementary Account, Supplementary Claim Account, Supplementary Claim Reserve Account, Supplementary Premium Account, None Default: Regular Account Mandatory: Yes |

Actual Account tab/Estimates tab |

| UwYR | A year against which results of a Reinsurance agreement is measured. Normally this is the year when it was incepted or renewed. Values: Year Derived from: The Insured Period selected in same booking line. An Underwriting Year is defined for each Insured Period in the business’ Insured Period tab. This Underwriting year is displayed in the booking line. Mandatory: Yes |

Actual Account tab/Estimates tab |

| Original UwYR | The underwriting year(s) of the policies covered by a reinsurance agreement based on underwriting years. Values: Year (yyyy) Default: UwYR if Accounting System Parameter Always default orig.uw.yr and occ.yr is activated. If system parameter is inactive, UwYR is the default value only if the agreement’s cession basis is defined as Underwriting Year. Otherwise the default value is blank. (Regarding ‘Cession Basis’ refer to Administration Conditions.) For businesses defined as ‘Multi Year Contracts’, the year derived from the Sub Period Start Date is defaulted, independent on cession basis and the above system parameter. The defaulted value cannot be changed. Mandatory: Only if the agreement’s cession basis is defined as Underwriting Year. (When the system parameter Original Underwriting and Occurrence Year NOT mandatory is selected, the field is validated but not mandatory.) Validations: Only when Cession basis = Underwriting Year: For Proportional treaties: Validated against ‘Portfolio from Year’ and the UwYR field of the booking line. (Regarding ‘Portfolio from Year’ refer to Administration Conditions). Otherwise validated against the Uw YR field of the booking line. |

Actual Account tab/Estimates tab |

| OccYR | The underwriting year(s) of the policies covered by a reinsurance agreement based on occurrence years. Values: Year (yyyy) Default: UwYR if Accounting System Parameter Always default orig.uw. yr and occ.yr is activated. If system parameter is inactive, UwYR is the default value only if the Cession Basis of the agreement is defined as Occurrence Year. Otherwise the default value is blank. (Regarding ‘Cession Basis’ refers to Administration Conditions.)(When the system parameter ‘Original Underwriting and Occurrence Year NOT mandatory’ is selected, the field is validated but not mandatory.). When the system parameter ‘Occurrence Year always mandatory’ is active, the Occurrence Year is mandatory independent of the Agreement’s Cession Basis. Validations: Only when Cession basis = Occurrence Year; Headline Loss Year if system parameter Use FX Headline for Technical Worksheet Details linked to Headline is activated, and the detail is linked to a Headline Loss and the entry code is “loss related” (also enabled for Claim worksheet) and the business is an Assumed Proportional Treaty business. The OccYR is an output only, and cannot be modified for such detail. Mandatory: Only if the Agreement’s Cession Basis is defined as Occurrence Year. Validations: Only when Cession basis = Occurrence Year; Validated against ‘Portfolio from Year’ as defined on Administration condition and the Insured Period To Year |

Actual Account tab/Estimates tab |

| Accounting Period From-To | The period within the Accounting Year for which the account applies. Values: From- and To date (mm/dd/yy - mm/dd/yy) Derived from: The AccYR, AccPeriod and the Insured Period. If the AccPeriod is None the day and month from the Insured Period from and -to is combined with current Accounting Year. If the AccPeriod has an other value, e.g.1stof 4 the from and to date is calculated as e.g. the three first months of the Insured Period in combination with current Accounting Year. If the Accounting Period Based on Calendar field on the worksheet is selected: >br/> Derived from: The AccYR, AccPeriod and the Calendar Period. If the AccPeriod is None, the day and month from the Calendar Period from and - to is combined with current Accounting Year. If the Insured Period is 01.04.2005 - 31.03.2006, AccYr is 2006 and AccPeriod has another value, e.g. 1st of 4, the from and to date is calculated as e.g. the three first months of the Calendar Year; 01.01.2006 - 31.03.2006.<br/br>Mandatory: Yes |

Actual Account tab/Estimates tab |

| Due Date | The date when the account is due to be settled. Values: Date (mm/dd/yy) Derived from: The calculated accounts in the Administration conditions of the selected Insured Period Default: The date defined in the Payment Cedent column of the calculated account in Administration Conditions. If no accounts are calculated, today’s date is suggested. If the Due Date Not Defaulted on Technical Worksheet system parameter is selected, the due date remains empty if no administration condidtion has been defined on the business. Mandatory: Yes. |

Actual Account tab/Estimates tab |

| Amendment | A change of the business conditions, in effect from a specific date. Values: Amendment no. + effective from date (x(mm/dd/yy)) Derived from: The Amendment conditions of the Insured Period Default: The newest amendment number and the effective from date of this amendment Mandatory: Yes |

Actual Account tab/Estimates tab |

| To Be Split | A value indicating whether or not the booking is to be split into Accounting Classification in accordance with a predefined percentage split on the agreement. (Refer to the chapter Split Selected Booking per Accounting Classification). Values: Yes and No Derived from: A Base Company Specific Settings System Parameter and the percentages defined in the Accounting Classification conditions. Validations: The value Yes is only valid if the total accounting Classification split percentage on the agreement is exactly 100%. Functional Impact: The Split Per AC field on Business Ledger is updated with value Yes when booking automatically split per Accounting Classification Mandatory: Yes |

Actual Account tab/Estimates tab |

| Section | The agreement may be split into different components according to the agreement’s classifications. Values: Section names given on the agreement Derived from: The Structure of the agreement Default: Main section if only one section. If more than one section, the field is empty and the user has to select from drop-down list. Mandatory: Yes |

Actual Account tab/Estimates tab |

| Legal Area | The Country(ies)/Country Group(s) defined in the agreement’s classifications. Values: System defined names Derived from: The selected section Mandatory: Yes |

Actual Account tab/Estimates tab |

| Acc.Classification | A unique combination of the different components in the agreement’s classifications. Values: A system defined or user defined name for each classification Derived from: The Accounting Classification conditions and the selected Section. Mandatory: Yes |

Actual Account tab/Estimates tab |

| Orig Class of Bus | An additional classification defined in the reference data. Values: An Original Class of Business. Derived from: Reference data, data type ‘Accounting Original Class of Business’ Mandatory: No |

Actual Account tab/Estimates tab |

| Original Cession | The Insured Object Cessions of the business to which you are making your bookings. Only in Life Values: The Cession name Derived from: The selected Section Mandatory: No |

Actual Account tab/Estimates tab |

| Entry Code | A code determining the nature of the booking. Values: A combination of code and name, i.e. 10 Premium, 30 Paid Losses. Note that only entry codes valid for the Base Company and/or Main Class of Business and/or Type of Participation for the selected Insured Period and Section are available. If Entry Code restrictions are defined in your User Preferences, the available entry codes are limited. Also the Entry Code property itself decides if an Entry Code appears in the drop-down list or not. Moreover, your system adminitrator may have separately set up Entry Code Restrictions for Technical and Claim Worksheets based on whether the business is inward or outward, and this setup can be done per base company. Be aware of that this restriction is not valid for Automatic Bookings. However if you later try to modify the automatic generated Entry Code manually on an open worksheet, only the restricted Entry Codes will be available for selection. Validation: The Entry Code may be basis for system validations against the conditions of the Insured Period, i.e. brokerage, portfolio, etc. Mandatory: Yes |

Actual Account tab/Estimates tab |

| Amount | The amount that applies for the entered booking details, i.e. Insured Period, Accounting Period, Entry Code etc. Values: Amount, maximum 20 characters Mandatory: No |

Actual Account tab/Estimates tab |

| New Amount | Actual Account tab/Estimates tab | |

| Headline Loss | The Identification of a linked Headline Loss (Refer to the chapter ‘Link Bookings to a Headline Loss from a Technical Worksheet’) Values: A user-defined id. Derived from: Headline Loss Mandatory: No |

Actual Account tab/Estimates tab |

| Government Tax Category | When an error message is issued on a Technical Worksheet due to booking is not according to the respective Rule defined in the Government Tax Table or the field ‘Always Stop if Trigger/Target EC is booked’ is selected in the Government Tax Table or the corresponding Validation Indicator is defined on the business insured period, a Government Tax Category for this breach may be required. The column is only enabled when an error message is issued due to the Government Tax validation Values: Customised by your System administrator. Mandatory: Yes (when column is enabled). |

Actual Account tab/Estimates tab |

| Government Tax Comment | A further description why you accept technical booking not according to Rule defined in the Government Tax Table/Validation Indicator on the Assumed Business. Column is only enabled when an error message is issued due to the Government Tax validation. Values: Free text input. Mandatory: When selected Acceptance Category requires additional comment. |

Actual Account tab/Estimates tab |

| Tax Country | The country for which the Government Tax applies. Values: Any country defined in the system. Derived from: Government Tax Table when detail is automatically booked, but can be edited. Mandatory: No. |

Actual Account tab/Estimates tab |

| Tax % | A Government Tax percentage used to calculate the Government Tax amount Values: Percentage. Derived from: Government Tax Table when detail is automatically booked, but can be edited. Mandatory: No. |

Actual Account tab/Estimates tab |

| Tax Type | Description of the Government Tax. Values: Available options are according to the list of reference data Tax Type. Derived from: Government Tax Table when automatically booked, but can be edited. Mandatory: No. |

Actual Account tab/Estimates tab |

| Government Tax Rule Ref | A reference number referring to a specific rule in the Government Tax Table. Can not be manually updated Values: A reference number automatically updated for the booking detail. Derived from: Government Tax Table when detail is automatically booked or validated based on the Government Tax Table. Mandatory: No. |

Actual Account tab/Estimates tab |

| Notes | A note applying to the booking detail can be entered Values: Free-text Validations: Against the Comments Required check box located on the Flags tab of the View Entry Code window. (Refer to the Maintain Entry Code section in the System Administrator’s Guide). Mandatory: Only if the check box mentioned for Validations is activated. |

Actual Account tab/Estimates tab |

| Delete | By switching the value to Yes you can indicate that the row is to be deleted. By selecting the popup menu option Delete Selected Details you are able to delete multiple rows in one go. By selecting the tick box Quick delete below the booking rows you can navigate between the booking rows in the Delete column by use of the Tab button on the keyboard. Use the Space button on the keyboard or double click to switch between Yes/No Values: Yes and No Mandatory: No |

Actual Account tab/Estimates tab |

| Original Responsible Partner | The partner originally responsible; e.g the Insured; enabled for Proportional Treaty Business when System parameter Use FX Headline for Technical Worksheet Details linked to Headline is activated. Values: Any Business Partner of type or types defined by your System Administrator. Mandatory: If System Parameter Original Responsible Partner is activated, the partner must be defined on Loss related details linked to a Headline Loss on Proportional Assumed Treaty Business. If worksheet is applied/closed without a partner defined, the default partner is assigned. |

Actual Account tab/Estimates tab |

Calculate and Book Value Added Tax Automatically #

For an assumed business that is subject to Value Added Tax (VAT), SICS calculates VAT automatically on technical bookings.

- Make your bookings on the Technical Worksheet.

- Select Change Status from the Edit menu button.

- SICS calculates VAT for the technical bookings that are subject to VAT calculation and adds the result to the worksheet.

- If VAT entry codes already exist on the worksheet, no further VAT calculation is done.

- Select Change Status again in order to close the worksheet.

Based on your selection of the check box Is Vat To Be Calculated On Gross, VAT is calculated on either gross or net basis.

- Gross basis: VAT is calculated by splitting the booked gross figures into net amount and VAT amount using the VAT percentage.

- Net basis: VAT is calculated by multiplying the booked net figures with the VAT percentage.

Example:

A technical worksheet contains following booking details:

| Written Premium | 1.000,00 |

| Commission | -50,00 |

| Paid Claims | -500,00 |

| VAT % | 10% |

All entries are subject to VAT calculation.

Calculation on Gross basis:

The system uses following formulas to calculate the VAT amounts:

| Gross Amount * 100 | = | Net Amount |

| (100 + VAT%) | ||

| Gross Amount - Net Amount | = | VAT Amount |

The VAT calculation results in following booking details:

| Written Premium | 909,09 |

| VAT Premium | 90,91 |

| Commission | -45,45 |

| VAT Commission | -4,55 |

| Paid Claims | -454,55 |

| VAT Paid Claims | -45,45 |

Calculation on Net basis:

The system uses following formula to calculate the VAT amounts:

| Net Amount * VAT% | = | VAT Amount |

The VAT calculation results in following booking details:

| Written Premium | 1.000,00 |

| VAT Premium | 100,00 |

| Commission | -50,00 |

| VAT Commission | -5,00 |

| Paid Claims | -500,00 |

| VAT Paid Claims | -50,00 |

Calculate and Book Value Added Tax Based on Entry Code Groups Automatically #

When the Automatic VAT calculation is activated; and additionally the system parameter VAT Calculation based on EC Groups is selected; SICS calculates VAT automatically for all businesses (inward and outward) as long as they are subject to Value Added Tax (VAT).

The bookings will be automatically done when the worksheet is saved to the database and will always be on Net Basis (see examples above).

The result of the Automatic Booking of VAT are booked with Entry Codes defined in the System Parameter Accounting/Entry Codes/Accounting Function (refer to the Accounting Functions listed below).

The Accounting Function used for the calculation of VAT depends on the type of VAT calculations you are using, i.e. VAT based on EC Sub Category or VAT based on EC Groups (the latter is the case if the system parameter VAT Calculation based on EC Groups is selected):

- VAT based on EC Sub Category (Accounting Function: Vat Calculation)

- VAT based on EC Group (Accounting Function: VAT Calculation based on EC Groups)

Additional VAT and WVAT calculation #

System Parameter Additional VAT Calculation will be available when Is Automatic VAT Calculation in Use and VAT Calculation based on EC Groups are selected. When Additional VAT Calculation is selected some addition functionality will be available for VAT(Value Added Tax) and WVAT (Withhold Value Added Tax).

Define WVAT flag on a Country #

On Locations–> Countries, WVAT flag will be available. This flag will NOT be selected by default

Where the broker on an Assumed Business or the Retrocessionaire on the ORP are from a country where the WVAT flag is selected, then the WVAT bookings as described in the sections below will be calculated

Define Surcharge on WVAT #

It will be possible to assign a surcharge % to the defined VAT % on the country. And VAT% and Surcharge% can be overwritten on Business, Insured Period tab, Individual Options.

This surcharge % will be applied to the WVAT calculations that will be calculated where applicable.

A new column on the Administration Conditions for all proportional business will be available labelled ‘Surcharge on VAT%

A new column on the Instalment for all non proportional business will be available labelled ‘Surcharge on VAT%

Where the percentage has been defined here, for all Surcharge on WVAT bookings made for the accounting period where the surcharge% is defined on the business level, the surcharge on WVAT will be calculated based on this value and not the value defined on Business, Insured Period tab, Individual Options.

Automatically calculate VAT, WVAT and Surcharge on WVAT #

- When the WVAT flag is ticked on the broker’s home country, then the VAT on brokerage will be calculated using the VAT percentage defined on Business, Insured Period tab, Individual Options.

- Where the WVAT flag is ticked on the Retrocessionaire’s home country on an Outward Business, then the VAT on premium will be calculated using the VAT percentage defined on Business, Insured Period tab, Individual Options.

- Where the Additional VAT Calculation system parameter is selected, four new VAT calculation rules will be available

WVAT on Premium

WVAT on Brokerage

Surcharge on WVAT on Premium

Surcharge on WVAT on Brokerage - Where VAT bookings are made and the WVAT flag is selected on the home country broker on an Assumed Business or the Retrocessionaire of an Outward Business-

a. A WVAT on Brokerage will be automatically calculated when the VAT on Brokerage is calculated. This will always be the reversal booking of the VAT on Brokerage. This calculation will only be done on an Assumed Business

b. A WVAT on Premium will be automatically calculated when the VAT on Premium is calculated. This will always be the reversal booking of the VAT on Premium. This calculation will only be done on an Outward Business

c. A surcharge on WVAT on Brokerage and WVAT on Premium will be calculated when WVAT on Brokerage is calculated using the Surcharge % defined on Business, Insured Period, Individual Options from which the VAT% has been taken from or the Surcharge % that is defined on the Administration conditions of the business for the corresponding accounting period for Proportional Business and from the Surcharge % defined on the instalment on the Non Proportional Business.

Define a VAT Exemption flag on the Business #

A new flag “VAT Exemption” will be available on the business, Insure Period tab. This will be enabled only when the flag ‘Use VAT Calculation’ is selected. When this flag is selected, VAT on Premium will not be calculated, but VAT on Brokerage will be calculated as per existing rules and where applicable, as per the rules specified in the previous section.

Maintain Bookings on a Technical Worksheet #

When you make bookings of an actual account and/or estimates in the technical worksheet you may need to, for example, navigate to other parts of the system, start an automatic function or add/delete a booking line. The pop-up menu in the Actual Account/Estimates tabs gives you several possibilities to maintain the bookings of a Technical Worksheet. (In the following only Actual Account will be used as reference. All functionality does however also apply for the Estimates tab.)

- Open your Technical Worksheet. Refer to Open a Technical Worksheet for a Business on page 11-12 for more information about how to open a worksheet.

- Select a ledger currency or select Add Currency from the pop-up menu in the Currency display list to add a currency.

- Click in the display list on the Actual Account tab and then click the right-mouse button to open the pop-up menu. Alternatively, click the Add Bookings button to make your bookings and open the pop-up menu afterwards.

Some of the options on the pop-up menu are enabled only when bookings exist.

Add a New Booking on a Technical Worksheet #

When you select Add New Booking from the pop-up menu on the Technical Worksheet, a new row is created. In the first row of the Actual Account, most of the columns are defaulted with values taken from the System Parameters and the Business. If booking lines already exist, the last of these rows is copied.

- Open your Technical Worksheet. Refer to Open a Technical Worksheet for a Business on page 11-12 for more information about how to open a worksheet.

- Select a ledger currency or select Add Currency from the pop-up menu in the Currency display list to add a currency.

- Select Add New Booking from the pop-up menu, or select the Add Bookings button on the Actual Account tab.

- If necessary, make your changes to defaulted entries by selecting entries from drop-down list in the columns of the first booking row and enter the entry code, amount and notes (if necessary).

To add more booking lines one by one, select Add New Booking from the menu or click the Add Bookings button.

If you want the entries of the last booking line to be copied onto several booking lines, enter the required number in the text box next to the Add Bookings button (SICS lets you enter up to 99 booking lines) and then click the Add Bookings button.

Add New Bookings using the Quick Entry Feature on the Technical Worksheet #

Using this feature, all editable columns in the worksheet except Entry Code and Amount, are disabled. When you tab between the columns, you navigate only between the Entry Code column and the Amount column. As these are the columns you are most likely to edit, this enables fast and easy entry of bookings.

- Open your Technical Worksheet and complete the initial booking procedure.

- Select the Quick Entry check box, add the number of new rows and click the Add Bookings button.

- Enter the entry codes and amounts for each of the booking lines in the Technical Worksheet.

By clearing the Quick Entry box again, you can edit all the other columns again.

Amount Multiplier on the Technical Worksheet #

If you want the amounts to be multiplied or sign of amount to be changed, enter the required multiplier e.g. -1 in the text box next to Multiply Button and then click Multiply. Multiplication applies to all booking details per business per currency in a worksheet. Actual Accounts and Estimates are treated separately for multiplication.

Use Selected Value to Populate a Technical Worksheet #

When you have entered several bookings into your worksheet and you find that for instance the Booking Period for some or all of the bookings should have been changed. Rather than changing the value in each and every booking line, you may use this feature to update all lines in one go.

You can select to change:

- All bookings - if the value is to be copied to all booking lines of the worksheet.

- All bookings below current - if the value are to be copied only to the booking lines below the line from where you selected the value.

- All bookings without a value - if the value is to be copied to all the booking lines with empty fields.

- All bookings without a value below current - if the value is to be copied only to the booking lines with empty fields below the line from where you selected the value.

- Open your Technical Worksheet. Refer to Open a Technical Worksheet for a Business on page 11-12 for more information about how to open a worksheet.

- Select a ledger currency or select Add Currency from the pop-up menu in the Currency display list to add a currency.

- Add your bookings on the Actual Account tab.

- Select the entry that you want to populate in the Technical Worksheet.

- Select Use Selected value to Populate from the pop-up menu and select one of the listed options.

- The system updates the fields in all rows in accordance with your option in the previous step.

Delete a Booking Line from the Technical Worksheet #

When you, for example, have copied too many booking lines or find that a line with incorrect information has been added, you can delete this from the Technical Worksheet.

- On your technical worksheet, select any field in any column of the row you want to delete.

- Select Delete from the pop-up menu.

- The system removes the row and recalculates the Worksheet Balance (if necessary).

Note! When the Government Tax Framework is in use and the line to be deleted from the worksheet includes a booking detail linked to one or more other booking details, system automatically removes the Government Tax link for all details included in the linkage.

Delete multiple Booking Lines from the Technical Worksheet #

When you, for example, have copied too many booking lines or find that some lines with incorrect information has been added, you can delete these from the Technical Worksheet.

- On your technical worksheet, select the Quick delete box. This will disable all editable columns in the worksheet except the Delete column.

- Select the Delete column in one of the rows you want to delete and use the Space button to switch the value from No to Yes (or double click)

- Move to the next row to be deleted by use of the Tab button and press Space again

- When completed select the Delete Selected Details from the pop-up menu

- The system removes the rows and recalculates the Worksheet Balances (if necessary)

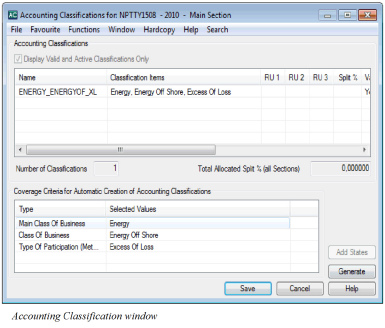

Split Selected Booking per Accounting Classification

You can reduce the time used for booking accounts by using the Split Selected Bookings per Accounting Classification option in SICS. This option allows you to capture a percentage split across the Accounting Classifications for this agreement’s Insured Period. This option also ensures that the accounting complies with the underwriting split.

(When processing manual booking entries on Technical Worksheets, this percentage split of Accounting Classifications is applied automatically.)

If you want the system to automatically suggest the split per accounting classification, you need to set the ‘Default Bookings to be split per Accounting Classifications’ system parameter. Refer to the Base Company Specific Settings/Classification Rules 1 in the System Administrator’s Guide for more information about how to set the system parameter.