Handle Limit and Premium Conditions

Terms and conditions regarding the maximum liability of a reinsurance agreement and the monetary amount to be received in return for the cover comprise, in SICS, the limit and premium conditions.

The limits range from the agreed monetary limitations and deductibles to more informational items, like run passenger miles and turnovers.

The premium conditions include items such as the estimated premium informed by the cedent, pre-agreed premiums, premium rates, and premium invoicing schedules.

Available Limit and Premium Conditions #

Your company generally decides the limit and premium items available to you. More specifically, your system administrator has selected the limit and premium items relevant for each category of business, so that you always see the ones relevant for the business you are working on.

The available fields depend on the following characteristics of your business:

- Type of Business (method), e.g. non-proportional treaty, proportional facultative

- Type of Participation (method), e.g. quota share, surplus

- Main Class, Class and Sub Class of Business, (property, marine, etc.)

- For premiums, also Premium Type (whether flat, fixed rate, etc.).

- For Single Treaty Protection, when Type of Business (method) is proportional treaty: Type of Business (covered) when this is non-proportional treaty

Your system administrator may also have defined the sequence in which you see the fields. (For example, he/she might have set up all limits to show up before deductibles).

Also, you may find a field name in this description under a different name in you system. This is because your system administrator may have changed the name of the field. The name should still be recognisable, as the meaning of it would be the same.

Maintain Limit and Premium Currencies #

In SICS you can efficiently capture and make use of the currencies in which the premium and limit amounts of an agreement are expressed.

Add New Currency #

The main currency of your agreement was defined when the agreement was set up. (Afterwards you see it at the top of the currency table). If the agreement expresses premium and limits in more than one currency, you may now register additional (secondary) currencies.

- Open your business and click the Limit and Premium Condition (P/L) button. If needed, select Edit from the Menu button on the Main tab.

- On the Main tab, select Add from the menu in Currency table.

- Select the currency(s) you require from the Available list and click the single right arrow (or double-click the required currency).

- Click Save.

- If relevant, enter the currency’s rate of exchange in the RoE Limit column, in the same row as the newly created currency.

- If you want the exchange rate automatically calculated, instead of the previous step, enter the main limit amount in the currency you just added.

- Click Save.

Delete Currency #

You can delete currencies (not main currency) registered by mistake.

- Select Edit from the Menu button to open the Limit and Premium condition in edit mode.

- On the Main tab, select the currency to be deleted in Currency table and select Delete from the pop-up list.

- Click OK.

Change Main Currency #

Your agreement may have the wrong main currency, so you need to change it.

- Open your business and click the Limit and Premium condition (P/L). Verify that the currency that you want as a new main currency is shown as a secondary currency in the Currency table. If it does not, add the currency as described in section Add New Currency.

2. Close the Limit and Premium condition.

3. Click the Classification tab of your business.

4. Click the Edit button.

5. The current main currency is shown in the Main Currency field. Change it by selecting the new main currency from the Main Currency drop-down list.

6. Click Save.

7. Click the Limit and Premium Condition (P/L) button again and verify that the new main currency is shown at the top of the Currency table and the old main currency is shown as a secondary currency in the table.

2. Close the Limit and Premium condition.

3. Click the Classification tab of your business.

4. Click the Edit button.

5. The current main currency is shown in the Main Currency field. Change it by selecting the new main currency from the Main Currency drop-down list.

6. Click Save.

7. Click the Limit and Premium Condition (P/L) button again and verify that the new main currency is shown at the top of the Currency table and the old main currency is shown as a secondary currency in the table.

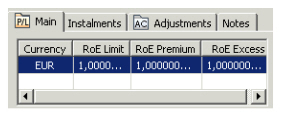

| Field | Description |

|---|---|

| Currency | Currency in which premiums and limits are expressed. The currency presented at the top of the Currency table is the main currency. The rest are secondary currencies. Values: ISO standard (currency short name). Derived from: Main currency of business or section. Mandatory: Yes Functional Impact: None |

| RoE Limit | Fixed rate of exchange for a currency, agreed specifically for this business. It expresses the rate of exchange of the currency on the same row against the main currency (at the top of table). Values: Maximum number of decimals: 9. Default: 1 (main currency only). Calculation: From limit amount in main currency and same limit amount in secondary currency. * Limit fields used in calculations: - Proportional Treaty: Liability - Non-Proportional Businesses: Cover - Proportional Facultative and Direct: Main Limit Changes of an amount in a secondary currency initiates recalculation of the exchange rate, while changes in amount in main currency does not recalculate exchange rate. (It recalculates the amounts in all secondary currencies.) Can be manually entered or changed. _Mandatory:_ Main currency: Yes Secondary currencies: No _Functional Impact:_ Limit Figures Rate of Exchange for Premium |

| RoE Premium | Fixed exchange rate for premiums agreed specifically for this currency and this business. Values: Maximum number of decimals: 9 Derived from: RoE Limit Calculation: Will always be kept the same as RoE Limit, unless RoE Premium is changed directly or premium amount in secondary currency is manually changed. Calculated from premium amount in main currency and amount entered for same premium in secondary currency. Premium figures used in calculations: Treaty Business: EPI Fac./Direct Business: Tot. Gross Premium Can be manually changed. Mandatory: Main currency: Yes Secondary currencies: No Functional Impact: Premium figures. |

| RoE Excess | Fixed exchange rate agreed specifically for the excess point, for this currency and this business. Values: Maximum number of decimals: 9 Default: 1 (main currency only) Calculation: Will always be kept the same as RoE Limit, unless you change RoE Excess manually or you change Excess amount in secondary currency manually Calculated from Excess amount in main currency and Excess amount in secondary currency. Validations: Available for non-proportional businesses only Mandatory: Main currency: Yes Secondary currencies: No Functional Impact: Limit Figures |

View Limits and Premiums in Other Currencies #

It is possible to convert premium and limit figures to any other currency as long as the currency has an exchange rate defined in the currency database.

This is a view feature only and the converted premium and limit figures are not stored in the system.

- Open the Limit and Premium condition in view mode.

- On the Main tab, select Convert To.

- Select the required currency from the list.

- Click the Calculate button.

General Method of Entering Limit and Premiums #

The below describes the general methods of entry for premiums and limits in display lists (tables).

For more details on entry of limit and premiums for a particular category of business, see the description of limit and premiums for this category of business.

Enter Limits and Premiums when NO Conditions Exist #

Input limit and premiums values when it is the first time that anybody enters limits and premiums conditions for the relevant business period.

- Open your business and click the Limit and Premium Condition (P/L) button in the Navigation bar. When you enter the limits and premium conditions for the first time, all available limit and premium items are shown in the left most columns. The conditions are in edit mode.

- Fill in your values for the item(s) that you require in the relevant columns.

- Click OK.

Enter Limits and Premiums when Conditions Exist #

The next time you want to register some limit or premiums, you follow a slightly different method of entry. Let us say you want to enter an additional limit value.

-

Click the Limit and Premium Condition (P/L) button.

The system shows existing values in view mode and only the limit and premium items already having a value. -

Select Edit from the Menu button on the Main tab.

-

In the Limit display list, select Add from the pop-up list

-

The system shows you the remaining available limit items.

-

Select the limit item(s), e.g. Liability that you require. Click Save.

-

Enter your value(s) for the added limit(s) item in the relevant columns.

-

Click OK.

Remove Limits and Premiums Items #

Premiums and/ or limits fields added by mistake can be removed.

- Click the Limit and Premium Condition (P/L) button.

- Select Edit from the Menu button on the Main tab.

- In the display list, select the premium/ limit item you want to delete and select Delete from the pop-up list

- Click OK.

Maintain Proportional Treaty Limits and Premiums #

For a business where the reinsurer and cedent have agreed in advance to share premium and losses proportionally, you may store relevant premium and limits information depending on the treaty being quota share, surplus or something else (e.g.open cover).

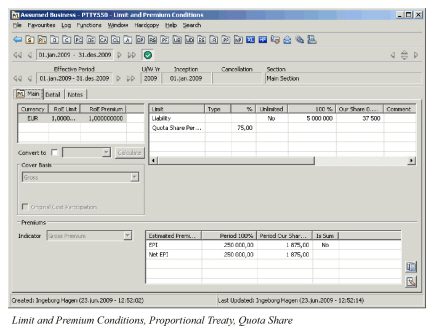

Maintain Quota Share Limits #

Record or update liabilities of a treaty where the reinsurer shares the responsibility with the cedent by assuming a fixed percentage of losses.

- Open your business and click the Limit and Premium Condition (P/L) button.

- If needed, select Edit from the Menu button on the Main tab. In the Limit column, select the limit items that you require from the pop-up list. For example, Liability.

- Click Save.

- On the Main tab, enter figures in the columns and rows that you require.

- Click OK.

Note! Your system administrator might have set up additional types of participation and given them quota share ‘behaviour’. For these businesses the system will behave the same way as for a quota share treaty.

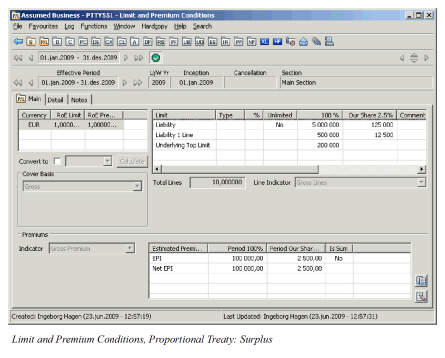

Maintain Surplus Limits #

To enter the limits of your treaty as a multiple of the cedent’s retention:

- Click the Limit and Premium condition button in the Navigation bar.

- Select Edit from the Menu button on the Main tab.

- Enter Liability 1 Line on the Main tab.

- Enter Total Lines on the Main tab.

- Click OK.

Note! Your system administrator might have set up additional types of participation and given them surplus ‘behaviour’. For these businesses, the system will behave exactly the same way as for a surplus treaty.

Your company decides what will appear in the columns with headers Limit and Type. The Field Descriptions only covers some of the most commonly used limits and types. For more details on customisation, refer to Available Limit and Premium Conditions

| Field | Description |

|---|---|

| Liability 100% | Treaty underwriting limit amount per risk, for the 100% contract. It is considered the main limit of a surplus treaty. Examples for illustration: Liability 100% 1.000.000, amount for 1Line : 250.000 Risk A: Sum Insured 500.000. 250.000 retained by cedent and 250.000 ceded to surplus treaty. Risk B: Sum Insured: 200.000 200.000 retained by cedent. Risk C: Sum Insured 1.500.000 250.000 retained by cedent, 1.000.000 ceded to surplus treaty. Remaining 250.000 ceded to e.g. a second surplus treaty Values: Amounts Number of decimal places: 0 Calculations: Liability 1 Line x Total Lines. From Liability Our Share and Share From 100% in Share condition. (From signed share, from written share if no signed share and from offered share if no written or signed share). Validations: If unlimited, Liability 100% is disabled Mandatory: No Functional Impact: * Other limit condition values * Claims Accounting * Automatic Protection Assignment * Insured Peril Cession * Reinsurance Program * Protection Program |

| Liability Our Share | Reinsurer’s share of the 100% liability. Values: Amounts Number of decimal places: 0 Calculations: From Liability 100% and Share From 100% in Share condition. (From signed share, from written share if no signed share and from offered share if no written or signed share). Validations: If unlimited, Liability Our Share is disabled Mandatory: No Functional Impact: Other limit figures |

| Liability Type | Values that further specifies liability, e.g. what liability is expressed as Values: EML (Estimated Maximum Loss) PML (Possible Maximum Loss) MPL (Maximum Possible Loss) Sum Insured Your company may have defined additional Liability Types Mandatory: No Functional impact: None |

| Liability Unlimited | Liability has no upper limit Values: Yes/ No Default: No Mandatory: Yes Functional Impact: * Liability * Claims Accounting * Reinsurance Program * Protection Program |

| Comment (all) | Free-text field regarding the limit on the same row Values: Text Maximum number of characters: 30 Mandatory: No Functional Impact: None |

| Liability 1 Line | The amount being the cedent’s retention. Values: Amounts Number of decimal places: 0 Calculation: Liability 100% /Total Lines. Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Liability 100% and Liability Our Share. Mandatory: No Functional Impact: Other limit figures * Reinsurance Program * Protection Program |

| Cession Limit | Maximum amount per ceding exposure (e.g. exposure to a certain peril, e.g. earthquake). Values: Amounts Number of decimal places: 0 Calculations: Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Liability 100% and Liability Our Share. Mandatory: No Functional Impact: None |

| Event Limit | Maximum liability per event, e.g. per earthquake Values: Amounts Number of decimal places: 0 Calculations: Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Liability 100% and Liability Our Share. Validations : If unlimited, Event Limit 100% and Our Share are disabled Mandatory: No Functional Impact: Claims Accounting |

| Underlying Top Limit 100% | Top limit of the preceding reinsurance. That is, top limit of 1stsurplus treaty becomes the underlying top limit of the 2nd surplus. Values: Amounts Number of decimal places: 0 Mandatory: No Functional Impact: * Reinsurance Program * Protection Program * Automatic Protection Assignment |

| Total Lines | Number of times by which the retention must be multiplied to get the liability of the treaty. Values: * Minimum Value: 1 Maximum Value: 9.999 Number of decimal places: 6 _Calculations:_ Liability / Liability 1 Line _Validations:_ Disabled for input when liability is “Unlimited”. _Mandatory:_ No _Functional Impact:_ * Other limit condition values * Reinsurance Program * Protection Program |

| Line Indicator | Indicates whether the amount for 1 line (cedent’s retention) is gross or net of a quota share contract. Values: G_ross Lines:_ Amount retained by the ceding company and its quota share reinsurers. _Net Lines:_ Amount retained by ceding company alone _Mandatory:_ No _Functional Impact:_ None |

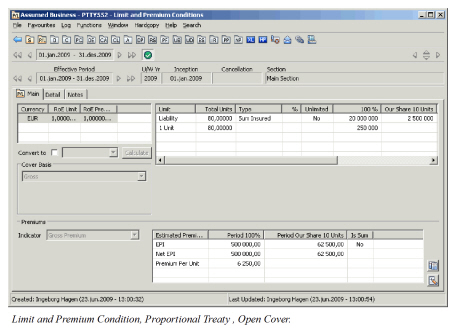

Maintain Other Proportional Treaty Limits when Share Expressed as Percent #

Enter or change limits of treaties where type of participation is something else than quota share or surplus, e.g. open cover. The limit items available here might be different than for the quota share and surplus treaties, however, the method of entry is the same. (Refer to the procedure in section Maintain Quato Share Limits.

Maintain Other Proportional Treaty Limits when Share Expressed as Units #

To enter or change limits for a proportional treaty placed in units instead of percent:

- Click the Limit and Premium condition button in Navigation bar.

- Select Edit form the Menu button on the Main tab

- Enter the limit per unit in 1 Unit in the 100% column on the Main tab. The system calculates applicable figures for you.

- Click OK.

Any proportional treaty, which your system administrator has not given a quota share or surplus ‘behaviour’, will receive an open cover‘behaviour’.

For how to express share as units, refer to Enter Share for Other Proportional Treaties when Expressed as Units.

| Field | Description |

|---|---|

| Total Units | Number of units in the reinsurance contract. Values: * Number * Maximum value: 99.999 * Minimum value: 0 * Number of decimal places: 5 _Derived from:_ Total Number of Units in Share condition. Cannot be changed in Limit condition. _Mandatory:_ Yes _Functional Impact:_ * Other limit condition values * Other share conditions values * Business Placement |

| Liability 100% | Treaty underwriting limit amount per risks for all units. It is considered the main limit of a proportional treaty. Values: * Amounts * Number of decimal places: 0 _Calculations:_ * When share in units: Total Units x 1 Unit * From Liability Our Share and Share From 100% in Share condition. (From signed share, from written share if no signed share and from offered share if no written or signed share). _Validations:_ If unlimited, Liability 100% is disabled _Mandatory:_ No _Functional Impact:_ * Other limit values * Claims Accounting * Automatic Protection Assignment * Insured Peril Cession * Reinsurance Program * Protection Program |

| Liability Our Share | If share is expressed in units, liability for 1 unit multiplied with your number of units (your share). To compare with share in percent, let us say Liability 100% is 1.000. Share From 100% is 10%, and Liability Our Share is then 100. .The equivalent if placed in units will be Liability Total Units (20) is 1.000, Liability 1 Unit is 50. Share From 100% is 2 units, and Liability Our Share 2 Units is 100. Values: Amounts Number of decimal places: 0 Calculations: If Share is expressed in units: Liability 100% x Share From 100% (units) /Total Units. (From signed share, from written share if no signed share and from offered share if no written or signed share). Validations: If unlimited, Liability Our Share is disabled. Mandatory: No Functional Impact: Other limit figures. |

| Liability Type | Values that further specify the liability. Values:EML (Estimated Maximum Loss) PML (Possible Maximum Loss) MPL (Maximum Possible Loss) Sum insured Your company might have defined additional Liability Types. Mandatory: No Functional impact: None |

| Liability Unlimited | Liability has no upper limit Values: Yes/ No Default: No Mandatory: Yes Functional Impact: * Other limit figures * Claim Accounting * Reinsurance Program * Protection Program |

| Comment (all) | Free-text field regarding the limit on the same row Values: Text Maximum number of characters: 30 Mandatory: No Functional Impact: None |

| 1Unit 100% | Liability for one unit Values: Amounts Number of decimal places: 0 Calculations: Liability 100% / Total Units. Mandatory: No Functional Impact: Other limit condition values |

| Cession Limit | Maximum amount per ceding exposure. You can agree on a maximum amount for ceding exposure to a certain peril, e.g. earthquake. Values: Amounts Number of decimal places: 0 Calculations: Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Liability 100% and Liability Our Share. Mandatory: No Functional Impact: None. |

| Event Limit | Maximum liability per event. Agreed maximum liability in the case of an event, e.g. earthquake. Values: Amounts Number of decimal places: 0 Calculations: Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Liability 100% and Liability Our Share. Validations: If unlimited, Event Limit 100% and Our Share are disabled Mandatory: No Functional Impact: Claims Accounting |

| Underlying Top Limit | Top amount of the preceding surplus treaty.For example, the top limit of 1stsurplus treaty becomes the underlying top limit of the 2nd surplus. Values: Amounts Number of decimal places: 0 Calculations: Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Liability 100% and Liability Our Share. Mandatory: No Functional Impact: * Reinsurance Program * Protection Program |

Maintain Proportional Treaty Premiums #

Record or update cedent’s estimated premiums for contracts where received premium will be a proportionate part of the actual premium.

- Click the Limit and Premium condition button in Navigation bar.

- Select Edit from the Menu button on the Main tab.

- Enter EPI in the Premiums part on the Main tab.

- Click OK.

| Field | Description |

|---|---|

| Indicator | Indicates what the premium is made of. Values: Customised by your company, for example: Gross- Premium reduced by returns and cancellations. Gross Net - Premium is reduced by returns, cancellation and premium ceded Net - Premium is reduced by returns, cancellations, premium ceded and deductions profit commissions. Mandatory: No Functional Impact: None |

| EPI Period 100% | Estimated premium income for the period informed by the cedent at underwriting stage. Values: Number of decimal places: 2 Calculations: From EPI Period Our Share and Share From 100% in Share condition. (From signed share, from written share if no signed share and from offered share if no written or signed share).From Net EPI and deductions in Deduction condition. Mandatory: No Functional Impact: Other premium figures |

| EPI Period Our Share | Reinsurer’s share of EPI Period 100% Values: Number of decimal places: 2 Calculations: From EPI Period 100% and Share From 100% in Share condition (From signed share, from written share if no signed share and from offered share if no written or signed share). Mandatory: No Functional Impact: Other premium figures |

| Net EPI Period | Estimated premium income 100% net of deductions. Values: Number of decimal places: 2 Calculations: From EPI Period 100% and deductions in Deduction condition. Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to EPI Period 100% and EPI Period Our Share. Mandatory: No Functional Impact: Other premium figures. |

| Revised EPI Period | Up-dated Estimated Premium Income. Values: Number of decimal places: 2 Calculations: Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Liability 100% and Liability Our Share. Mandatory: No Functional Impact: Other premium figures |

Maintain Classification Distribution for EPI #

Record the real distribution of classifications based on the underlying polices of the treaty. The Estimated Premium Income for this proportional treaty is then assumed to have the same distribution. This table of distribution is only available for Outward Cedent’s Contract and is only for information.

To attach an already imported EPID (Estimated Premium Income Distribution) table:

- From the Main tab, click the Premium Table menu-button.

- Select the Attach Table option. This brings you to the Find Lookup Table window.

- From the Find Lookup Table window, select an EPID Table. Table Type Estimated Premium Income Distribution is the only available table type.

- Click OK.

| Field | Description |

|---|---|

| Table Type | Finds tables by where they may be used and for what purpose. Values: Estimated Premium Income Distribution. Mandatory: Yes |

| Table Name | The name of the table you want to find Values: Free Text Mandatory: No |

| Currency | Only available for Life. |

| Amount Type | The financial measure of the table(s) for which you are searching. Values: * Fixed Monetary Amount Percent * None: Searches on all _Mandatory: No_ |

| Created by User | Finds tables created by the name of this person Values: Users set up by your system administrator. Mandatory: No |

| Status | Searches on the status of the tables Values: - Active: Searches only on tables that may be attached to a business - Inactive: Searches only on tables that may already be attached but may not be attached to new business. - All: Finds both active and inactive tables Default: All Mandatory: Yes |

| Table Source | Finds tables by the method in which they were entered into SICS. Values: Imported_ _Mandatory: Yes_ |

To import an EPID Table:

- Select the Import Table option from the Premium Table menu. This brings you to the Import Lookup Table wizard.

- Select the file you want to import.

- Enter Lookup Table Properties.

- Complete the Import Lookup Table wizard and press Finish.

To view an EPID Table:

- Select the View Table option from the Premium Table menu.

- Find Lookup Table window

- The system opens the View Lookup Table window.

- Click the Display button to see the table details.

To detach an EPID Table:

- Select the Detach Table option from the Premium Table menu.

- Click OK.

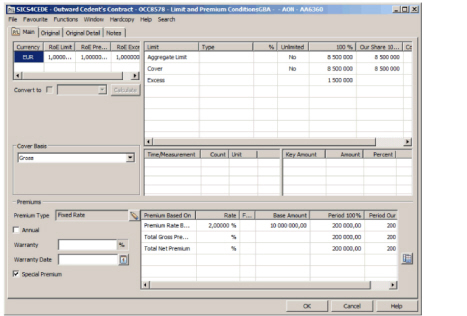

Maintain Non-Proportional Treaty Limits and Premiums #

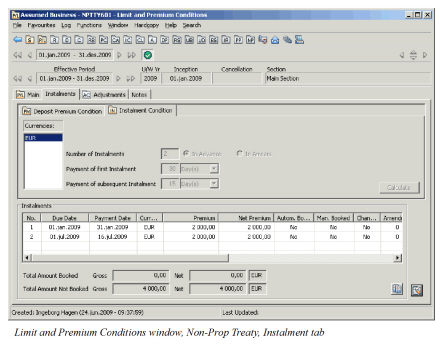

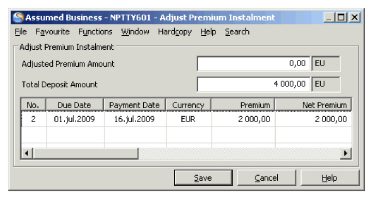

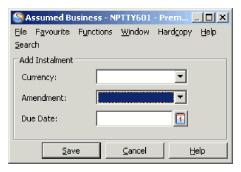

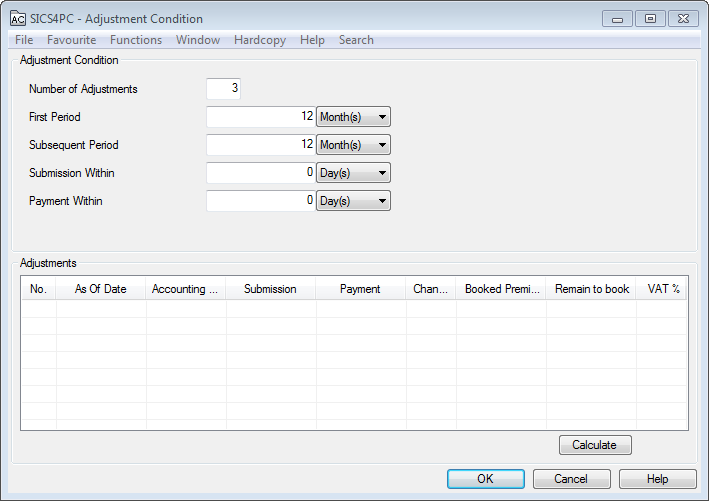

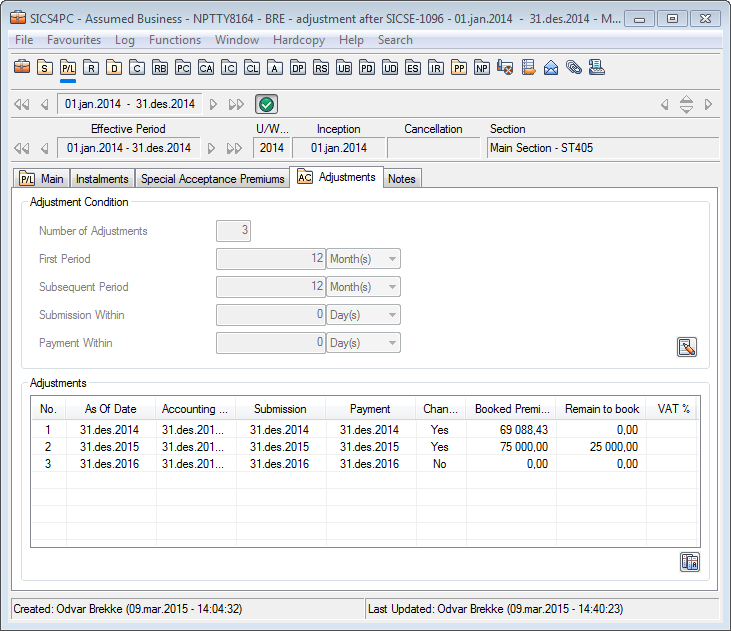

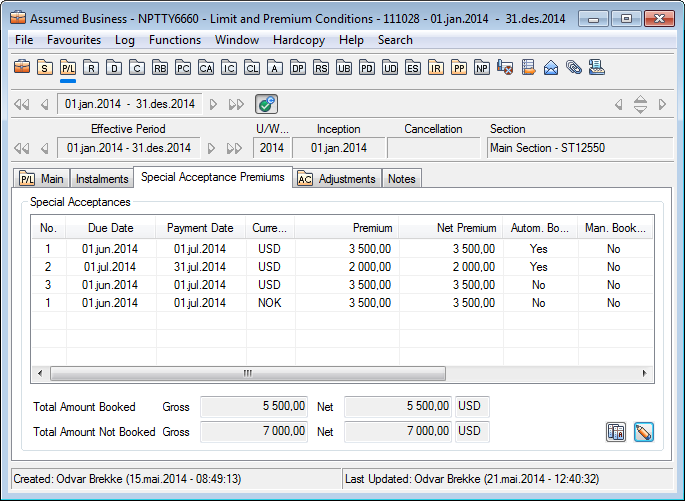

In SICS you may keep comprehensive limit and premium terms of contracts, where the reinsurers automatically share losses not being a proportionate part to their share of the original premium. It is essential to keep complete records of these terms as you then may benefit from several linked automatic functions, e.g. split of premium deposits in different currencies, calculation of premium instalment payment schedule, calculation and booking of premium adjustments.

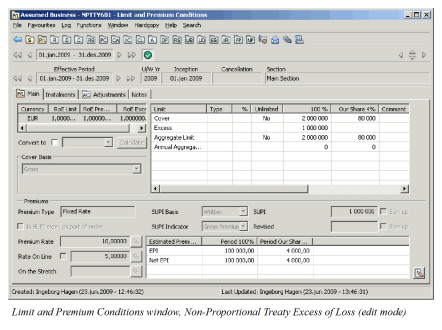

Maintain Excess of Loss Limits #

Record liabilities of treaties where the reinsurer assumes losses above a pre-agreed limit (Excess).

- Click the Limit and Premium condition button in Navigation bar.

- Select Edit from the Menu button on the Main tab.

- Enter limit figures on the Main tab.

- Click OK.

| Field | Description |

|---|---|

| Cover Type | An indication of what limit the cover amount express. Values: -EML (Estimated Maximum Loss) PML (Possible Maximum Loss) MPL (Maximum Possible Loss) Sum insured Top Loss Probability - indicates that cover is a combined limit Top Sum Insured' - indicates that cover is a combined limit Your company might have defined additional Cover Types. Mandatory: No Functional Impact: Non-Proportional Recovery Calculation |

| Cover 100% | Maximum liability per risk if this is a per risk treaty and per event if this is a per event treaty. It is considered the main limit of an excess of loss treaty. Values: Amount Number of decimal places: 0 Calculations: From Cover Our Share and Share From 100% in Share condition. (From signed share, from written share if no signed share and from offered share if no written or signed share). Validations: * Disabled when Cover is unlimited. * Must be entered if Excess 100% is defined. _Mandatory:_ No _Functional Impact:_-Premium condition values (e.g. Rate On Line) * Claims Accounting * Non-Proportional Recovery Calculation * Automatic Reinstatement Premium Calculations * Insured Peril Cession * Reinsurance Program * Protection Program * Automatic Protection Assignment * Other limit condition values |

| Cover Our Share | Reinsurer’s share of cover 100% Values: Amount Number of decimal places: 0 Calculations: From Cover 100% and Share From 100% in Share condition. (From signed share, from written share if no signed share and from offered share if no written or signed share). Validations: Disabled when cover is unlimited. Mandatory: No Functional Impact: Other limit conditions values. |

| Cover Unlimited | No limitation of liability per risk if this is a per risk treaty and per event if this is a per event treaty Values: Yes/ No Default: No Mandatory: Yes Functional Impact: * Claims Accounting * Non-Proportional Recovery Calculation * Reinsurance Program * Protection Program * Other limit condition values |

| Comment (all) | Additional information regarding the limit on the same row Values: Free-text. Maximum number of characters: 30 Mandatory: No Functional Impact: None |

| Excess 100% | The amount above which the from ground-up loss have to reach before the cover comes into effect. Values: Amount Number of decimal places: 0 Validations: Must be entered if Cover 100% is defined Mandatory: No Functional Impact: * Claims Accounting * Non-Proportional Recovery Calculation * Reinsurance Program * Protection Program * Automatic Protection Assignment * Other limit conditions values |

| Aggregate Limit | Total maximum liability for the period. Values: Amount Number of decimal places: 0 Calculations: Cover 100% + Cover 100% x Number of Reinstatements.If no reinstatements, Aggregate Limit 100% and Cover 100% are the same amount.Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Cover 100% and Cover Our Share. Validations: Disabled if Cover or Reinstatements are unlimited. Mandatory: No Functional Impact: * Claims Accounting * Insured Peril Cession * Non-Proportional Recovery Calculation * Other limit conditions values |

| Aggregate Limit Unlimited | No upper limit for liability for the period. Values: Yes/ No Default: No Validations: Will always be the same as for Cover.Indication cannot be changed for Aggregate Limit (only Cover) Mandatory: Yes Functional Impact: * Claims Accounting * Non-Proportional Recovery Calculation * Other limit conditions values |

| Aggregate Limit Type | Specifics regarding agreed aggregate limit. Values: Combined Aggregate Limit - The maximum recoverable for all sections, regardless of their individual maximum. Mandatory: No Functional Impact: Non-Proportional Recovery Calculation, and if your System Administrator has activated functionality Assumed Reinstatement Calculation, claim worksheet validation |

| Annual Aggregate Deductible (AAD) | Amount a cedent during a year must bear of losses, otherwise recoverable, before the protection comes into effect. Values: Amount Number of decimal places: 0 Calculations: Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Cover 100% and Cover Our Share. Validations: Only available for input when Annual Aggregate Deducible Type is None, Combined, or blank Mandatory: No Functional Impact: * Claims Accounting * Non-Proportional Recovery Calculation |

| Annual Aggregate Deductible (AAD) Type | Indicates what annual aggregate deducible is expressed as. Values:None - You enter a specific amount. This is the amount the cedent has to retain during a year. Of Loss- You enter a percentage. This percentage should be deducted from any loss that is recoverable on this treaty. The remaining loss amount will be recovered on the treaty. Of SUPI- You enter a percentage. The amount calculated from this percentage and SUPI, is the annual deductible amount Combined- An indication that the AAD entered is valid for current section, and all child sections. When selected the AAD limit is displayed in blue on “parent” section. Mandatory: No Functional Impact: * Claims Accounting * Other limit condition values |

| Annual Aggregate Deductible (AAD) % | Percent used in calculation of the deductible amount when annual aggregate deducible is expressed as percent of loss or of subject premium income. Values: * Percent * Maximum percentage: 999,00 * Number of decimal places: 2 _Validations:_ Available only when Type is _Of Loss_ or _Of SUPI_ _Mandatory:_ No _Functional Impact:_ Claims Accounting |

| Per Event Cover | Maximum limit for a single event, e.g. earthquake. Values: Amount Number of decimal places: 0 Calculations: Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Cover 100% and Cover Our Share Validations: If unlimited, Per Event Cover 100% and Our Share are disabled Mandatory: No Functional Impact: * Claims Accounting * Non-Proportional Recovery Calculation |

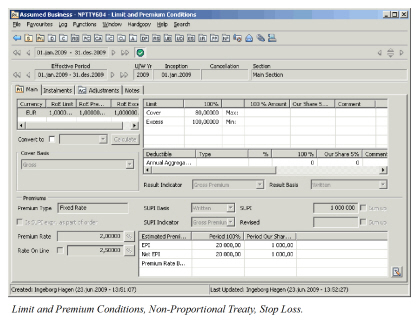

Maintain Stop Loss Limits #

To record or update liability terms of an aggregate excess of loss reinsurance:

- Open your business and click the Limit and Premium condition (P/L) button.

- If needed, select Edit from the Menu button in Limit and Premium condition on the Main tab. In the limit display list, enter your excess and cover percentages in the 100% column.

- Indicate what the percentages are of by selecting appropriate Result Indicator.

- If relevant, enter other limit and deductibles on the Main tab.

- Click OK.

| Field | Description |

|---|---|

| Result Indicator | Indicates how to calculate the premium basis used in calculation of limits. Values: * Gross Net Premium * Gross Premium * Net Net Premium * Net Premium * None - unspecified _Default:_ None _Mandatory:_ No _Functional Impact:_ None |

| Result Basis | Indication on which terms premium basis used in calculation of limits are calculated _Values: * Accounted * Earned * Written _Default:_ None _Mandatory:_ No _Functional Impact:_ None |

| Cover % | Maximum liability expressed as a percent of the cedent’s retained income (e.g. SUPI). Values: * Percent (Entered in the ‘100%’ column) * Minimum value: 0 * Maximum value: 99.999,99999 * Number of decimal places: 5 _Validations:_ If unlimited, Cover 100% is disabled _Mandatory:_ No _Functional Impact:_ * Claims Accounting * Premium conditions values (e.g. rate on line) |

| Cover 100% Amount | A maximum amount as a further limitation to the cover. SUPI may change during the insured period, but the cover cannot exceed the agreed maximum. Values: * Amount (entered in the ‘100% Amount’ column) * Minimum value: 0 * Number of decimal places: 0 _Calculation:_ From Cover Our Share Amount and Share From 100% in Share condition. (From signed share, from written share if no signed share and from offered share if no written or signed share). _Mandatory:_ No _Functional Impact:_ Claims Accounting |

| Cover Our Share Amount | Reinsurer’s share of cover for 100% Values: * Amount * Minimum value: 0 * Number of decimal places: 0 _Calculation:_ From Cover 100% Amount and Share from 100% in Share condition. (From signed share, from written share if no signed share and from offered share if no written or signed share). _Mandatory:_ No _Functional Impact:_ Other limit condition values |

| Comment (all) | Additional information regarding the limit on the same row Values: * Free-text. * Maximum number of characters: 30 _Mandatory:_ No _Functional Impact:_ None |

| Excess % | Starting point of the cover expressed as a percentage of cedent’s retained income (SUPI). Values: * Percent (entered in the ‘100%’ column) * Minimum value: 0 * Maximum value: 99.999,99999 * Number of decimal places: 5 _Mandatory:_ No _Functional Impact:_ Claims Accounting |

| Excess 100% Amount | A minimum amount as a further limitation to the excess. SUPI may change during the insured period, but the excess point cannot be less than the agreed minimum. Values: * Amount (Amount (entered in the ‘100% Amount’ column) * Minimum value: 0 * Number of decimal places: 0 _Mandatory:_ No _Functional Impact:_ Claims Accounting |

Maintain Classification Distribution for Loss Recovery #

Record the distribution of classifications based on the real losses of the treaty. This is to be used for loss recovery calculations. This table of distribution is only available for Outward Cedent’s Contract.

To attach an already imported SLD (Stop Loss Distribution) table:

- From the Main tab, click the Loss Table menu-button.

- Select the Attach Table option. This brings you to the Find Lookup Table window.

- From the Find Lookup Table window, select an SLD Table. Table Type Stop Loss Distribution is the only available table type.

- Click OK.

| Field | Description |

|---|---|

| Table Type | Finds tables by where they may be used and for what purpose. Values: Stop Loss Distribution Mandatory: Yes |

| Table Name | The name of the table you want to find Values: Free Text Mandatory: No |

| Currency | Only available for Life. |

| Amount Type | The financial measure of the table(s) for which you are searching. Values: Fixed Monetary Amount |

| Percent * None: Searches on all _Mandatory: No_ |

|

| Created by User | Finds tables created by the name of this person Values: Users set up by your system administrator. Mandatory: No |

| Status | Searches on the status of the tables Values: - Active: Searches only on tables that may be attached to a business - Inactive: Searches only on tables that may already be attached but may not be attached to new business. - All: Finds both active and inactive tables Default: All Mandatory: Yes |

| Table Source | Finds tables by the method in which they were entered into SICS. Values: Imported Mandatory: Yes |

To import an SLD Table:

- Select the Import Table option from the Loss Table menu. This brings you to the Import Lookup Table wizard.

- Select the file you want to import.

- Enter Lookup Table Properties.

- Complete the Import Lookup Table wizard and press Finish.

To view an SLD Table:

- Select the View Table option from the Loss Table menu.

- The system opens the View Lookup Table window.

- Click the Display button to see the table details.

To detach an SLD Table:

- Select the Detach Table option from the Loss Table menu.

- Click OK.

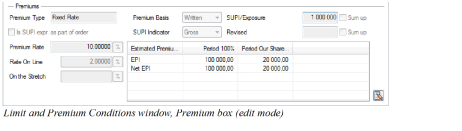

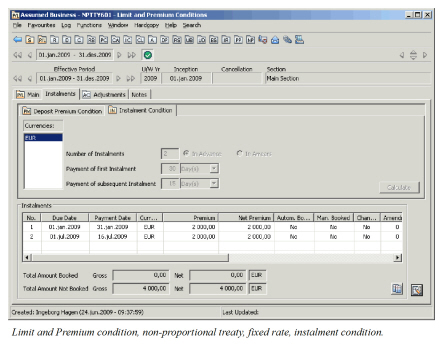

Maintain Fixed Rate Premiums #

For a non-proportional treaty, enter conditions for premiums to be based on a fixed rate of actual premium. These are called SUPI (Subject Premium Income).

Enter Premium Rate and Basis

To capture the agreed premium rate and related information:

- Open your business and click the Limit and Premium condition (P/L) button.

- If required, select Edit from the Menu button in Limit and Premium condition on the_Main_ tab.

- If needed, click the Edit button for the Premium Type.

- Select Premium Type Fixed Rate.

- Click Save.

- Select Premium Basis.

- Select SUPI Indicator.

- Enter SUPI/Exposure amount.

- Enter Premium Rate.

- Select OK.

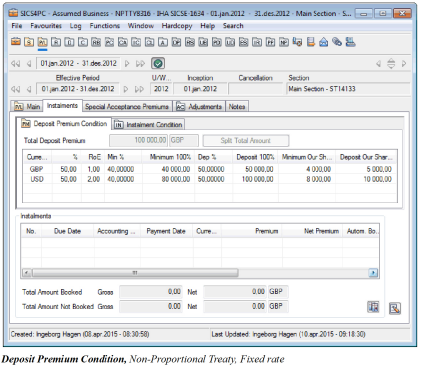

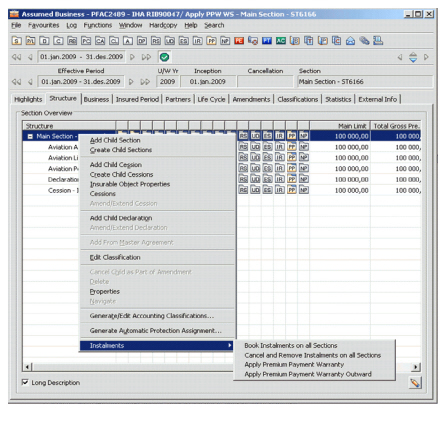

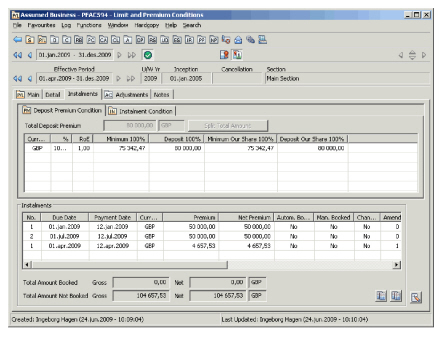

Enter Minimum and Deposit Premiums

Enter Minimum and Deposit Premiums

To capture the agreed minimum and/or deposit premium:

- Open your business and click the Limit and Premium Conditions (P/L) button.

- Click the Instalments tab.

- If needed, select Edit from the Menu button in the Deposit Premium Condition sub tab.

- Enter the Minimum and Deposit premium figures, as an amount or as a percentage.

- Click OK.

Deposit premiums are normally paid in instalments. Refer to Maintain Premium Instalment Conditions on page 6-188 for more information.

Enter Minimum and Deposit Premiums in More than One Currency

Enter the amounts for each currency if the minimum and deposit premiums have been agreed in more than one currency.

Note! These are NOT the same premium amount represented in different currencies, but individual amounts which all have to be paid.

- Open your business and click the Limit and Premium Conditions (P/L) button.

- Select the Instalments tab.

- If needed, select Edit from the Menu button in the Deposit Premium Condition sub tab.

- On the row showing the currency you require, type in the belonging premiums in the Minimum and/or the Deposit column or the Min% and/or the Dep%. Repeat this for as many currencies as your agreement requires. For how to add a new currency, refer to Add New Currency.

- Click OK.

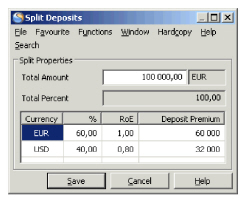

Split Minimum and Deposit Premiums in More than One Currency Automatically

Split Minimum and Deposit Premiums in More than One Currency Automatically

Use the Split Total Amount functionality to distribute the total M&D premium in main currency amount across the given currencies.

- Open your business and click the Limit and Premium condition (P/L) button.

- Click the Instalments tab.

- If needed, select Edit from the Menu button on the Deposit Premium Condition sub tab.

- Click the Split Total Amount button (only available when more than one currency exists.). You see the Split Deposits window.

5. Enter the total amount (in main currency).

6. In the % column, enter the percentage of Total Amount for each currency.

7. Click Save.

8. Click OK

5. Enter the total amount (in main currency).

6. In the % column, enter the percentage of Total Amount for each currency.

7. Click Save.

8. Click OK

Maintain Classification Distribution for Premiums

For more information, please see the Automatic Premium Accounting chapter.

| Field | Description |

|---|---|

| Premium Type | Indicates how the final premium will be calculated Values: Fixed Rate * Sliding Rate * Sliding Amount * Flat Premium * Permissible L/R (Retrospective) _Default:_ Fixed Rate _Mandatory:_ Yes _Functional Impact:_ Other premium condition values * Automatic Premium Adjustment Calculation |

| Is SUPI expr. As part of Order | Whether the estimated subject premium income represents something else than 100%, e.g. an agent’s order. Values: Yes - SUPI represent something else than 100%. EPI Our Share will be calculated using reinsurer’s share from an order No - SUPI represent 100%. Premium is calculated using reinsurer’s share from 100%. Default: No Mandatory: Yes Functional Impact: * Other premium condition figures * Underwriter’s Estimate * Business Highlights * Section Overview * On-Line Statistics * Automatic Premium Adjustment Calculation |

| Premium Basis | Indication on which terms SUPI is calculated. Values: Customised by your company, for example: Earned , Written, Accounted, Limits in Force, Total Insured Value, PML, Sum At Risk Mandatory: No Functional Impact: None |

| SUPI Indicator | Indicates what SUPI is made up of. Values: Customised by your company, for example:Gross - premium reduced by returns and cancellations Gross Net - premium reduced by returns, cancellations and premium ceded Net - premium reduced by returns, cancellations, premium ceded deductions and profit commissions. Mandatory: No Functional Impact: None |

| SUPI/Exposure | Subject Premium Income or Exposure. Expected premium income for the underlying businesses covered by this non-proportional treaty. The estimate is advised by the cedent at underwriting stage. Values: Amount * Minimum Value: 0 * Number of decimal places: 0 _Mandatory:_ No _Functional Impact:_ * Other premium values * Stop Loss Claims Accounting |

| Revised SUPI | An estimate from the cedent of the final subject premium income made at a later stage than the initial estimated SUPI. Values: Amount * Minimum value: 0 * Number of decimal places: 0 _Mandatory:_ No _Functional Impact:_ Stop Loss Claims Accounting |

| Premium Rate | The portion of the actual subject premium income that has been agreed to be the premium for the cover. Values: Minimum value: 0 * Number of decimal places: 5 _Calculation:-_ If no value entered manually: (EPI / SUPI) x 100 - Later changes in EPI and SUPI will not recalculate Premium Rate - The Premium Rate Factor Type decides the devisor used when calculating the premiums, e.g. (SUPI/1000) x Rate if factor is pm (rate expressed in per mille) - If the rate is already saved, changing the Premium Rate Factor type changes the rate decimals accordingly _Mandatory:_ No _Functional Impact:_ * Other premium values * Automatic Premium Adjustment Calculation |

| Premium Rate Factor Type | Button representing the factor type used when expressing the rate and in calculations. Values: % pm (per mille) pmn (per million) Default: % (percent) Validation: For Factor Type pmn, Premium Type must be Fixed Rate and Type of Business must be Non-Proportional Treaty. Mandatory: Yes Functional Impact: * Premium Rate * Other premium values * Automatic Premium Adjustment Calculation |

| Rate on Line (RoL) | A comparison rate that shows how much premium (EPI) is expected in comparison with the cover. Values: Number of decimal places: 5 Calculations: (EPI / Cover) x 100 If RoL is manually overridden, the indicator next to the field is automatically selected. If you clear the indicator, SICS calculates RoL. Mandatory: No Functional Impact: None |

| On the Stretch | A comparison rate that shows how much premium (EPI + reinstatement premium) is expected in comparison with the total cover (cover x number of reinstatements) given. Values: Number of decimal places: 5 Calculations: Depends on what is defined in reinstatement conditions. Refer to Calculation of Rate on Line on the Stretch, Examples Validations: Not calculated if reinstatements are unlimited, or when type of participation is stop loss (stop loss treaties have no Reinstatement condition). Mandatory: No Functional Impact: None |

| EPI Period 100%: | Estimated premium income for the period informed by the cedent at underwriting stage. Values: Number of decimal places: 2 Calculations: SUPI x Premium Rate /100 Premium Rate Factor Type default is % and above formula is default When factor type is per mille, then: SUPI x Premium Rate / 1.000 When factor type is per million, then: SUPI x Premium Rate / 1.000.000 If less than Minimum 100%, then set equal to Minimum 100% From EPI Period Our Share and Share From 100% in Share conditions. (From signed share, from written share if no signed share and from offered share if no written or signed share). If Is SUPI expr. as Part of Order selected, EPI calculated from EPI Period Our Share and Share From Order (in share conditions. If no Share from Order, then Share From Net of Gross and if no Share from Net of Gross, then Share from 100%). May be manually overwritten Mandatory: No Functional Impact: Other premium values |

| EPI Period Our Share | Reinsurer’s share of EPI 100% Values: Number of decimal places: 2 Calculations: EPI Period 100% x Share From 100% in share condition / 100 (From signed share, from written share if no signed share and from offered share if no written or signed share).If Is SUPI expr. as Part of Order selected: EPI Period 100% x Share From Order in share conditions / 100 (If Share from Order does not exist, then Share from Gross of Net and if this does not exist, then Share from 100%.) Mandatory: No Functional Impact: Other premium figures |

| Net EPI Period | Estimated premium income net of deductions. Values: Number of decimal places: 2 Calculations: From EPI Period 100% and deductions in Deduction Conditions. Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to EPI Period 100% and EPI Period Our Share. Mandatory: No Functional Impact: Other premium values. |

| Total Deposit Premium | Sum of premium entered in Deposit 100% column, expressed in main currency. Values: Number of decimal places: 2 * Minimum value: 0 _Calculations:_ From Deposit 100%. If multiple currencies, amounts entered in Deposit 100% are converted to main currency using fixed RoE entered in the Currency table. _Mandatory:_ No _Functional Impact:_ Other premium values |

| %: | Portion of Total Deposit Premium per currency. Values: Maximum value: 100% * Minimum value: 0 * Number of Decimals: 2 _Default:_ 0,00 _Calculations:_ From Total Deposit Premium in main currency, fixed RoE Premium in Currency table and Deposit Premium 100% in same currency. Can only be manually entered if using _Split Total Amount_ option. _Validations:_ Sum of % must be 100 _Mandatory:_ Yes _Functional Impact:_ Other premium values. |

| Min % | Minimum percent. The lowest premium the cedent must pay for this reinsurance, expressed as a percent of SUPI x Premium Rate Values: Minimum value: 0,00000 Maximum value: 999,99999 Number of decimals: 5 Validations: Warning when above 100 Calculations: Minimum 100% amount x 100 / SUPI x Premium Rate Mandatory: No Functional Impact: Other premium figures |

| Minimum 100% | The lowest premium the cedent must pay for this reinsurance. (The accumulated actual premium the cedent pays should never go below this amount.) Values: Number of decimal places: 2 * Minimum value: 0 _Calculations:_ If Min % exists: SUPI x Premium Rate x Min % / 100 x 100. From Minimum Our Share and Share From 100% in the Share Conditions. (From signed share, from written share if no signed share and from offered share if no written or signed share). If Is SUPI expressed as Part of Order selected: Minimum 100% calculated from Minimum Our Share and Share From Order (in share conditions). If no Share from Order, then Share From Net of Gross and if no Share from Net of Gross, then Share from 100%. _Mandatory:_ No _Functional Impact:_ Other premium values * Automatic Premium Adjustment Calculation |

| Minimum Our Share | Our share of Minimum 100% Values: Number of decimal places: 2 * Minimum value: 0 _Calculations:_ Minimum 100% x Share From 100% in share conditions / 100%. (From signed share, from written share if no signed share and from offered share if no written or signed share). If Is SUPI expressed as Part of Order selected: Minimum 100% x Share From Order in share conditions. (If Share from Order does not exist, then Share from Gross of Net and if this does not exist, then Share from 100%.) _Mandatory:_ No _Functional Impact:_ Other premium figures |

| Dep % | Deposit percent. The premium the cedent will pay in advance for this reinsurance, expressed as a percent of SUPI x Premium Rate Values: Minimum value: 0,00000 Maximum value: 999,99999 Number of decimals: 5 Validations: Warning when above 100. Calculations: Deposit 100% amount x 100 / SUPI x Premium Rate Mandatory: No Functional Impact: Other premium figures |

| Deposit | Premium that the cedent will pay in advance. Values: Number of decimal places: 2 * Minimum value: 0 _Calculations:_ If multiple currencies: from Total Deposit Amount, % (split) and fixed RoE.If Dep % exists: SUPI x Premium Rate x Dep % / 100 x 100. From Deposit Our Share and Share From 100% in the Share Conditions. (From signed share, from written share if no signed share and from offered share if no written or signed share). If Is SUPI expressed as Part of Order selected: Deposit 100% calculated from Deposit Our Share and Share From Order (in share conditions). If no Share from Order, then Share From Net of Gross and if noShare from Net of Gross, then Share from 100%. _Mandatory:_ No _Functional Impact:_ Other premium values * Premium instalments conditions * Automatic Premium Adjustment Calculation |

| Total Amount | Deposit premium for all currencies expressed in main currency, (used in the Split Total Amount per currency option). Values: Minimum value: 0 * Number of decimal places: 2 _Default:_ Currency field: Main currency of business _Mandatory:_ No _Functional Impact:_ Other premium values |

| Total Percent | Percent showing how much of the Total Amount is distributed to currencies (used in the Split Total Amount per currency option). Values: Minimum percentage: 0 * Maximum percentage: 100 * Number of decimal places: 2 _Default:_ 0,00 _Calculations:_ Sum of percentage for each currency _Validations:_ Must be 100% to be able to save. _Mandatory:_ Yes _Functional Impact:_ None |

EXAMPLES - Rate on Line on the Stretch

Calculations of Rate on Line on the Stretch depend on Payment Rule, Amount % and Time % of the reinstatement conditions. For more information, refer to the_Maintain Reinstatement Conditions_ section.

When you want to calculate the Rate on Line on the Stretch and the premium type is flat premium, SICS uses the same formulas as when calculating fixed rate. The only difference is that when the premium is flat, SICS uses Total Flat Premium instead of EPI.

**Example 1

Reinstatements are Pro Rata Amount.

EPI + (EPI x Total Reinstatement Amount %)Cover + (Cover x Reinst. No)

**Example 1a

** Layer: 1.000.000 xs 1.000.000

EPI: 100.000

2 reinstatements: 1st 100% Amount, 2nd 50% Amount

100.000 + (100000 x 150%) = 8,33333%

1.000.000 + (1.000.000 x 2)

Example 1b

** 2 reinstatements: Free

100.000 + (100.000 x 0%)= 3,33333%

1.000.000 + (1.000.000 x 2)

**Example 2

Reinstatements are Pro Rata Time.

** When reinstatements are calculated Pro Rata to Time, we assume that all losses happen mid period (182,5/ 365)

EPI + (EPI x Total Reinstatement Time %) x 182,5/365Cover + (Cover x Reinst. No)

Example 2a

** Layer: 1.000.000 xs 1.000.000

EPI: 100.000

2 reinstatements: 1st 100% Time, 2nd 50% Time

100.000 + (100.000 x 150%) x 182,5/365 = 5,83333%

1.000.000 + (1.000.000 x 2)

Example 3

** Reinstatements are Pro Rata Amount and Time without extra % for Time.

EPI + (EPI x Total Reinst. Amount %) x 182,5/365Cover + (Cover x No of Reinst.)

**Example 3a

** Layer: 1.000.000 xs 1.000.000

EPI: 100.000

2 reinstatements: 100% Amount

100.000 + (100.000 x 200%) 182,5/365= 6,66667%

1.000.000 + (1.000.000 x 2)

**Example 4

** Reinstatements are Pro Rata Amount and Time, with extra % for Time.

EPI + (EPI x Total reinst. Amount %) x Average Time % Cover + (Cover x No of Reinst.)

Example 4a

** Layer: 1.000.000 xs 1.000.000

EPI: 100.000

2 reinstatements: 100% Amount, 1st 100% and 2nd 75% Time

100.000 + (100.000 x 200%) x 87,5%= 9,16667%

1.000.000 + (1.000.000 x 2)

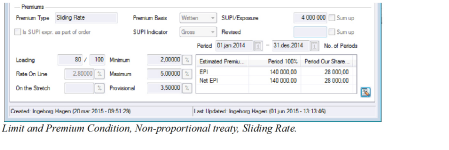

Maintain Sliding Rate Premium #

Record Premium Type Sliding Rate, when premium is calculated from a rate determined by the loss amount multiplied with a loading factor.

The reinsurance parties agree on a Minimum, a Maximum and a Provisional Premium Rate.

To enter Premium Rates and Basis:

- Click the Limit and Premium condition button in Navigation bar.

- Select Edit from the Menu button on the Main tab.

- If needed, click the Edit button for the premium type

- Select premium type Sliding Rate.

- Click Save

Select a Premium Basis. - Select a SUPI Indicator.

- Enter a SUPI/Exposure amount.

- Enter a Loading factor.

- Enter a Minimum Rate.

- Enter a Maximum Rate.

- Enter a Provisional Rate.

- Click Save.

Enter Minimum and Deposit Premium

| Field | Description |

|---|---|

| Loading | A factor to allow for cedent’s expenses and profit. The Loading factor reduces the Premium Rate (claims in percent of premium). Values: * Maximum value: 9.999.999 * Number of decimal places: 0 _Mandatory:_ No |

| Period | From and to dates for which the sliding premium rates and loading are valid. Values: Date fields Default: Same dates as insured period Mandatory: Yes |

| No. of Periods | Number of periods for which the sliding premium rates and loading are valid. Values: Minimum value: 0 * Number of decimal places: 0 _Default:_ 1 _Mandatory:_ Yes |

| Minimum Rate | Indicates minimum percentage/ per mill of SUPI cedent will have to pay as premium to reinsurers. Values: Percent or Per Mille * Number of decimal places: 5 _Validations:_ Must be less than Maximum Rate _Mandatory:_ No |

| Maximum Rate | Indicates maximum percentages/ per mill of SUPI cedent will have to pay as premium to reinsures. Values: Percent or Per Mill * Number of decimal places: 5 _Validations:_ Must be higher than Minimum Rate _Mandatory:_ No |

| Provisional Rate | Indicates the agreed percentage/ per mill of SUPI cedent has to pay reinsurers until the exact SUPI is known. Values: Percent or Per Mill * Number of decimal places: 5 _Mandatory:_ No |

| EPI Period 100% | Estimated Premium Income for the period. Values: Number of decimal places: 2 Calculations: SUPI x Provisional Rate / 100. If less than Minimum 100%, then set equal to Minimum 100% From EPI Period Our Share and Share From 100% in Share condition. (From signed share, from written share if no signed share and from offered share if no written or signed share). If Is SUPI expr. as Part of Order selected, EPI calculated from EPI Period Our Share and Share From Order (in share conditions. If no Share from Order, then Share From Net of Gross and if no Share from Net of Gross, then Share from 100%). Mandatory: No |

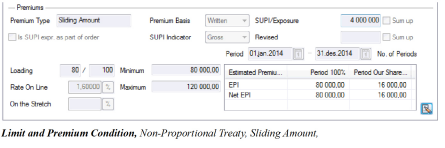

Maintain Sliding Amount Premium #

Record premium type Sliding Amount, when the reinsurance parties agree on a minimum and a maximum amount for the premium.

Enter Premium Amount Boundaries and Basis

- Click the Limit and Premium condition button in the Navigation bar.

- Select Edit from the Menu button on the Main tab.

- If needed, click the Edit button for the premium type

- Select premium type, Sliding Amount

- Click Save

Select a Premium Basis. - Select a SUPI Indicator.

- Enter a SUPI/Exposure amount.

- Enter a Loading factor.

- Enter a Minimum Amount.

- Enter a Maximum Amount.

- Click Save.

Enter Minimum and Deposit Premium

| Field | Description |

|---|---|

| Loading | A factor to allow for cedent’s expenses and profit. The Loading factor reduces the Premium Rate calculated as Claims in percent of Premium. Values: * Maximum value: 9.999.999 * Number of decimal places: 0 _Mandatory:_ No |

| Period | From and to dates for which the sliding premium rates and loading are valid. Values: Date fields Default: Same dates as insured period Mandatory: Yes |

| No. of Periods | Number of periods for which the sliding premium rates and loading are valid. Values: Minimum value: 0 * Number of decimal places: 0 _Default:_ 1 _Mandatory:_ Yes |

| Minimum | Indicates minimum amount the cedent will have to pay as premium to reinsurers. Minimum amount entered is copied to EPI 100% and Minimum 100% in Instalments Values: * Minimum value: 0 * Number of decimal places: 2 _Validations:_ If Minimum 100% is manually overridden, Minimum is up-dated with same amount _Mandatory:_ No |

| Maximum | Indicates maximum premium the cedent will have to pay as premium to reinsures. Values: Number of decimal places: 2 Mandatory: No |

| EPI Period 100% | Estimated Premium Income for the period. Values: Number of decimal places: 2 Calculations: From EPI Period Our Share and Share From 100% in share conditions. (From signed share, from written share if no signed share and from offered share if no written or signed share). If Is SUPI expr. as Part of Order selected, EPI calculated from EPI Period Our Share and Share From Order (in share conditions. If no Share from Order, then Share From Net of Gross and if no Share from Net of Gross, then Share from 100%). Validations: * Copied from Minimum * Cannot be less than Minimum 100% _Mandatory:_ No |

| Minimum 100% | Amount indicating the lowest premium the reinsured will have to pay (instalment and adjustment premium). Values: Number of decimal places: 2 * Minimum value: 0 _Calculations:_ From Minimum Our Share and Share From 100% in Share conditions. (From signed share, from written share if no signed share and from offered share if no written or signed share). If Is SUPI expr. as Part of Order selected, Minimum 100% calculated from Minimum Our Share and Share From Order (in share conditions). If no Share from Order, then Share From Net of Gross and if no Share from Net of Gross, then Share from 100%. _Default:_ Minimum amount _Mandatory:_ No |

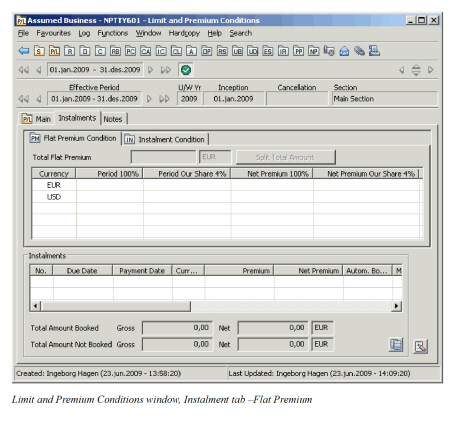

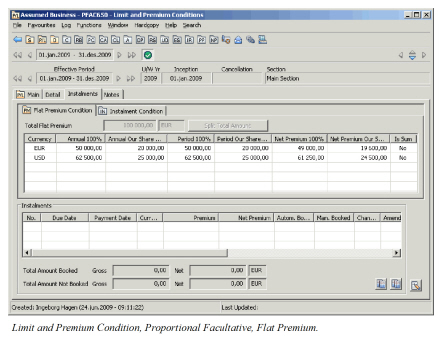

Maintain Flat Premium #

Record premium type Flat Rate Premium when a fixed premium amount is agreed on in advance and the premium amount will not be adjusted.

- Open your business and click the Limit and Premium condition (P/L) button in the Navigation bar

- If needed, select Edit from the Menu button in the Limit and Premium condition on the Main tab.

- If needed, click the Edit button for the Premium Type.

- Select Premium Type Flat Premium.

- Click Save

- If the Limit and Premium Conditions already had values before the above operation, you must now click OK.

- Click the Instalments Tab.

- Click the Flat Premium sub tab and if needed, select Edit from the Menu button.

- Enter the flat premium figure in the Period premium.

- Click OK.

For how to enter flat premium in more than on currency, refer to the Maintain Fixed Rate Premiums section.

| Field | Descriptions |

|---|---|

| Rate on Line | A comparison rate that shows how much Total Deposit Premium is in percent of Cover given.Refer to Rate on Line in Field Description for Fixed Rate Premium. Same principles will apply. Calculations: Flat Premium in percent of Cover. |

| On the Stretch | A comparison rate that shows how much premium is expected in comparison with the total cover. Refer to On the Stretch in Field Description for Fixed Rate Premium. Same principles will apply. |

| Total Deposit Premium | Premium entered in Period 100% column, expressed in main currency. Refer to Total Deposit Premium in Field Descriptions for Fixed Rate Premium. Same principles will apply. |

| Period 100% | Premium the reinsured must pay for this reinsurance Values: * Number of decimal places: 2 * Minimum value: 0 _Calculations:_ From Period Our Share and Share From 100% in share condition. (From signed share, from written share if no signed share and from offered share if no written or signed share). If Is SUPI expr. as Part of Order selected, Period 100% is calculated from Period Our Share and Share From Order (in share conditions). If no Share from Order, then Share From Net of Gross and if no Share from Net of Gross, then Share from 100%. _Mandatory:_ No |

| Period Our Share % | Our share of Period 100% Values: * Number of decimal places: 2 * Minimum value: 0 _Calculations:_ Period 100% x Share From 100% in share condition / 100. (From signed share, from written share if no signed share and from offered share if no written or signed share). If Is SUPI expr. as Part of Order selected: Period 100% x Share From Order in share conditions. (If Share from Order does not exist, then Share from Gross of Net and if this does not exist, then Share from 100%.) _Mandatory:_ No |

| Net Premium | Period 100% net of deductions in Deduction condition Values: * Number of decimal places: 2 * Minimum value: 0 _Calculations:_ From Period 100% and deductions in Deduction conditions. Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Period 100% and Period Our Share. _Mandatory:_ No |

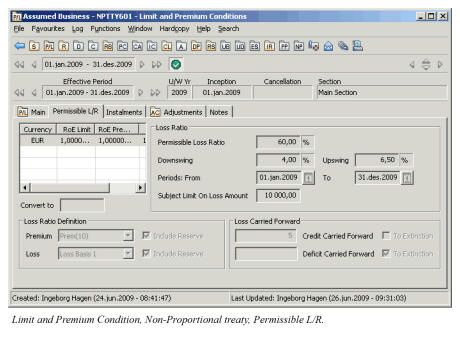

Maintain Permissible Loss Ratio Based Premium #

Record premium type Permissible Loss Ratio when the reinsurance parties have agreed on a loss percentage as the starting point for the reinsurance premium adjustment calculation.

When Permissible L/R you often refer to Initial Premium instead of EPI. In SICS we use the term EPI.

Enter Ratios and Basis

- Click the Limit and Premium condition button in the Navigation bar.

- Select Edit from the Menu button on the Main tab

- If needed, click the Edit button for the Premium Type

- Select Premium Type Permissible L/R (Retrospective).

- Click Save

- Select the Permissible L/R tab.

- Enter a Permissible Loss Ratio.

- Enter a Downswing.

- Enter an Upswing.

- Enter a Period From and To.

- Enter a Subject Limit on Loss Amount.

- Click OK.

For entering premium details on the Main tab, refer to the Maintain Fixed Rate Premiums section.

Enter Minimum and Deposit Premium

The field descriptions below will only give description of fields specific (or with specific validations) for Premium Type Permissible L/R. For the other fields, refer to the Maintain Fixed Rate Premiums section.

| Field | Description |

|---|---|

| Permissible Loss Ratio | Agreed loss percentage that will be the staring point for the reinsurance adjustment premium calculation Values: * Maximum percent: 999 * Minimum percent: 0 * Number of decimal places: 2 _Mandatory:_ No |

| Downswing | Downswing percent times EPI equals the maximum adjustment premium the reinsurer can owe. Values: * Maximum percent: 999 * Minimum percent: 0 * Number of decimal places: 2 _Mandatory:_ No |

| Upswing | Upswing percent times EPI equals the maximum adjustment the reinsured can owe. Values: * Maximum percent: 999 * Minimum percent: 0 * Number of decimal places: 2 _Mandatory:_ No |

| Period From/To | Period for which the loss ratio percentages are valid (period may be several insured periods) Values: Date field Mandatory: No |

| Subject Limit on Loss Amount | Any one occurrence plus pro rata share of claims expenses Values: Number of decimal places: 2 Mandatory: No |

| Premium | How to calculate premiums (gross/ net) that are used in calculation of loss ratio. Value is selected or not selected to indicate if premium reserves should be included in calculation. Values: Customised by your company. For example, Gross Premium Net Premium Mandatory: No |

| Loss | How to calculate losses that are used in calculation of Loss Ratio. Values is selected or not selected to indicate if Loss Reserves should be included in calculation. Values: Customised by your company Mandatory: No |

| Credit Carried Forward | When Downswing times EPI is less than Permissible Loss Ratio, the difference may become a Credit Carried Forward. Values: * Maximum number of years: 9999 * Minimum number of years: 0 _Validations:_ When To Extinction is selected, number of years is disabled. _Mandatory:_ No |

| Deficit Carried Forward | When the Upswing times EPI is higher than the maximum premium adjustment, the exceeding amount becomes a Deficit Carried Forward. Values: * Maximum number of Years: 9999 * Minimum number of Years: 0 _Validations:_ When _To Extinction_ is selected, the number of years is disabled. _Mandatory:_ No |

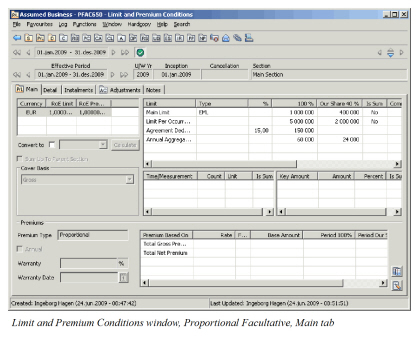

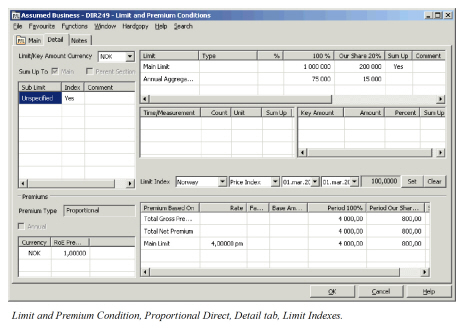

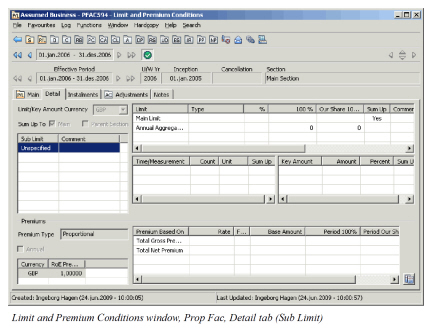

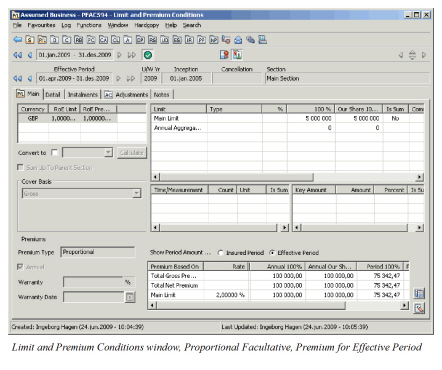

Maintain Proportional Facultative Limits and Premiums #

When your type of business is proportional facultative, limits and premiums available for input varies depending on main class of business, class of business and even sub class of business.

Limits can be entered as main limits and sub limits. In addition you can enter more details about the limits in display lists for:

- Time/ Measurement. Used to define contract limitations that are not monetary, e.g. Items and Indemnity Period

- Key Amounts. Used to display informational monetary or percentage limits, e.g. Payroll and Turnover

Maintain Proportional Facultative Limits #

To record liabilities of agreements, where the reinsured assumes a fixed percentage of the losses:

- Click the Limit and Premium condition button in the Navigation bar.

- Select Edit from the Menu button on the Main tab

- Enter limit figures on the Main tab.

- Click OK.

In the field descriptions below we only give examples of the most common limits. If e.g. the Type field is not described for a limit, we consider it most likely that this limit is not described further with a Type value. This is; however, user defined, and is therefore dependent of how your system is customised

| Field | Descriptions |

|---|---|

| Main Limit 100% | Maximum liability per underlying risks per insured period. Values: Number of decimal places: 0 * Minimum value: 0 _Calculations:_ From Main Limit Our Share and Share From 100% in Share condition. (From signed share, from written share if no signed share and from offered share if no written or signed share). _Mandatory:_ No |

| Main Limit Our Share | Our Share of Main Limit 100% Values: Number of decimal places: 0 * Minimum value: 0 _Calculations:_ From Main Limit 100% and Share From 100% in Share conditions (From signed share, from written share if no signed share and from offered share if no written or signed share). _Mandatory:_ No |

| Main Limit Type | Values that further specifies Main Limit Values: Customised by your company, e.g.: * _EML_ (Estimated Maximum Loss) * _PML_ (Possible Maximum Loss) * _MPL_ (Maximum Possible Loss) * _Sum insured_ _Mandatory:_ No |

| Comment (all) | Additional information regarding the limit on the same row Values: Maximum digits: 30 Mandatory: No |

| Limit Per Year | Maximum liability reinsurer(s) will have to pay per year Values: Number of decimal places: 0 * Minimum value: 0 _Calculations:_ Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Main Limit 100% and Main Limit Our Share. _Mandatory:_ No |

| Limit Per Year Type | Values that further specify Limit Per Year. Values: Customised by your company, e.g.: * _Partial Loss * Total Loss * None_ _Mandatory:_ No |

| Limit Per Occurrence | Maximum liability reinsurer(s) will have to pay per event, e.g. earthquake Values: Number of decimal places: 0 * Minimum value: 0 _Calculations:_ Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Main Limit 100% and Main Limit Our Share.If Sub Class of Business is Business Interruption refer to field descriptions for Business Interruption. _Mandatory:_ No |

| Total Sum Insured (TSI) | Maximum value per insured object Values: Number of decimal place: 0 * Minimum value: 0 _Calculations:_ Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Main Limit 100% and Main Limit Our Share. _Mandatory:_ No |

| Top Location Sum Insured (TLSI) | Maximum value in one location Values: Number of decimal place: 0 * Minimum value: 0 _Calculations:_ Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Main Limit 100% and Main Limit Our Share. _Mandatory:_ No |

| Top Location Loss Probability (TLLP) Type | Values that further specifies the TLLP Values: Customised by your company, e.g.: * _EML_ (Estimated Maximum Loss) * _PML_ (Possible Maximum Loss) * _MPL_ (Maximum Possible Loss) * _Sum insured_ _Mandatory:_ No |

| Top Location Loss Probability % | Percentage used to calculate TLLP from Top Location Sum Insured, Total Sum Insured or Main Limit Values: Minimum percentage: 0,00 * Maximum percentage: 999 * Number of decimal places: 2 _Mandatory:_ No |

| Top Location Loss Probability | Probable maximum value of a loss Values: Number of decimal place: 0 * Minimum value: 0 _Calculations:_ Depending on Limits entered (in below sequence), and TLLP % Top Location Sum Insured Total Sum Insured Main Limit Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Main Limit 100% and Main Limit Our Share. _Validations:_ When calculated from Total Sum Insured, TLLP is recalculated if TSI is changed _Mandatory:_ No |

| Total Limit For Items 100% | Total limit for all items added together. Values: Number of decimal places: 0 * Minimum value: 0 _Calculations:_ From number of Items in Time Measurement and Main Limit 100%. Cannot be manually altered _Mandatory:_ No |

| Annual Aggregate Deductible (AAD) | Amount used to reduce the cost of the non-proportional protection for the period.Cedent retains a specific amount of losses otherwise recoverable, before the protection comes into effect. Values: Number of decimal places: 0 Calculations: Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Main Limit 100% and Main Limit Our Share. Validations: Only available when Type is None or blank Mandatory: No |

| Annual Aggregate Deductible Type | Values that further specify the limit. Values: Your company customises what will appear in the type field. * _None._ Enter AAD 100%. Amount the cedent retains during a year. * _Of Loss_Enter AAD%. Percentage deducted from any loss recoverable on this treaty. Remaining loss amount is recovered on the treaty. * _Of SUPI_. Enter AAD%. Amount calculated from this percentage and SUPI, is Annual Deductible Amount _Default:_ Blank _Validations:_ When Type is _Of Loss_ or _Of SUPI_ AAD 100% is disabled _Mandatory:_ No |

| Annual Aggregate Deductible (AAD) % | Percentage used to calculate AAD when expressed as percent Of Loss or Of SUPI. Values: Maximum percentage: 999,00 * Number of decimal places: 2 _Validations:_ Available only when Type is _Of Loss_ or _Of SUPI_ _Mandatory:_ No |

| Initial Value | Pre-agreed insured value Values: Minimum value: 0 * Number of decimal places: 0 _Calculations:_ Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Main Limit 100% and Main Limit Our Share. _Validations:_ Available only when Class of Business Behaviour is Marine Hull Construction. Cannot exceed Main Limit _Mandatory:_ No |

| Increased Value 100% | Increased value of Initial Value Values: Minimum value: 0 * Number of decimal places: 0 _Calculations:_ From Main Limit and Initial Value. Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Main Limit 100% and Main Limit Our Share. _Validations:_ Available only when Class of Business Behaviour is Marine Hull Construction. _Mandatory:_ No |

| Location Limit | Maximum liability in one location Values: Minimum value: 0 * Number of decimal places: 0 _Calculations:_ Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Main Limit 100% and Main Limit Our Share. _Validations:_ Available only when class of business is Marine Hull/ Cargo and when Main Class of Business is Marine or Marine Direct. _Mandatory:_ No |

| Construction Value | Use this limit to define the part of the project related to the construction itself. Values: * Minimum value: 0 * Number of decimal places: 0 _Calculations:_ Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Main Limit 100% and Main Limit Our Share. _Validations:_ Available only when class of business is engineering. _Mandatory:_ No |

| Maintenance Value | Use this limit to define the value insured during maintenance period. Values: Minimum value: 0 * Number of decimal places: 0 _Calculations:_ Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Main Limit 100% and Main Limit Our Share. _Validations:_ Available only when class of business is _engineering._ _Mandatory:_ No |

| Extension Value | Limit in case of period extension for a project to define remaining value insured during the extension period. Values: Minimum value: 0 * Number of decimal places: 0 _Calculations:_ Amount for 100% is calculated from amount for our share and vice versa. For more details, refer to Main Limit 100% and Main Limit Our Share. _Validations:_ Available only when class of business is _engineering._ _Mandatory:_ No |

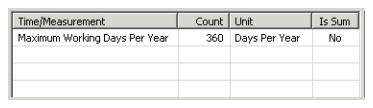

Maintain Proportional Facultative Time and Measurement Figures #

To record Time/ Measurement limits when you want to define limitations that are not monetary:

- Click the Limit and Premium condition button in the Navigation bar.

- Select Edit from the Menu button on the Main tab

- Enter Time/ Measurement values on the Main tab

4. Click Save.

4. Click Save.

| Field | Description |

|---|---|

| Run Passenger Distance Count | The actual distance run Values: Minimum value: 0 * Number of decimal places: 0 _Mandatory:_ No |

| Run Passenger Distance Unit | Text that further specifies the Count Values: Customised by your company: Typical values will be: Kilometres or Miles Mandatory: No |

| Items Count | The actual number of items covered by this reinsurance. Values: Minimum value: 0 * Number of decimal places: 0 _Mandatory:_ No |

| Items Unit | Text that furthers specifies Items. Values: Your company customises what will appear in the type field. For example,Items, Day or Miles Mandatory: No |

| Cold Testing Period Count | Use this time limit to define the period defined in the contract to be used for cold testing Values: Minimum value: 0 * Number of decimal places: 0 _Mandatory:_ No |

| Cold Testing Period Unit | Text that further defines the Cold Testing Period Values: Customised by you company. Examples: Day(s), Week(s) or Month(s) Mandatory: No |

| Hot Testing Period Count | Use this time limit to define the period defined in the contract to be used for hot testing Values: Minimum value: 0 * Number of decimal places: 0 _Mandatory:_ No |

| Hot Testing Period Unit | Refer to Cold Testing Period Unit Extension Period Count: Time limit to define period caused by delayed project Values: Minimum value: 0 * Number of decimal places: 0 _Mandatory:_ No |

| Extension Period Unit | Refer to Cold Testing Period Unit. |

| Maintenance Period | Time limit to define period in which the maintenance value is valid Values: Minimum value: 0 * Number of decimal places: 0 _Mandatory:_ No |

| Maintenance Period Unit | Refer to Cold Testing Period Unit. |

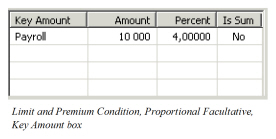

Maintain Proportional Facultative Key Amounts #

Record Key Amounts when you want to display informational monetary or percentage limits.

- Click the Limit and Premium condition button in the Navigation bar.

- Select Edit from the Menu button on the Main tab

- Enter Key Amounts on the Main tab.

- Click Save.

Your company customises what appear in the Key Amount column. We will only give an example in field description table below.

| Field | Description |

|---|---|

| Payroll Amount | For example, cost from production Values: * Minimum values: 0 * Number of decimal places: 0 _Mandatory:_ No |

| Payroll % | Payroll expressed as percentage Values: * Minimum value: 0 * Number of decimal places: 2 _Mandatory:_ No |

| Turnover Amount | The amount of business done, degree of business activity Values: * Minimum values: 0 * Number of decimal places: 0 _Mandatory:_ No |

| Turnover % | Refer to Payroll %. |

| Field | Description |

|---|---|