Retrocession Calculation Order for Non-Proportional

The Retrocession Calculation Order for Non-Proportional lets you do automatic calculation and booking of deposits to be retroceded to the Retrocessionaire’s Participation (RP) of the OCC.

Before running the Retrocession Calculation Order for Non-Proportional, one or more RP’s must be defined on the OCC and the OCC’s Placement List must be complete.

The normal procedure in the Non-Proportional Accounting process:

- Enter Accounts and Accounting Basis on the Administration Condition - Accounts tab.

- Define Premium and/or Loss Deposit Conditions on the Deposit Conditions.

- Define Premium and/or Loss Reserve Conditions, if selected Calculation Method for Premium and/or Loss Deposit is Percent of Premium Reserve and/or Percent of Loss Reserve.

- Make Technical/Claim bookings on the Non-Proportional OCC. Bookings are automatically created ‘As Booking’.

- Select the Account No. to be processed.

- Select Create Retrocession Calculation Order for Non-Proportional from the menu.

- Define the order and run it without closing the worksheets.

- View the open worksheets created from the order.

- Runthe order again with the Close Worksheet option selected.

Create and Run the Retrocession Calculation Order for Non-proportional #

- Open the administration conditions of the OCC for which the account should be created.

- Select the account number to be processed from the Accounts tab.

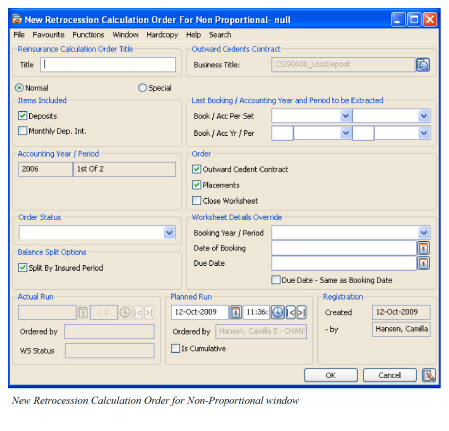

- Select Create Retrocession Calculation Order for Non-Proportional from the menu. The New Retrocession Calculation Order for Non-proportional window appears.

- Define the different fields of the order. (Refer to field description later in this chapter)

- Select Run Now from the menu.

Note! DXC recommends you to create and run the accounts in a sequence. We also recommend you to run/rerun the order without closing the worksheets until the figures on the RP business ledgers are correct. When all figures are correctly booked, you select Close Worksheets option and clear the Outward Cedent Contract and the Placement option before running the order for the last time.

| Field | Description |

|---|---|

| Title | A title making it easier to find/identify the specific order among other orders in a list, i.e. from the Find: Accounting order window. Values: Free text Functional Impact: Search criterion in the Title field in the Find: Accounting order window Mandatory: No |

| Business Title | The title defined on the OCC business. (The detail button next to the field displays the Business Id and Insured Periods/UW Years. You can access the Business Properties by selecting one Insured Period) Values: Output of text Derived from: The title field placed on the Business tab of the OCC business |

| Items Included - Deposits | Selected: Selected by default. Deposit, Interest and Tax on Interest are calculated according to conditions defined on OCC/RP. Cleared: The calculation of Deposit, Interest and Tax on Interest are not calculated even if conditions apply. Relevant when: Select the check box when you want the system to calculate Deposit, Interest and Tax on Interest according to conditions. You should clear the check box if the same account number has to be run for the second time and the previous account was run with the Order Status Partial or Adjustment. You then avoid having the Deposit Retained in 1strun Released in 2nd run and the Interest and Tax on Interest calculated. |

| Items Included - Monthly Dep. Int. | Selected: All Interest Calculations are done on a monthly basis. Monthly Interest Calculations will only make sense if Interest Calculation method on OCC/RP is On Deposit Balance - Each Account. Whenever Monthly Interest Calculation is selected, the check box Deposits has to be cleared. Cleared: Cleared by default. No monthly interest calculations are performed. Relevant when: Select the check box when Monthly Interest Calculation is to be calculated and booked. |

| Accounting Year/Period | The Year and Period the account applies for .Values: Accounting Year: Year Value (yyyy), Accounting Period: 3rd of 4, 2nd of 2, 1st of 12, etc. Derived from: The Account no. selected, and the Account frequency defined in the OCC’s Administration Conditions. E.g. Account no. ‘3/2004’ and Account frequency ‘Quarterly’ => Accounting Year/Period ‘2004, 3 rd of 4’. Functional Impact: The OCC- and RP business ledgers in booking currency are updated with the Accounting Year/Period values both on balance and detail level. |

| Last Booking/Accounting Year and Period to be extracted -Booking Period Set | Defines a group of booking periods. Determines the available Booking Periods in the Period field below. Values: Half Years, Months or Quarters Mandatory: Yes |

| Accounting Year and Period to be extracted -Booking Year/Period | The last Booking Year and Period to be extracted from the OCC’s As Booking business ledger. Values: Year: Free input of Year value, Period: A set of periods according to definition in Period Set above, e.g. 1st Quarter, 2nd half year, Month 09, etc. Functional Impact: All bookings having Booking Year and -Period up to and including these defined values are extracted, unless they are marked as being processed in a previous order.Also, if defined in the Retrocession System Parameters by your system administrator, the Booking Year/Period values are allocated to the OCC-and RP business ledgers in booking currency. Mandatory: Yes |

| Last Booking/ Accounting Year and Period to be extracted -Accounting Period Set | Defines a group of accounting periods. Determines the available Accounting Periods in the Period field below. Values: Half Years, Months, Quarters, Trimester or Years Mandatory: No |

| Last Booking/ Accounting Year and Period to be extracted -Accounting Year/ Period | Last Booking/Accounting year and Period to be extracted. Accounting Year/Period: The last Accounting Year and Period to be extracted from the OCC’s As Booking business ledger. Values: Year: Free input of Year value, Period: A set of periods according to definition in Period Set above, e.g. 1st of 2, 1st of 12, 1st of 4, 1st of 3, Yearly etc. Functional Impact: All bookings having Accounting Year and -Period up to and including these defined values are extracted, unless they are marked as being processed in a previous order. The extract criteria will be in addition to the Last Booking Year and -Period to be Extracted. Mandatory: Only when input in Accounting Period Set. |

| Order -Outward Cedent Contract | Selected: Is selected alone or together with the Placements check box. The check box is selected by default when a new order is first created. Cleared: Only allowed to clear the check box if the OCC step has been included in a previous run of the same order. Relevant when: Select the check box when you want the order to select all new bookings matching the extraction criteria. |

| Order -Placement | Selected: The OCC As booking amounts are used as basis for calculation of each RP share. Calculations according to OCC conditions and RP specific conditions are performed. You have to select the OCC check box in addition to the Placement check box, unless the OCC step is previously run with the same order and extraction criteria. The check box is selected by default when a new order is first created. Cleared: The Placement (RP) step is not included running the order, i.e. calculations according to share and conditions are not performed. Relevant when: Select the check box when the RP share and conditions are to be calculated or recalculated and details booked on the RP business ledger in booking currency. |

| Order - Close Worksheet | Selected: The worksheets created for the RP business ledgers are closed. If you want to include new bookings and/or recalculate the figures when closing the worksheets, the OCC- and Placement- check boxes should also be selected. If open worksheets only are to be closed, only the check box Close Worksheet should be selected. Once the worksheets are closed, it is not possible to rerun the order. Note! In case the RP business is linked to an Intra Group Assumed Business the bookings in the closed worksheet will be copied to the linked Assumed Business. Manual booking on a Non-proportional treaty ORP, both actual and estimated, are not copied to a linked IGC Assumed Business. Cleared: The worksheets created for the RP business ledgers have the status open. It is possible to rerun the order. Relevant when: Select the check box alone or in combination with the OCC- and Placement check boxes when you want to close worksheets produced by the order. Do not select the check box when you want to control the calculated amounts and possibly rerun the order. |

| Order Status | The selected value defines the status of the order Values: Partial, Final or Adjustment Functional Impact: In the Administration Conditions/Accounts tab, the Account’s status field is updated with the Order Status value when the order is run with the Close Worksheet option selected. The status field is relevant if the same account number is selected for the second time and the previous account was run with the status Partial or Adjustment. (Refer to the field description of Items Included - Deposits). Mandatory: Yes |

| Balance Split Options - Split by Insured Period | Selected: All balances are split by Insured Periods when booked on the RP business ledgers in booking currency. The check box is selected by default. Cleared: All Insured Periods are included in one balance. Relevant when: Select the check box when you want the system to split balances per Insured Period. |

| Worksheet Details Override -Booking Year /Period | The defined Booking Year/Period overrides either a) Original Booking Years/Periods or b) Year/Period values defined in the order as Last Booking Year and Period to be extracted. (It is System Parameter definition whether a) or b) applies.) Values: Year, Period (E.g. 2003, Month 05 or 2004, 1st half-year) Derived from: Open Booking Year/Periods for Local defined for the Base Company in the System Parameters by your system administrator. Functional Impact: If defined, the system uses the value from this field when updating the Booking Year/Period fields in the RP business ledgers. Mandatory: No |

| Worksheet Details Override - Date of Booking | A date to override the default Date of Booking. (The default date is when the order is run and figures booked.) Values: Date value (mm/dd/yy) Validations: Max allowable value is according to system parameter Accounting, Booking Dates defined by your System Administrator. Functional Impact: Updates the Booking Date field of the RP business ledgers with the value entered in this field Mandatory: No |

| Worksheet Details Override - Due Date | A date to override the default Due Date. (The default due date is the Payment Cedent date defined in the Administration Conditions for the account number being processed.) Values: Free input of Date value (mm/dd/yy_)_ _Functional Impact:_ Updates the Due Date field of the RP business ledgers with the value entered in this field _Mandatory:_ No |

| Worksheet Details Override - Due Date-Same as Booking Date | Selected: The default Due Date is overridden by the Booking Date and updated in the RP business ledgers. I.e. the Due Date and Booking date values are the same. The Worksheet Details Override - Due Date field is disabled. Cleared: The Due Date updated in the RP business ledgers is either the default value (the Payment Cedent date of the account) or another date defined to override the default value. Relevant when: Select the check box when you want the system to use the booking date as due date, e.g. in case of an overdue account being processed. |

| Actual Run | A date- and time field updated each time the order is run. Values: Date (mm/dd/yyyy) and Time (hh:mm:ss PM/AM) Functional Impact: When the order is run with the Order step Closed selected, the Account’s Closed__Date field in the Administration Conditions is updated with this date. Mandatory: Yes |

| Actual Run - Ordered by | The name of the person who runs the order Values: Full Name and Logon ID Derived from: The register of System Users in SICS Mandatory: Yes |

| Actual Run -WS Status | The status of the worksheets produced when running the order Values: Open, Closed Derived from: The definition of the Order section.The status is Open until the order is run with the Close Worksheet check box selected. Mandatory: Yes |

| Planned Run | A date- and time field to indicate when the order is planned run. Values: Free input of: Date (mm/dd/yyyy) and Time (hh:mm:ss: PM/AM) Default: The date and time when the order was first opened from the Administration Conditions Functional Impact: The order is listed among Retrocession Accounting Run Due Orders with the Planned Run Date & Time if the order is created/modified but not yet run/rerun. Mandatory: Yes |

| Planned run -Order by | The name of the person who created the order Values: Full Name and Logon ID Derived from: The register of System Users in SICS Mandatory: Yes |

| Registration Created and -by | The date when the order was first created and name of the person who created the order. Values: Created = Date (mm/dd/yyyy), by = Full Name and Logon ID Mandatory: Yes |

| Is cumulative - | Selected: The Retrocession Calculation order is processed on a cumulative basis: The RP’s share of the current account is calculated by taking: Bookings for the whole Accounting Year less Bookings from Previous accounts in same Accounting Year Cleared: The Retrocession Calculation order is processed on a non-cumulative basis. All new bookings are distributed to the RP’s according to their share, e.g. premium, losses. Basis for calculations is current account except for some specific calculations that have to be calculated cumulatively to have correct result, e.g. Reserves, Deposits, Portfolio. Relevant when: You should ask for cumulative run (select the check box) if any conditions/share has changed and you want the system to recalculate already calculated accounts for current accounting year. If conditions/shares are not changed, you should run the order on a non-cumulative basis to increase performance. |

View Worksheets From Retrocession Calculation Order for Non-Proportional #

When the order has been run, the produced worksheets can be inspected directly from the order.

- Create and Run a Retrocession Calculation Order for Non-Proportional.

- Select View Worksheets from the order menu. The View Worksheet window appears.

- Select the Worksheet you want to inspect and select View Worksheet from the pop-up menu. The Worksheet Closing window appears.

- In order to inspect the booking details of the balance, select a balance and select View Balance Details from the pop-up menu. The View Balance Details window appears.

In the View Worksheet window a worksheet is produced per Business ID. You are allowed to access the Business Properties and Business Ledger for these businesses by selecting Business Properties or Business Ledger from the pop-up menu.

In order to open the Balance details window for a balance, select the balance and select More Balance Information. You are allowed to do the following from the More Balance Information window in Edit mode:

- Select the Include in Statement check box.

- Update the Cedent/Broker reference field.

- Update the EDI reference field.

(For further information about the More Balance Information window, see The Business Ledger)

(For further information about the Worksheet Closing window, see Manual Bookings on a Worksheet)

| Field | Description |

|---|---|

| WS ID | The Worksheet IDs created per Business ID running the order. Values: Prefix + number, e.g. ‘RW100’ Derived from: A value from a Worksheet Identifier Series predefined for the Type of Worksheet Retrocession in the System Parameters by your System Administrator. Mandatory: Yes |

| WS title | (Not relevant for automatically produced worksheets). |

| WS origin | Describes the origin of the worksheet. Values: REAC Temporary Mandatory: Yes |

| Business ID | The IDs of the different businesses for which worksheets are produced. Values: Business ID’s for RP businesses. (For example: OCC100-1, OCC100-2) Mandatory: Yes |

| Registration Date | The date when the worksheet was created/updated. Values: Date value (mm/dd/yyyy) Derived from: The Actual Run Date field of the order. Mandatory: Yes |

| Status | The current status of the worksheet Values: Open, Closed Derived from: The WS Status field from the order Mandatory: Yes |

| Notes | (Not relevant for automatically produced worksheets.) |

| # bookings | The number of booking details included in the balance. Values: A number Mandatory: Yes |

Inactivate a Worksheet from a Retrocession #

Calculation Order for Non-Proportional #

You are allowed to inactivate the worksheets produced from a Retrocession Calculation Order for Non-Proportional. The worksheets must have the status Open.

- Create and run the Retrocession Calculation Order for Non-Proportional without closing the worksheets.

- Select Inactivate Worksheet from the menu of the order.

A confirmation message appears asking if you want to continue. Select Yes to confirm, or No to Cancel.

The order is inactivated along with the worksheets.

Copy a Retrocession Calculation Order for Non-Proportional #

You can make a copy of a Retrocession Calculation Order for Non-Proportional when the order is run and Worksheets have the status Closed. This may be relevant when you want to create a new order for the same business and Accounting Year and - Period as defined in the source order.

- Open a Retrocession Calculation Order for Non-Proportional, where the status of the Worksheets is Closed.

- Select Copy to from the order menu.

- A New Retrocession Calculation Order for Non-Proportional is created.

Compared with a New Retrocession Calculation Order for Non-Proportional created from the Administration Conditions, more fields are predefined in the copied order:

Title: The title ‘copy of ……’ is displayed. If a title is defined in the source order, the title is added to copy of.

Order Status: Copied from the source order.

Last Booking Year and Period to be Extracted: Period Set and Year/Period values are copied from the source order.

Access the Business Ledger from a Retrocession Calculation Order for Non-Proportional #

You may access the Business Ledger of the OCC business and RP businesses. This may be relevant if you want to inspect figures booked to the RP business ledger.

To open Business Ledger directly from the Order Menu:

When you want to access the OCC business ledger only, you can navigate directly from the order menu.

- Create and run the Retrocession Calculation Order for Non-Proportional, or open an existing order.

- Select Business Ledger from the menu of the order.

- The Business Ledger of the OCC business is opened.

- You may navigate to the as original ledger and as booking ledger.

To open Business Ledger from View Worksheet window:

When you want to access the Business Ledger for the RP’s in addition to the OCC business ledger, you should navigate via the View Worksheet window:

- Create and run the Retrocession Calculation Order for Non-Proportional, or open an existing order.

- Select View Worksheet from the order menu.

- Select the WS/ID/Business Id for which the Business Ledger is to be opened.

- Select Business Ledger from the menu.

Note! If the Worksheet status of the order is Open you must select WS status Open in the OCC as booking business ledger to view the worksheets produced from the specific order.

(Refer to the chapter The Business Ledger for further information about business ledger details.)